Seizing life-changing returns in the stock market is akin to discovering gold in a roaring river. Investors have seen the likes of Apple, Netflix, and Nvidia monumentally elevate portfolios to soaring heights over recent years.

Why Sticking with Proven Winners Might Not Cut It for Growth Investors

The glory days of massive gains from Apple, Netflix, and Nvidia might very well be behind us. As these stalwart stocks continue their solid ascent, the potential for meteoric multiplication is dwindling amidst their commanding market capitalization.

While stability and reliable long-term returns are hallmarks of these established stocks, their days of exponential growth transformations could be a memory of the past. The time is ripe for identifying budding potential rather than resting on the laurels of proven performers.

Vibrant startups with ample room for growth are bubbling in the market’s cauldron, offering a fresh canvas for investors seeking the thrill of fledgling opportunities. The pursuit of a small-cap company today may hold the key to future prosperity beyond wildest dreams.

Introducing Duolingo’s Progression in the E-Learning Realm

Enter Duolingo, a linguistics virtuoso that has orchestrated an extraordinary 242% surge in stock value over the past two years. The company’s revenue trajectory over the last twelve months has soared by a staggering 87%, with free cash flows (FCF) ascending to a remarkable 553% increase. Duolingo is a beacon of rapid growth, magnetizing keen interest from market spectators.

Although Duolingo’s shares may bear lofty valuation multiples – standing at 55 times FCF and 203 times earnings – the company is encroaching on crucial expansion areas. Noteworthy revenue escalations, a surge in monthly active users, and a pronounced uptick in paid subscriptions and FCF bolster Duolingo’s foundations for sustained business progression.

The celestial horizons that now appear within Duolingo’s grasp, substantiated by the recent introductions of math and music modules, herald a diversification strategy in the e-learning space. With the global online learning sector burgeoning, Duolingo’s sliver of the pie has immense room for expansion, painting a vivid roadmap for future success.

Roku’s Paradigm Shift in the Media Landscape

Roku, a trailblazer in media-streaming technology, has transcended the tides of time by assuming a mantle of primacy in the North American streaming platform arena. Evolving from its genesis as Netflix’s hardware arm, Roku now commands a lion’s share of the domestic streaming platform domain and is eyeing global outreach, akin to the footsteps of its precursor a decade prior.

The seismic upheaval that streaming services have propagated in the media domain is palpable, with cable, satellite, and terrestrial broadcasters witnessing encroachments on their hegemonic realms. Embracing a strategic metamorphosis from hardware vending to software assimilation and licensing has consolidated Roku’s resilience in an industry perpetually in flux.

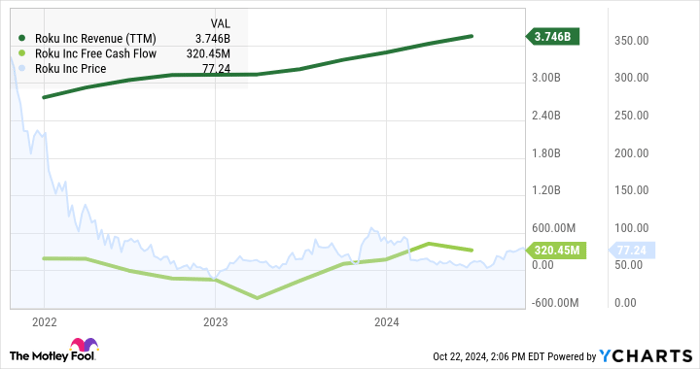

Roku’s uptrend in revenue and recuperation from an ephemeral brush with adverse free cash flows signifies an auspicious trajectory:

📈 Visual of Roku’s Revenue Trends 📈

The stock’s languishing in Wall Street’s bargain bin, attributed to negative after-tax earnings and a faltering digital advertising milieu, belies its colossal growth potential and substantiated cash viability. At a modest price-to-sales ratio of 3.0, Roku beckons investors to partake in its overseas escapade amidst lucrative prospects and burgeoning valuations.

Roku: A Closer Look at Long-Term Returns

Exploring Investment Opportunities in Roku

Before diving headfirst into the turbulent waters of the stock market, wise investors take a moment to heed the advice echoing from the grand halls of financial wisdom.

In Search of the Holy Grail

The legendary Motley Fool Stock Advisor analysts have spoken, selecting the shining knights of the investment realm – the 10 best stocks to forge paths into the future. Yet, amidst the glimmering treasures, Roku stands aloof, a maiden waiting for her time to shine.

A Glimpse Back in Time

History unfolds like an ancient tapestry, revealing tales of fortunes won and lost. Behold the saga of Nvidia, whose name graced the coveted list on April 15, 2005. A meager sum of $1,000 sown then would reap a golden harvest – a staggering $855,238* today.

The Beacon of Success

Amidst the tumultuous seas of the market, the Stock Advisor beckons with promises of guidance and enlightenment. Offering a roadmap to prosperity, this service has outshone the mighty S&P 500, quadrupling its returns since the dawn of 2002*.

Unveiling the Future

Curious minds seeking the next revolutionary wave are invited to gaze upon the horizon, where the 10 chosen ones reside. Venture forth, and may the echoes of financial legends guide your hand towards untold riches.