Sam Bankman-Fried’s recent legal maneuver to reduce his potential century-long jail term has stirred the crypto world. His team submitted a petition along with multiple character references and supporting documents to argue against an excessively prolonged sentence following his conviction on fraud and conspiracy charges in November.

The Sentencing Drama Unfolds

A presentence report backing a 100-year prison term for Sam Bankman-Fried was deemed “gruesome” by his lawyers, who advocated for a more moderate 5 to 6.5-year duration, allowing him to swiftly reintegrate into society. The sentencing hearing is slated for March 28, posing a looming threat of up to 115 years behind bars, with expert opinions indicating a likely range of 10 to 20 years.

Diving into the Conviction

Bankman-Fried’s defense team outlined in a detailed 98-page memo that while he deeply regrets the harm caused to clients, his actions did not warrant a lifetime sentence. The fallout from the conviction includes financial ruin, tarnished reputation, and a dismal career outlook, signifying profound personal consequences.

A Plea for Leniency

Bankman-Fried’s fresh legal representation recently replaced his trial lawyers, emphasizing in their plea that his missteps were not a product of malice but rather unfortunate misjudgment. The submission consisted of over 30 ancillary documents, notably featuring 29 testimonials underscoring his dedication and compassion.

The Human Element Emerges

Sentiments from Bankman-Fried’s inner circle, including his family, underscored his positive attributes such as diligence, empathy, and awkwardness, painting a more humane image of the crypto magnate facing a potential draconian sentence. Even a poignant endorsement from a former cellmate vouched for his genuine remorse and contrition.

The Judicial Conundrum

The impending decision by Judge Lewis Kaplan, who presided over Bankman-Fried’s trial, injects a layer of complexity into the sentencing dynamics. Amidst arguments regarding his capacity to present a robust defense from jail, the looming DOJ retort by March 15 promises further legal entanglements and a high likelihood of an ensuing appeal process.

Conclusion

As the crypto community anxiously awaits the fate of Sam Bankman-Fried, the impending sentencing verdict will undoubtedly reverberate across the industry. The intersection of regulation and innovation hangs in the balance, underscoring the pivotal nature of this high-stakes legal saga.

Market Insights and Regulatory Developments in the Crypto Sphere

Insights on Legal Proceedings and Hearings

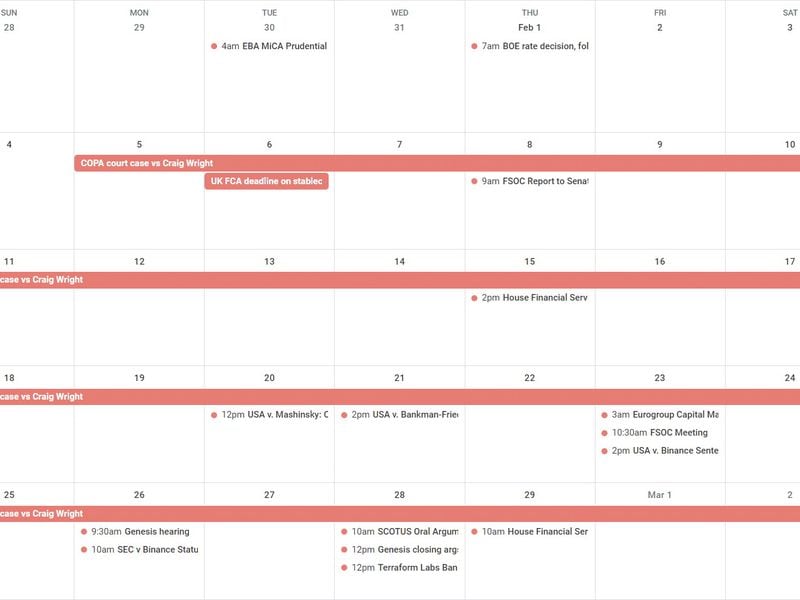

On Monday, the financial world was buzzing with a Genesis bankruptcy hearing scheduled at 14:30 UTC (9:30 a.m. ET). Shortly thereafter, another significant event unfolded at 15:00 UTC (10:00 a.m. ET) with a status conference hearing in the SEC’s case against Binance. The parties engaged in discussions on ongoing discovery issues, signifying the intensity of legal battles in the crypto sphere.

Wednesday brought more legal drama, as the Supreme Court of the U.S. delved into arguments in Coinbase v. Suski at 15:00 UTC (10:00 a.m. ET). This marked the exchange’s second appearance before the highest court within a year, centering once again on arbitration agreements. Simultaneously, the bankruptcy court overseeing Genesis heard closing arguments on the proposed settlement with the New York Attorney General’s office. As if this wasn’t enough, Terraform Labs’ bankruptcy was also discussed, underscoring the intricate financial landscape that demanded attention.

Thursday witnessed the House Financial Services Committee convening for a markup on various bills, some addressing critical crypto issues. Among these were legislations such as the Combating Money Laundering in Cyber Crime Act, aiming to enhance the U.S. Secret Service’s capabilities in investigating illicit crypto activities. Additionally, the Financial Services Innovation Act sought to establish sandboxes for regulators to test innovative strategies, indicative of the evolving regulatory framework in response to digital currencies.

Industry Highlights and Personal Ventures

Beyond the legal intricacies, the financial realm saw interesting developments with notable figures making waves. Fortune’s Leo Schwartz delved into attorney John Deaton’s announcement to run for Senate in Massachusetts, challenging incumbent Elizabeth Warren, a move that injected a dose of volatility into the political landscape.

In a somewhat unexpected turn of events, Salesforce CEO Marc Benioff discreetly acquired “hundreds of acres of land” in Waimea, Hawaii. This revelation, disclosed during a conversation with NPR’s Dara Kerr, raised eyebrows with Benioff sharing personal tidbits about Kerr and family details, adding an intriguing subplot to the unfolding financial narrative.

If you have any thoughts on what should be explored in the coming weeks or wish to share feedback, feel free to reach out via email at nik@coindesk.com or connect on Twitter @nikhileshde. Join the group conversation on Telegram to stay engaged in the dynamic financial discourse. Until next week, stay informed and keep an eye on the ever-evolving market trends!