The Dawn of Microsoft’s Quarterly Results

Steering straight into this week’s earnings carousel is MSFT. The tech juggernaut Microsoft is gearing up to unveil its fiscal fourth-quarter results post-market close on Tuesday, July 30. As the curtains rise, investors anxiously await a glimpse into Microsoft’s financial landscape amidst the ebbing tide of inflation.

Microsoft’s Q4 Prognosis

Powered by the celestial growth of Azure, Microsoft is poised to achieve a 14% surge in Q4 sales to $64.19 billion, unwrapping a stark leap from $56.19 billion in its akin quarter. Azure, the cornerstone of Microsoft’s cloud services realm, has asserted its dominance in the cloud computing sphere, enticing customers with bespoke AI solutions. The strategic kinship with the creator of ChapGPT, OpenAI, has bolstered Microsoft’s AI arsenal, while the silicon virtuosos at AMD and the formidable Nvidia add unique hues to Microsoft’s AI palette.

The Financial Horizon

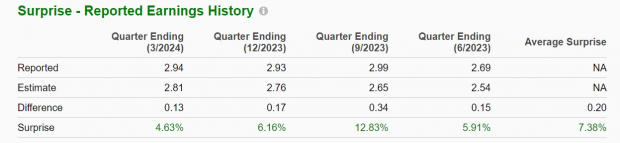

Ahead of the earnings symphony, anticipations are rife that Microsoft’s Q4 EPS has burgeoned by 8%, clocking in at $2.90 in comparison to the $2.69 per share a year ago. Microsoft has consistently outpaced earnings projections over the past seven quarters, averaging a 7.38% earnings dazzle in its previous four quarterly exploits.

Image Source: Zacks Investment Research

Microsoft’s Year-to-Date Performance

Microsoft’s stock has gallantly surged by a commendable +13% on a year-to-date basis, slightly trailing its broader indices and most of its stellar compatriots, including the illustrious Nvidia. This performance stands shoulder to shoulder with Apple’s trajectory while soaring past the somber descent of Tesla.

Image Source: Zacks Investment Research

An Inquisition into Microsoft’s Valuation

At present altitudes, Microsoft’s stock is ruffling at 32.2X forward earnings, perched atop a premium vantage point in juxtaposition to the S&P 500’s 22.9X, albeit treading below its Zacks Computer-Software industry average of 35.1X. This valuation thread finds Microsoft pirouetting beneath its previous decade’s zenith of 38.2X forward earnings yet loftily hovering over the median at 26.3X.

Image Source: Zacks Investment Research

The Final Verdict

As the stage is set for the Q4 soiree, Microsoft’s stock finds itself adorned with a Zacks Rank #3 (Hold). The looming crescendo of meeting or surpassing quarterly anticipations could unlock doors to further ascents in Microsoft’s stock price. The valuation spectacle hints at potential lucid buying prospects down the road, although Microsoft’s growth narrative spins a riveting yarn, promising to satiate the palates of long-term investors.