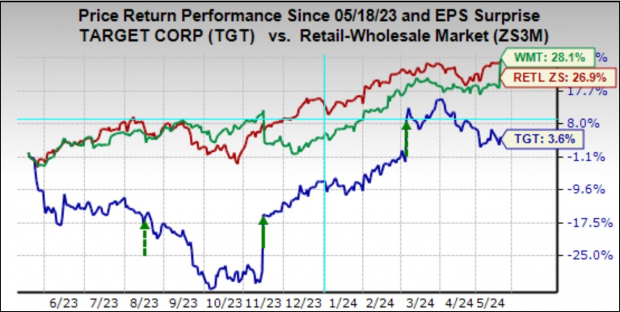

Diverging Paths: Walmart vs. Target

Following Walmart’s exceptional quarterly performance, the market eagerly anticipates what Target has in store. However, distinctions run deep between the two retail giants, with Walmart’s pivot towards digital transformation setting it apart. The retail behemoth’s innovative approach has attracted affluent consumers with a penchant for convenience, propelling a +5.8% increase in revenues on the back of a remarkable +21% surge in digital sales.

Mismatched Merchandise Strategies

Walmart’s stronghold on groceries contrasts sharply with Target’s focus on discretionary goods. While Walmart experienced a mid-single-digit growth in same-store sales, Target grappled with a decline, albeit with prospects for improvement. Analysts anticipate Target to post $2.05 in EPS on $24.5 billion in revenues, signaling stability in earnings compared to the previous year.

Insight into the Retail Sector

In a broader context, the retail sector has witnessed a positive trend in Q1 earnings, with a remarkable +38.7% rise in total earnings from the same period last year. Notably, 69.6% of companies exceeded EPS estimates, showcasing resilience amidst economic fluctuations. However, challenges loom as certain segments struggle to meet revenue expectations.

The Amazon Effect

Amazon’s stellar performance in Q1 serves as a benchmark for the industry, with a staggering +278.7% in earnings growth and a +12.5% revenue surge. As digital and traditional retail converge, market dynamics continue to evolve, further accelerated by the impact of the global pandemic.

Forecasting Amidst Uncertainty

While economic indicators suggest a robust labor market, concerns persist regarding the purchasing power of lower-income brackets. Inflationary pressures, though moderating, remain a key consideration for retail players navigating a complex landscape. The upcoming earnings calls are poised to shed light on companies’ strategies to navigate these challenges and capitalize on emerging opportunities.

Shifting Dynamics and Future Outlook

As the retail sector adapts to changing consumer behaviors and economic conditions, the performance of key players like Target and Walmart serves as a barometer of industry health. With a nuanced approach to merchandise mix and digital integration, retailers are poised to navigate the ever-changing retail landscape with agility and foresight.

Insights into S&P 500 Earnings Growth

Putting Q1 EPS and Revenue Beats into Historical Context

The comparison charts below provide a historical context for Q1 EPS and revenue beats percentages. As noted in the Retail sector, beats percentages have been weaker for the index as a whole, with a notable variance relative to other recent periods, especially on the revenues side.

The Earnings Big Picture

Examining Q1 as a whole, total S&P 500 earnings are forecasted to increase by +6.3% from the same period last year with +4.3% higher revenues. This follows a +6.9% earnings growth on +3.9% revenue gains in the preceding period.

The chart below illustrates the current earnings and revenue growth expectations for 2024 Q1 in the context of the previous four quarters and the projections for the following three quarters.

Impact of Tech and Energy Sectors

The Tech and Energy sectors are exerting contrasting effects on the overall growth picture. Excluding the Tech sector, Q1 earnings for the rest of the index would experience a decrease of -0.7%, while the growth pace improves to +9.2% on an ex-Energy basis.

For the current period (2024 Q2), total S&P 500 earnings are anticipated to increase by +9% with +4.5% higher revenues. The trend in revisions has been particularly favorable for Q2 estimates, as depicted in the chart below.

Annual Earnings Outlook

On an annual basis, total 2024 S&P 500 earnings are projected to rise by +8.9% with +1.6% revenue growth.

For a detailed look at the overall earnings picture, including expectations for the coming periods, please refer to our weekly Earnings Trends report.