Nasdaq NDAQ shook the investment landscape with its recent proposal for stricter delisting standards designed to target penny stocks that fail to meet listing requirements. The move signifies a potential cleansing of underperforming entities by the stock exchange operator.

New Nasdaq Delisting Regulations

As reported by Reuters, Nasdaq mandates that companies listed on its exchanges must maintain a minimum bid price above $1. Failure to uphold this criterion for 30 consecutive sessions results in non-compliance, with companies granted 180 days to regain conformity. Should compliance not be restored within this period, firms can request an additional 180-day extension.

The proposed rule changes introduce a stricter framework by suspending publicly traded companies that see their share price drop below $1 after 360 market sessions. Moreover, entities executing a reverse stock split within a year of their share price falling beneath $1 would face immediate delisting.

Impact on Market Dynamics

Enhancing listing standards is expected to elevate the quality of small-cap companies as only the most robust enterprises will receive attention, potentially benefitting the Russell 2000 index.

Simultaneously, lesser-known firms have witnessed positive sentiment, exemplified by the recent value surge in small-cap stocks possibly linked to a market shift away from large caps, especially in the tech sector.

Exploring Leveraged ETF Opportunities

Innovative ETF Offerings: In response to market opportunities arising from these shifts, Direxion offers two leveraged exchange-traded funds to investors. The Direxion Daily Small Cap Bull 3X Shares TNA aims to deliver 300% of the daily performance of the Russell 2000 index. Conversely, the Direxion Daily Small Cap Bear 3X Shares TZA provides 300% inverse exposure to the same index.

It is essential to note that these ETFs cater to traders interested in short-term market speculation, given the daily compounding effects of leverage and the heightened volatility inherent in small-cap stocks. Holding leveraged 3X ETFs for an extended period may experience value decay.

Performance Analysis

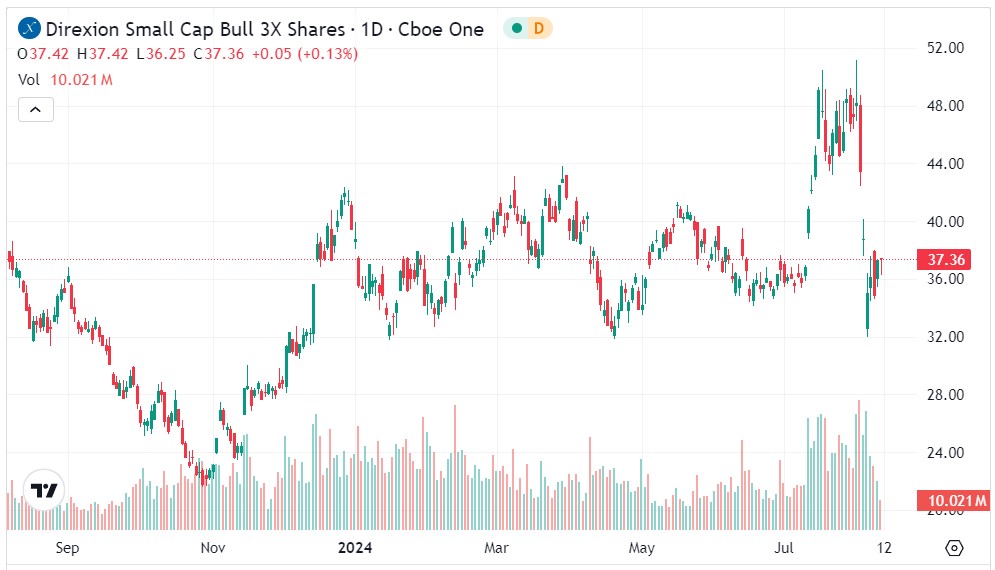

Evaluating TNA: Recent price movements show significant volatility in TNA, reaching a recent peak of $49.09 within the past month but currently trading around $37. The ETF’s movement below and above its 200-day moving average has provided insight into market sentiment and technical indicators for investors.

- While TNA briefly dipped below its 200-day moving average earlier, subsequent price actions helped it recover above this critical level. The near-term goal for TNA supporters is consolidating support around $38 and possibly pushing towards the $40 threshold.

Reviewing TZA: The inverse ETF TZA has also experienced fluctuations, dropping to a low of $13.51 before rebounding to $17. Recent struggles to breach the 50-day moving average point to ongoing challenges for small-cap bear proponents.

- Although surpassing the 20-day exponential moving average, TZA has yet to conquer the 50 DMA. Long-term objectives for TZA advocates include securing the $18 support and aiming for the significant level of $20.

Image Credit: Mohamed Hassan from Pixabay