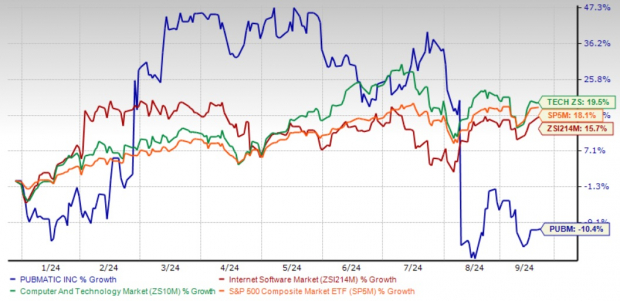

PubMatic PUBM shares have lost 10.4% year to date against the Zacks Computer and Technology Sector and S&P 500 index’s return of 19.5% and 18.1%, respectively.

PubMatic stock has also underperformed the Zacks Internet – Software industry’s return of 15.7% in the same time frame. The underperformance is mainly due to PUBM stock’s sharp decline following its missed revenue estimates for the second quarter of 2024.

However, PUBM is constantly winning big clients, implying the company’s ability to gain market share. PubMatic recently secured a Supply Path Optimization (SPO) deal with a global healthcare giant, Haleon. PUBM will execute SPO for Haleon’s media investments where it will streamline access to video, display and connected TV inventory while promoting sustainability in media investments.

Haleon will also leverage PUBM’s transparent bidding services and have direct access to inventory sources, where it will bypass unnecessary intermediaries to reduce costs and carbon footprint. The collaboration will enable Haleon’s data-driven decisions, ramp up media impressions and increase the efficiency of ad campaigns.

Deal Wins to Aid PubMatic’s Prospects

PUBM is constantly increasing its clientele in the SPO category where it has also signed a deal with Netherland-based Omnicom Media Group and another consumer electronic company, Roku ROKU. Another major deal includes PUBM’s collaboration with Disney’s DIS Diney+ Hotstar to expand the latter’s advertising reach in India.

Roku recently integrated PUBM’s expertise into its Roku Exchange platform. ROKU is leveraging PUBM’s expertise in the SPO and Activate platform to increase the usage of its ad inventory. The deal with Disney is leveraging PUBM’s solutions for programmatic monetization of content in several buying channels. This also includes private marketplace and programmatic guaranteed campaigns.

PubMatic YTD Performance

Image Source: Zacks Investment Research

In the second quarter of 2024, PUBM added Roblox and Rapido to its clientele. Other major companies like Netflix NFLX and NBC are opening up programmatic access to their high-end inventory through PUBM’s solutions.

The continuous flow of contracts will drive PubMatic’s top-line growth. The Zacks Consensus Estimate for 2024 and 2025 suggests revenues to grow in the high-single-digit percentage range.

Near-Term Headwinds for PUBM Stock

PUBM is also facing some macroeconomic headwinds due to the high inflation, higher interest rates and geopolitical tensions forcing enterprises to delay their IT spending.

One of PubMatic’s major DSP clients also revised the bidding approach, affecting PUBM’s top line. PubMatic also faces stiff competition in the advertising space from Amazon (AMZN), Google and Meta.

There is direct competition from Amazon’s Transparent Ad Marketplace and Alphabet’s Google Open Bidding that remain a major concern. Google and Amazon, which are much larger entities and command a larger resource base, put enormous pressure on PubMatic.

The Zacks Consensus Estimate for PUBM’s 2024 revenues is pegged at $290 million, indicating year-over-year growth of 8.7%.

Conclusion: Hold PUBM Stock for Now

An uncertain macroeconomic environment and stiff competition might hurt PubMatic’s near-term growth prospects. However, a strong client base of big companies and a steady flow of contracts provide the company with the required stability in the ongoing macroeconomic uncertainties. So, it is prudent for investors to hold PUBM stock for now. PubMatic currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Netflix, Inc. (NFLX) : Free Stock Analysis Report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Roku, Inc. (ROKU) : Free Stock Analysis Report

PubMatic, Inc. (PUBM) : Free Stock Analysis Report