In the arena of semiconductor supremacy, three titans stand tall: Broadcom Inc (NASDAQ: AVGO), Micron Technology Inc (NASDAQ: MU), and Marvell Technology Inc (NASDAQ: MRVL).

Let’s delve into the battleground to see who emerges victorious and who falters.

The Dominator: Broadcom

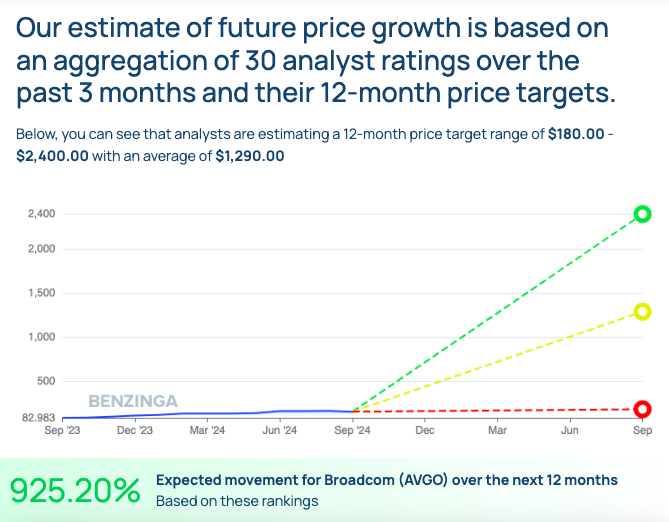

Broadcom’s stock is ablaze, showing no signs of cooling down. With a remarkable 97.28% surge in the past year and a 54.5% rise year-to-date, it’s like a wildfire burning bright. Analysts even tout a potential price target soaring to $2,400, signaling an eye-watering 925.2% expected uptick!

Source: Benzinga Stock Report – AVGO

With a Sharpe ratio of 2.7687 over five years, Broadcom’s stock streaks ahead in risk-adjusted returns, leaving competitors in the dust.

While Broadcom exhibits bullish signs across all fronts with its moving averages below the current price, a slight shift towards negative options sentiment warns of potential turbulence.

Memory Struggles: Micron Technology

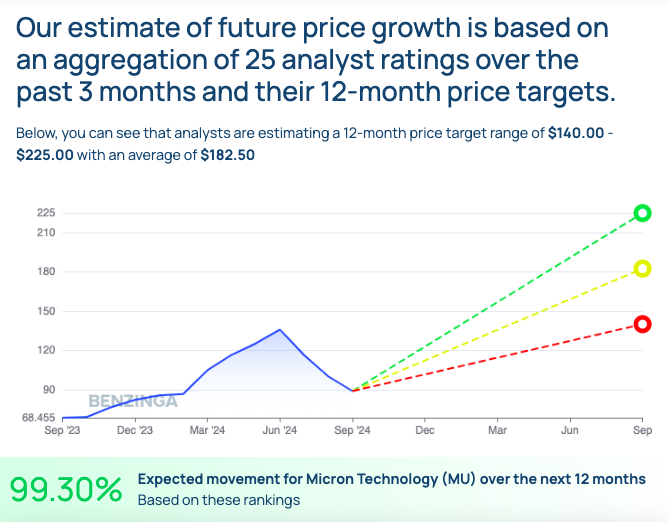

Micron, a memory chip powerhouse, walks a different path than Broadcom. Despite a respectable 29.39% uptick in the last year and a 10.78% rise YTD, its future appears shrouded in uncertainty.

Projections peg Micron’s price range more modestly, peaking at $225 with a 99.3% expected movement.

Source: Benzinga Stock Report – MU

Yet, Micron lags in risk-adjusted returns with a Sharpe ratio of 0.9228 and crosses below key moving averages, residing in bearish territory across various SMAs. It seems a mere memory reboot won’t suffice to reverse its fortunes.

Quiet Momentum: Marvell Technology

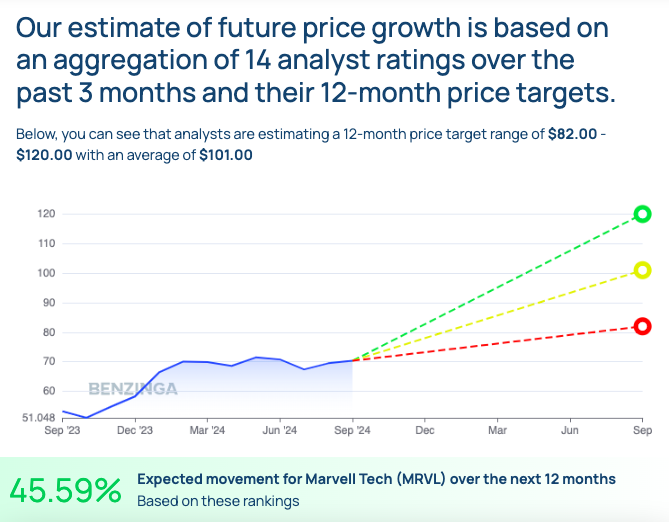

Marvell, the unassuming chip designer renowned for networking tech, steadily gains traction. Boasting a 35.96% climb over the past year and a 28.04% rise YTD, Marvell’s stock surfs a bullish tide.

Source: Benzinga Stock Report – MRVL

Analysts foresee an upside with a 12-month target of $101, anticipating a 45.59% upward surge ahead.

Technically sound, Marvell flaunts bullish signals across all moving averages and a Sharpe ratio of 1.4239, surpassing peer averages. Despite a recent dip in options sentiment, Marvell’s stable stock price above key moving averages positions it as a reliable contender poised for growth.

The Final Word

While each company excels in its niche, Broadcom shines with its robust price performance, positive technical indicators, and exceptional risk-adjusted returns.

Marvell emerges as a formidable rival, showcasing consistent buy signals, while Micron trails in technical fortitude and risk-adjusted metrics.

If you seek momentum in the semiconductor sphere, Broadcom leads the charge, yet Marvell holds potential as the dark horse to watch.

Will Broadcom’s $2,400 target steal the spotlight in the semiconductor saga, or can Marvell surprise with an unexpected rally?

One certainty prevails: the chip wars persist, promising an intriguing battle ahead!