The Financial Frenzy Unveiled

Exceeding both revenue and profit forecasts for its fiscal second quarter, Deere & Company witnessed a tumultuous -5% plunge in its stock during Thursday’s trading escapade. This nosedive ensued subsequent to the pessimistic tweak in Deere’s fiscal 2024 net income projection.

The inquiry that stewards the realm of investors now revolves around the aptness of buying the dip in Deere’s stock amidst this turmoil, oscillating on the pendulum of its robust historical performance.

A Peek Into Q2 Finances

The glitz and glamour of Deere’s Q2 show were illuminated with a net income standing at $2.37 billion or $8.53 per share, trumping the Zacks Consensus by a striking 8%. On the sales front, the Q2 revenue of $13.61 billion outshone estimates by a humble 2% margin, landing above the predicted $13.25 billion.

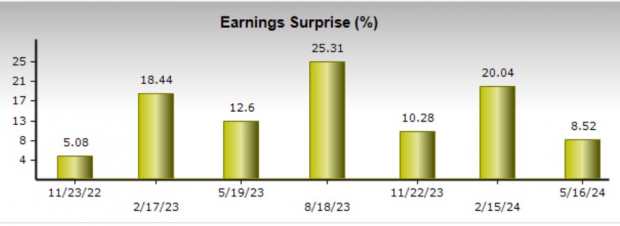

The year-over-year analysis unraveled a somber tale of Q2 earnings taking an 11% dip from a picturesque $9.65 per share in its counterpart quarter, ascribed to soaring operating costs. The plunge in sales by 15% was akin to a sinking ship tethered to lower volumes. Notwithstanding, Deere has paraded its prowess by surpassing earnings anticipations for seven consecutive quarters and embellishing its crown with eight consecutive quarters of sales estimate outperformance.

Gating the Guidance & Gander at the Future

Deere’s stride was slightly impeded by slashing its fiscal 2024 net income forecast to $7 billion, inching below the earlier guided range of $7.5-$7.75 billion, as pronounced in the February festivities. This subconscious reverence for caution was emboldened by Deere’s prophecy of a 15% slash in the expansive agricultural sector in the U.S. and Canada, with dingy shadows cast upon the small agriculture alcove and the turf domain, prophesying a 20% starvation.

Zacks’ crystal ball predicts a 21% freefall in Deere’s FY24 EPS, dwindling to $27.39 in contrast to the handsome $34.63 per share witnessed in the yesteryears. The overall sales narrative is somber, with a projected dip by 15% to $47.19 billion, echoing whispers of uncertainty in the corridors of the financially astute.

Delving into Deere’s Historical Performance & Market Musings

The stock market sees Deere’s shares languishing at a 1% dip since the dawn of the fiscal calendar but gallantly striding up by 7% in the rearview mirror of the past year. The stock’s racetrack has lagged behind the S&P 500’s meteoric 28% rise and paled in comparison to the construction colossus, Caterpillar’s robust 65% upsurge. Nonetheless, history quietly whispers tales of triumph as Deere’s 192% ascension edges past Caterpillar’s 186% in the last quinquennium, overshadowing the S&P 500’s meager 89% increment.

The fin de siècle celebrations go a notch higher with Deere’s stock gallivanting a 338% leap, trumping Caterpillar and the benchmark index with a formidable +237% and +189% respectively. This tale of the ticker tape will soon be etched in the annals of valor.

Navigating the Valuation Voyager

Amidst the looming shadows, Deere’s stock, perched at $394, flirts with trading at 15.1X forward earnings, marginally trailing its cozy five-year median of 16.1X while gleefully prancing below the staggering high of 33.1X. The gulf extends deeper as this valuation dance resonates with a discount tag when juxtaposed against the S&P 500’s 22.2X, finding a kinship with Caterpillar’s 16.5X.

Concluding Cadence

Deere’s stock presently wears the Zacks Rank #3 (Hold) badge, beckoning investors to gaze upon the greener pastures that may blossom from the agrarian slowdown. The tantalizing whispers of past valor and the melody of reasonable valuation orchestrate a symphony tailored for the patient virtuosos, inviting them to partake in the medley unfolding at Deere & Company.