PowerSchool Holdings, Inc. PWSC recently announced a significant move in the financial landscape by reaching a definitive agreement with Bain Capital, one of the leading private multi-asset alternative investment firms. The acquisition deal, valued at a whopping $5.6 billion, is slated to conclude in the latter half of 2024, pending customary closing conditions and regulatory green lights.

Marking a substantial premium, PowerSchool stockholders are set to receive $22.80 per share in cash upon the finalization of the transaction. This offer stands as a generous 37% above PWSC’s share price of $16.64 as of May 7, 2024, which was the last reported trading day before speculations on a potential takeover began circulating.

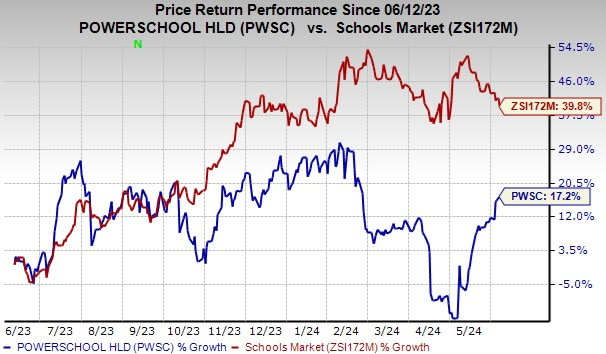

Noteworthy is the modest 0.4% increase in the company’s shares during the trading session on June 7, 2024.

Vista Equity Partners & Onex Partners: Continuing with Minority Stakes

Vista Equity Partners has been a stalwart supporter of PowerSchool, playing an instrumental role in the company’s journey towards digital transformation within K-12 education. Their ongoing investment underscores a strong belief in the enduring significance of software in the ever-evolving educational realm. The strategic partnership has fueled innovation, particularly in addressing the challenges posed by remote learning and the development of AI-assisted educational tools.

The collaboration with Onex Partners also deserves due credit for its contributions in enhancing the educational experience and outcomes for students, educators, administrators, and parents. Together, their joint efforts have been pivotal in driving PWSC’s technological prowess and global influence in its upcoming phase of growth.

Prospects for Future Growth within PowerSchool

PowerSchool, a global education technology entity, serves a vast student base exceeding 55 million and caters to more than 17,000 clients across 90 countries. The company’s stronghold lies in integrating state-of-the-art K-12 educational and operational technology to support all facets of the learning journey. Post-acquisition, PowerSchool will continue its operations as an independent entity, ensuring a seamless transition in business operations and customer service.

As a leading provider of cloud-based software tailored for K-12 education, PWSC shines particularly in North America’s SaaS technology landscape. It boasts of distinctive, mission-critical solutions that drive better educational outcomes and assist educators and district operations. With Bain Capital’s infusion of support, PowerSchool is poised to amplify its resources and flexibility for future growth and innovation, notably through its transformative AI platform, PowerBuddy, and an expanded global educational footprint.

The company’s innovative software solutions both inside and outside the classroom lay a robust foundation for K-12 academic achievement. These products command high esteem among administrators, educators, students, and parents, fostering active collaboration and delivering actionable insights crucial for positive educational outcomes.

With the escalating demand for K-12 education technology, there exist substantial avenues to widen access to PowerSchool’s premium product suite on a global scale. This strategic move is anticipated to accelerate the company’s growth trajectory while upholding its commitment to empowering educators and students in reaching their full potentials.