The Meteoric Rise of SMCI Stock in 2025

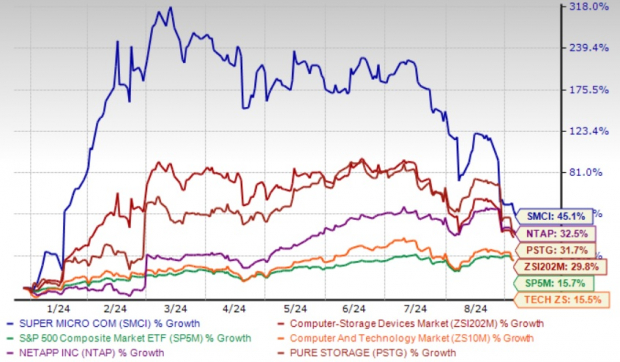

Super Micro Computer, Inc. (SMCI) has been racing ahead in the stock market, boasting a staggering 45.1% surge in the year-to-date period. This feat surpasses industry benchmarks, leaving competitors like NetApp (NTAP) and Pure Storage (PSTG) in the dust with their more modest returns of 32.5% and 31.7%, respectively, during the same period.

SMCI’s Dominance in the AI Landscape

Super Micro Computer stands at the forefront of the AI revolution, leveraging its cutting-edge technology and product prowess in the AI infrastructure market. With a diverse AI portfolio and robust AI integrations in its storage systems, SMCI is painting a picture of innovation.

The Engine Driving SMCI’s Growth

The momentum behind Super Micro Computer is fueled by its success across various sectors, including data centers, cloud service providers, and enterprise customers. Its innovative Direct Liquid Cooling (DLC) solutions are particularly instrumental in seizing the opportunities presented by the AI surge.

SMCI’s Strategic Partnerships and Growth Prospects

Super Micro Computer’s strategic collaborations with industry giants like NVIDIA, Intel, and AMD are pivotal in steering its growth trajectory forward. The company’s forward-looking investments in generative AI and inference-optimized systems underscore its commitment to staying ahead in the rapidly evolving tech landscape.

Valuation and Risks on the Horizon

Despite its meteoric rise, SMCI stock presents an attractive valuation opportunity for investors, trading at a discount compared to industry averages. However, concerns loom over potential shipment delays and supply chain bottlenecks, which could impact the company’s margins in the near term.

The Unseen Hurdles: Super Micro Computer Stock Faces Forecasted EPS Impact

Forecasted Earnings Projections

The Zacks Consensus Estimate for fiscal 2025 earnings predicts growth, with a rise to $33.50 per share, signaling a 51.6% increase year-over-year. However, this figure has experienced a slight decline of 0.2% over the last 30 days.

Investor Recommendation: Hold or Wait?

Given the solid fundamentals, attractive valuation, and promising future growth in the AI infrastructure sector, current shareholders of Super Micro Computer are advised to retain their shares. The company is well-positioned for continued expansion, especially as the demand for AI technologies remains robust.

On the other hand, prospective investors might want to exercise caution. Factors such as shipment delays, supply chain disruptions, macroeconomic challenges, and decreasing earnings estimates cloud the near-term outlook for SMCI.