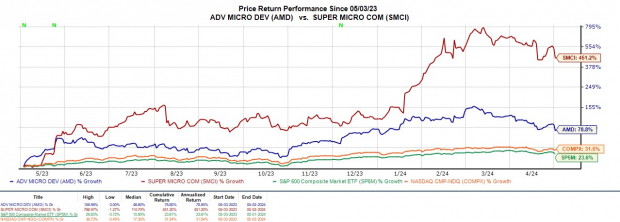

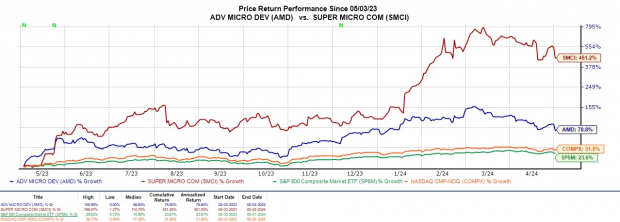

Despite exceeding their quarterly earnings expectations on Tuesday evening, AMD and Super Micro Computer’s stock fell sharply in yesterday’s trading session. Corrections can be healthy; Super Micro shares have soared +451% over the last year, with AMD up a remarkable +79%.

Investors might be pondering whether there was an overreaction in the market and if it’s the right time to buy the post-earnings dip. SMCI rebounded with a +3% increase on Thursday, while AMD saw a modest uptick of +1%.

Image Source: Zacks Investment Research

Overview

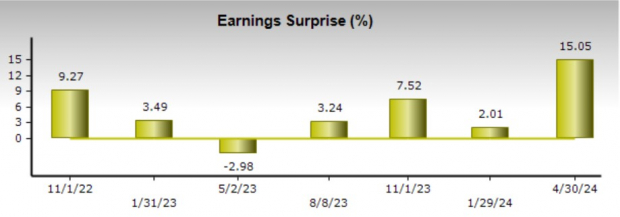

Given Nvidia’s stellar growth due to high demand for AI chips, investors may have expected more from AMD’s Q1 report. AMD’s earnings of $0.62 per share surpassed expectations of $0.60 per share, showing a 2% increase from the previous year. Super Micro, known for its server solutions, posted earnings of $6.65 per share for its fiscal third quarter, exceeding estimates by 15%.

Image Source: Zacks Investment Research

Despite the strong performance, Super Micro still missed Q3 sales estimates, but saw a significant 200% rise from the previous year. Excitement over Super Micro’s AI-capable servers has boosted its stock significantly.

Image Source: Zacks Investment Research

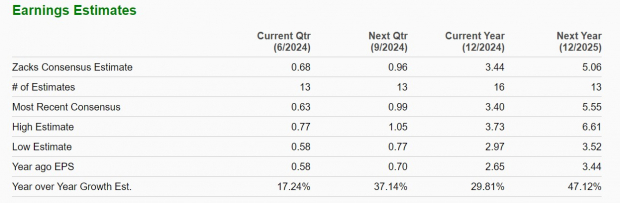

Growth Trajectories

AMD’s annual earnings are predicted to increase by 30% in fiscal 2024 and jump by another 47% in FY25. Sales are expected to rise 11% this year and further by 23% in FY25 to $30.97 billion. On the other hand, Super Micro is projected to witness an 85% surge in FY24 earnings to $21.88 per share and a 35% increase to $29.51 in FY25. Sales are forecasted to increase by 103% in FY24 and an additional 35% in the following year.

Image Source: Zacks Investment Research

When considering their market performance over the past year, the recent selloff in AMD and Super Micro Computer’s stock may not have been an overreaction. Their growth paths are still enticing, with AMD maintaining a Zacks Rank #2 (Buy) and Super Micro securing a Zacks Rank #3 (Hold) post a substantial rally.