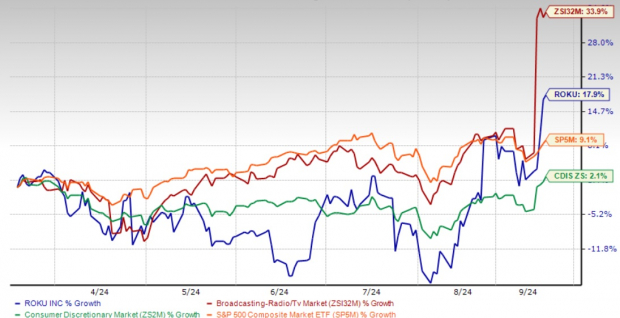

Roku Inc. ROKU, the leading TV streaming platform in the United States, has seen its stock jump 17.9% over the past six months, outperforming the broader Zacks Consumer Discretionary sector’s return of 2.1% and catching the attention of investors. This impressive growth has been fueled by several factors, including the company’s expanding user base and its strategic focus on the Roku Channel.

Launched in 2017, this free and ad-supported platform has quickly become a key driver of the company’s revenues and user engagement. The Roku Channel offers a diverse array of content, including movies, TV shows, live news, and original programming, catering to a wide range of viewer preferences. As the streaming landscape continues to evolve, industry analysts are now questioning whether the Roku Channel can sustain this momentum and drive further growth for the company.

Performance Over the Last 6 Months

Image Source: Zacks Investment Research

Roku’s Ad-Driven Growth in the Streaming Landscape

The Roku Channel has emerged as a powerful growth engine for Roku, employing a multifaceted strategy that combines content acquisitions, original productions, and partnerships with major studios. By offering a mix of free, ad-supported content and premium subscriptions, the channel has successfully attracted cost-conscious consumers seeking alternatives to traditional cable and expensive streaming services.

The second quarter of 2024 demonstrated the effectiveness of this strategy, with impressive year-over-year growth in streaming households (14%) and streaming hours (20%).

Strategic partnerships have further strengthened Roku’s position. Collaborations have enhanced advertisers’ ability to leverage audience data, optimize campaigns, and measure ad performance.

A Stretched Valuation Conundrum

Image Source: Zacks Investment Research

Additionally, Roku’s stock might be considered expensive relative to its cash flow generation and industry peers, which could be a concern for investors focused on finding undervalued stocks. Roku’s two-year price-to-cash flow ratio of 32.44X is ahead of the Zacks Broadcast Radio and Television industry average of 16.89X.

Conclusion: A Glimpse into the Future

In conclusion, the Roku Channel has undoubtedly been a significant driver of the company’s recent success, contributing to its impressive stock performance. However, sustaining this growth will require continued innovation, strategic content investments, and a keen understanding of the evolving streaming landscape.

Existing investors may consider holding their positions in the stock, but new investors should exercise caution, potentially waiting for a more favorable entry point. Roku currently has a Zacks Rank #3 (Hold).

Unveiling Spectacular Stock Performances

The stock prices have experienced impressive surges, with increases of +143.0%, +175.9%, +498.3%, and +673.0%.

The majority of the stocks highlighted in this analysis are currently flying under Wall Street’s radar. This presents a unique opportunity for investors to potentially capitalize on undiscovered gems at their early stages.

Seeking the next big winners? Discover these 5 potential home runs today >>

Get a comprehensive stock analysis of Netflix, Inc. (NFLX) for free here

Access a detailed stock analysis report on The Walt Disney Company (DIS) for free

Receive a complimentary stock analysis of The Trade Desk (TTD) here

Explore a free stock analysis of Roku, Inc. (ROKU) now

Read an insightful article about Roku’s recent growth on Zacks.com