Apple stands tall as the reigning champion, the paragon of value with a market capitalization of $3.4 trillion. Yet, lurking in the shadows are two behemoths of technology – Microsoft and Nvidia. Like celestial bodies orbiting a financial sun, these giants have danced at the edge of the market’s zenith, challenging Apple’s dominance at times only to yield to its resurgence, stoked by a surge in stock price.

Microsoft: Unlocking the Power of AI

In the financial firmament, Microsoft gleams with a market cap of $3.3 trillion, poised at Apple’s doorstep. Its trajectory, propelled by swift growth outpaces the Cupertino giant, riding the AI wave cresting in diverse markets. In Q3 of fiscal 2024, Microsoft’s revenue surged by 17%, scaling $61.9 billion year over year, a stark contrast to Apple’s 4% decline at $90.8 billion in the same period. The chasm between these tech titans is bridged by AI, with Microsoft tapping into the exponential growth spurred by cloud computing, into PCs and workplace collaboration tools. Azure, its cloud segment, ascended by 21% YoY to $26.7 billion in Q3, buoyed by cloud-based AI services.

The Azure constellation receives a 7% AI-enhanced boost, propelling Microsoft into a realm where the cloud-based AI services market brims with promise, aiming to amass $647 billion by 2030. Azure’s 25% slice of the cloud computing pie places it squarely for a banquet on a feast of AI. Microsoft’s Copilot, a generative AI chatbot, has taken flight, finding perch among 100 million developers. The narrative expands, Fortune 500 corporations embrace Copilot, heralded by names like Amgen, BP, and Nvidia, already flaunting over 10,000 seats purchased.

At $30 per user per month, Microsoft monetizes the AI-assistant domain, a realm slated to burgeon eightfold by 2033, forecasting revenues of nearly $167 billion. Microsoft emerges as the sprinter, projected to register a 16% annual earnings growth over the next five years, overshadowing Apple’s 10% estimate, unfurling vistas of ascent to dizzying heights, outshining Apple in the horizon.

Nvidia: The Sentinel of AI Dominance

Nvidia, the third colossus with a $3 trillion mantle, strides as the shepherd of semiconductors, its shares soaring a staggering 745% since 2023. The AI oasis beckons, with Microsoft and its ilk coveting Nvidia’s AI GPUs for modeling and services. Nestled snugly, Nvidia commands over 90% of the AI chip market, driving a meteoric rise eclipsing Apple’s trudge.

In a crescendo of prognostications, the global AI chip mart, a $300 billion bastion forecasted to sprout tenfold by 2034, sings an ode to Nvidia’s triumph. Analysts espouse the soaring trajectory of its data center revenue, poised to leap to $280 billion from $47.5 billion over the ensuing four years. Watchful forays into AI-enabled PCs stoke its gaming business, fostering a precipitous growth, foretold to surge by 46% annually for five years, dwarfing Apple’s projected pace.

The landscape may shift, akin to tectonic movements led by AI smartphones boosting Apple. Yet investors are beckoned to heed the competitive maelstrom encircling the Cupertino colossus, as Nvidia and Microsoft waltz towards eclipsing in the 5-year horizon.

The Battle for Market Dominance: Nvidia vs. Apple

Apple’s Declining Market Share

Apple’s grip on the smartphone market is slipping. In the second quarter of 2024, the tech giant’s market share stood at 15.8%, down from 16.6% in the same quarter the previous year. While its shipments saw a meager 1.5% increase year over year, the overall smartphone market witnessed a robust growth of 6.5% during the same period.

Nvidia’s Ascendancy in AI

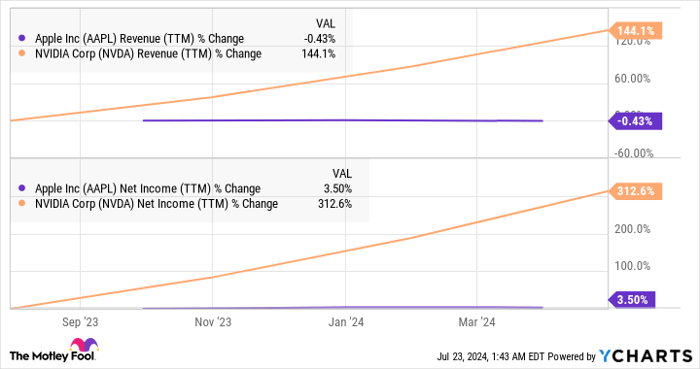

As Apple faces stiff competition in the crowded smartphone arena, Nvidia is poised for faster growth, driven by its leadership in the AI chip market. The semiconductor company’s bottom-line growth outshines Apple’s, hinting at a potential shift in market dominance over the next five years. The role of AI is pivotal in Nvidia’s quest to outrun Apple and claim the top spot.

Investing in Nvidia: A Wise Move?

Before diving into Nvidia stock, it’s essential to weigh the options. While the Motley Fool Stock Advisor team may have overlooked Nvidia in their top stock picks, history speaks volumes. Consider this: back on April 15, 2005, an investment of $1,000 in Nvidia would have grown to a staggering $692,784 today. The Stock Advisor service has triumphed over the S&P 500, providing investors with valuable insights and lucrative stock recommendations since 2002.

Final Verdict

In the ongoing saga of tech supremacy, Nvidia emerges as a formidable contender poised to challenge Apple’s reign. With a strategic foothold in the AI domain and promising growth prospects, Nvidia presents an enticing investment opportunity. As the tides of the market ebb and flow, the battle for dominance unfolds, inviting investors to partake in the high-stakes game of technological evolution.