The imminent arrival of the Q3 earnings season brings with it a deliciously tempting opportunity for investors looking to feast on financial insights. Before the spotlight turns towards the big banks next Friday, all eyes are on PepsiCo (PEP), the consumer staples stalwart set to unveil its latest fiscal report on Tuesday, October 8th, just as the market begins to stir from its slumber.

Keen to stay in the loop with all the quarterly unveilings?

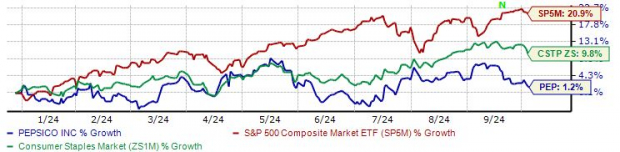

Let’s delve into the prospectus for the consumer giant, whose shares have meandered lackadaisically throughout 2024, limping along with an uninspiring uptick of merely 1.2%. Notably, investors have been showing a growing reluctance to flirt with Consumer Staples equities this year, with the siren call of Technology stocks blazing red-hot in the market’s soundscape.

Below, a visual symphony chronicling the performance of PEP shares against the Zacks Consumer Staples sector and the illustrious S&P 500.

Sight Source: Zacks Investment Research

Analysts, wielding their crystal ball, have gradually tempered their earnings forecasts over the preceding months. The current Zacks Consensus EPS estimate stands at $2.30, a moderate 2% descent since mid-July, yet a tantalizing 2.2% surge from the same period last year.

Vision Source: Zacks Investment Research

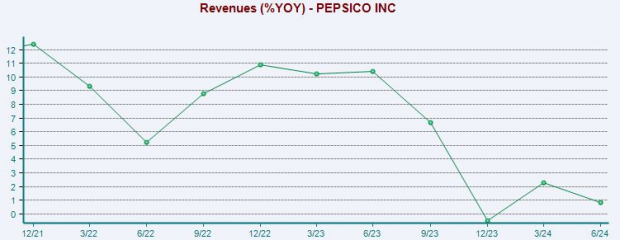

A parallel narrative unfolds on the revenue front, with prognostications looking marginally dimmer at $23.9 billion, a slight 1% dip across the timeline. Despite the decrease, this still signifies a favorable 1.9% elevation compared to the year-prior figures. Noteworthy is the decelerated pace of revenue growth for the company in recent cycles, a trend laid bare in the graphic below.

Be mindful that the graph below illustrates the year-over-year percentage shift rather than raw sales metrics.

Visual Source: Zacks Investment Research

From a valuation perspective, PEP shares do not command a princely sum, boasting a current forward 12-month earnings multiple of 19.6X – a figure appreciably below the 23.6X median of the past five years and the dazzling zenith of 27.8X within the same timeframe. This humbler multiple is reflective of investors scaling back their growth anticipations, as previously discussed.

Is it Time to Add to Your Portfolio?

With the sun dipping towards the horizon of PepsiCo’s impending quarterly revelation, the atmosphere is tinged with reserved optimism, tinged with modest downward tweaks to analysts’ earnings and sales prognosis. Although 2024 has been a rather lukewarm year for PEP shares, a constructive outlook could inject fresh effervescence into their performance.

This juncture appears to call for a cautious “wait and watch” stance, particularly in light of the subdued revisions. Notwithstanding, given its more defensive nature, PEP shares are less likely to suffer a seismic drop should the results miss their mark.

Deciphering the “Single Best Pick to Double” Secrets

Amongst a throng of equities, a quintet of Zacks savants has each plucked their favored contender poised to soar by a lofty +100% or more in the imminent months. From this constellation, the Director of Research Sheraz Mian has singled out one as harboring the greatest potential for a meteoric rise.

This particular entity captivates the hearts of millennial and Gen Z cohorts, freshly minting nearly $1 billion in revenue in the penultimate quarter alone. The recent market retreat paints an opportune moment to hop aboard this bandwagon. Of course, not all our elite selections blossom into winners, but this gem has the potential to outshine prior Zacks’ Stocks Set to Double, akin to Nano-X Imaging which skyrocketed a breathtaking +129.6% in a little over 9 moons.

Uncover Our Top Stock And 4 Runners Up

PepsiCo, Inc. (PEP) : Free Stock Analysis Report