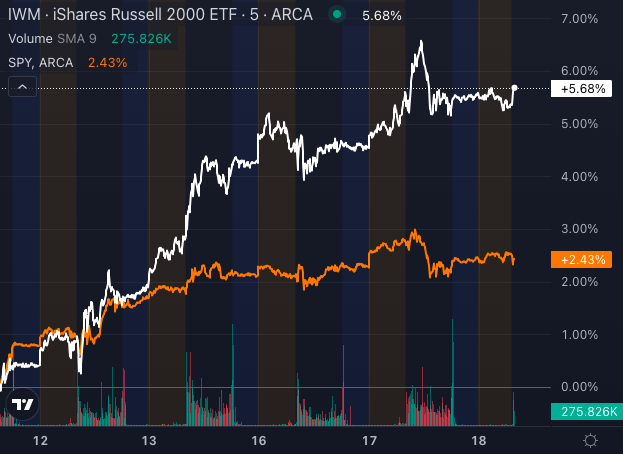

Small-cap stocks are ablaze ahead of the looming Federal Reserve interest rate cut, seizing the spotlight in a dazzling performance. The Russell 2000 Index has surged over 5% in the past week, outpacing its larger-cap counterparts in the S&P 500 Index, which have seen a more modest 2.5% uptick.

Evidently, the iShares Russell 2000 ETF (IWM) has outperformed the SPDR S&P 500 ETF (SPY). Noteworthy small-cap performers fueling this surge include IGM Biosciences Inc. (IGMS), Intuitive Machines Inc. (LUNR), and Applied Therapeutics Inc. (APLT), marking impressive gains of 59.33%, 38.62%, and 44.90%, respectively, over the past five days.

Small Caps Eagerly Awaiting a Reduction in Borrowing Costs

Investors appear confident in the upcoming easing by the Fed, a move that particularly benefits small caps tied to floating rates and burdened by debt.

Small-cap companies frequently rely on floating-rate debt, which means that when interest rates decline, so do their borrowing expenses. This scenario can potentially free up capital and alleviate pressure on firms with less stable financial footing. Thus, rate cuts are viewed as a tantalizing opportunity for investors eyeing substantial gains in these smaller equities.

However, it’s important to note a caveat before jumping on the small-cap bandwagon.

Earnings and Economic Outlook Impacting the Small-Cap Landscape

While the allure of reduced borrowing costs is palpable, concerns loom over subdued earnings and an uncertain U.S. economic future. As a result, the excitement surrounding small caps could wane if the economy fails to live up to expectations.

For investors seeking exposure to this segment, exchange-traded funds such as IWM or the Vanguard Small-Cap ETF (VB) offer diversified access to small-cap stocks. These funds track small-cap indexes, providing a convenient way to capitalize on potential gains without the need to cherry-pick individual stocks.

Yet, the duration of this rally remains a pertinent question.

Small Cap ETF Demonstrates Robust Bullish Momentum

The IWM, a proxy for small-cap stocks, exhibits a strong bullish trend, with its share price of $219.23 positioned above the five, 20, 50, and 200-day simple moving averages (SMAs).

Notably, the eight-day SMA at $213.80, the 20-day SMA at $215.07, and the 50-day SMA at $214.41 all signal a bullish trend, reflecting the ETF’s robust upward trajectory.

Despite mildly experiencing selling pressure, indicating potential short-term volatility, IWM’s notable position well above its 200-day SMA of $203.57 underpins a favorable technical outlook, suggesting continued strength in the small-cap sector.

If the Fed opts for a significant rate cut, small caps could steal the limelight. Even a modest 25-basis-point reduction might sustain the rally, at least for the interim period.

Investors keen on broader small-cap exposure that may benefit from lower rates could monitor the SPDR S&P 600 Small Cap ETF (SLY).