As the fourth quarter earnings season kicks off, the spotlight is on two financial powerhouses – BlackRock (BLK) and Goldman Sachs (GS). With BlackRock exceeding Q4 earnings expectations, all eyes are now on Goldman Sachs, which is set to report its quarterly results on January 16. This begs the question – is it the right time to dive into stocks of these financial giants?

BlackRock’s Impressive Q4 Performance

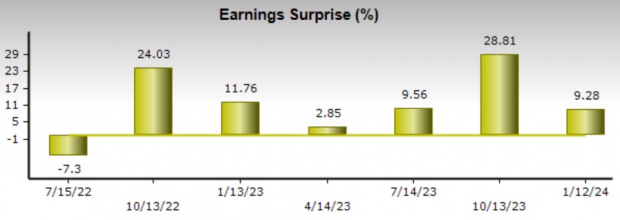

BlackRock has outperformed with fourth quarter earnings of $9.66 per share, beating the Zacks Consensus of $8.47 a share by 9% and registering an 8% year-over-year increase. The company also saw Q4 sales of $4.63 billion, slightly surpassing estimates and spiking 7% from the previous year. Notably, BlackRock has now surpassed earnings expectations for six consecutive quarters.

Image Source: Zacks Investment Research

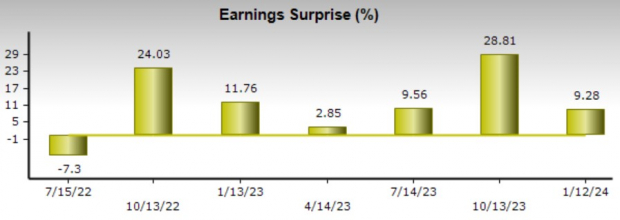

The favorable Q4 results were accompanied by the news of BlackRock’s acquisition of Global Infrastructure Partners for around $12 billion. This deal will create a leading infrastructure platform valued at over $150 billion and is positioned to meet the fast-growing investor demand.

Image Source: BlackRock Q4 Investor Presentation

Goldman Sachs’ Q4 Expectations

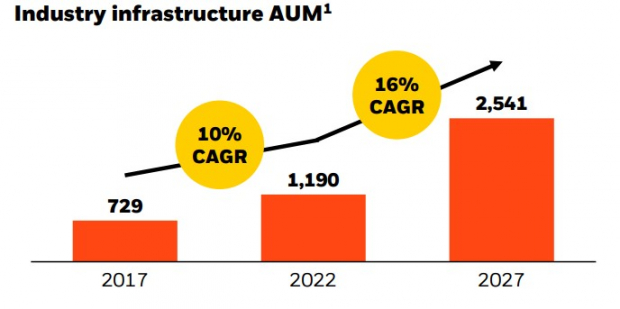

Investors are hoping that Goldman Sachs’ Asset & Wealth Management segment will continue to drive the company’s expansion amid a recovering capital market. According to Zacks estimates, Goldman Sachs is expected to see a 4% rise in earnings to $3.47 per share in Q4, with sales projected to be up 1% to $10.71 billion.

Image Source: Zacks Investment Research

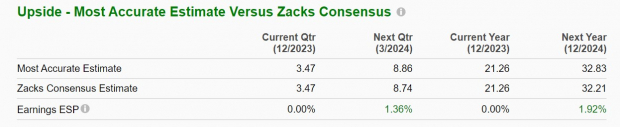

In the most recent quarter, Goldman Sachs topped Q3 earnings expectations by 3%, but has also missed estimates twice in its last four quarterly reports.

Image Source: Zacks Investment Research

Bottom Line

Currently, BlackRock’s stock sports a Zacks Rank #2 (Buy) with Goldman Sachs landing a Zacks Rank #3 (Hold). Both firms are expected to maintain their robust top and bottom line figures, with BlackRock standing out after consistently beating earnings expectations for six consecutive quarters.

The decision to invest in BlackRock or Goldman Sachs is not just a matter of earnings projections, but about the companies’ long-term potential and their ability to generate sustained value for investors. As the tides of the market ebb and flow, it’s wise for investors to look beyond quarterly results and consider the historical and prospective performance of these financial giants.

The grand narrative encompassing BlackRock and Goldman Sachs extends beyond earnings season, spanning through periods of market euphoria and downturn. While quarterly earnings provide a snapshot of a company’s financial health, they are just a part of the larger, unending story of investment opportunities in the financial sector.