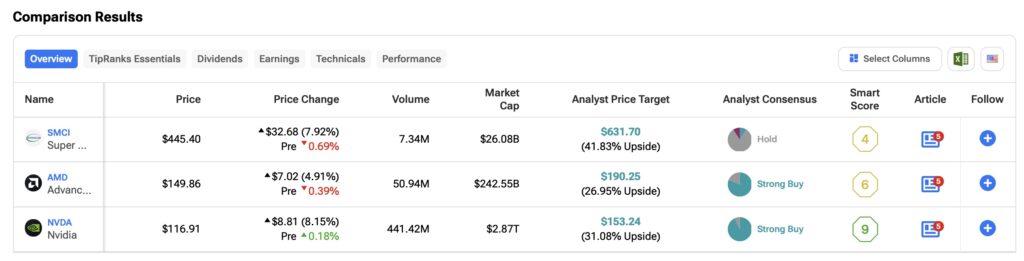

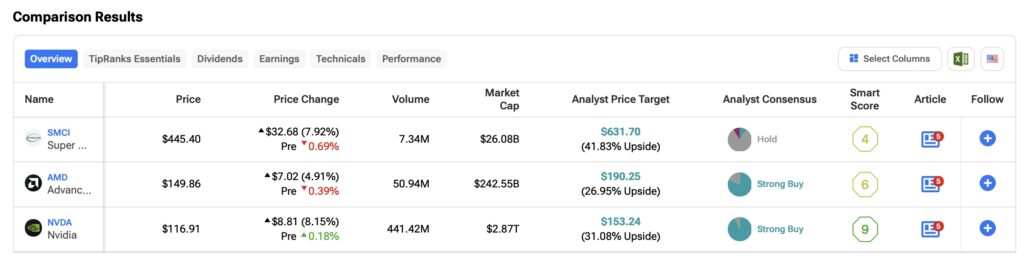

Investing in the world of advanced computing and artificial intelligence is akin to navigating a tumultuous sea, where the waves of innovation can either carry you to fortune or capsize your prospects. In this scrutiny, we pit three heavyweight contenders against each other – Super Micro Computer (SMCI), Advanced Micro Devices (AMD), and Nvidia (NVDA), using the discerning lens of the TipRanks Stock Comparison Tool. As the tides ebb and flow, my judgment unfurls: Nvidia, gleaming with promise, emerges as the star player, warranting a Buy rating, while Super Micro Computer and AMD linger in the shadows with my lukewarm Hold stance.

Before we decipher the intricate tapestry of these stocks, it is prudent to grasp the roles donned by each entity. While NVIDIA and AMD forge the beating heart of servers and data centers with their graphic processing units (GPUs), it is Super Micro Computer that lays the bedrock, providing the indispensable infrastructure. As NVIDIA and AMD sprint down the path of expedited computations, Super Micro is the silent architect.

Super Micro Computer (SMCI): The Fortunes and Perils

Standing at the threshold of robust expansion, Super Micro Computer beckons with promise, yet my confidence wavers as I tip the scales at Hold. The company’s coffers swell with revenues vaulting skyward by 109.7% over the previous year, accompanied by a sturdy 63.9% surge in earnings, a fuel derived from the flames of fervent AI demand.

Prognosticators espouse that Super Micro’s revenue will not quell its upward march, foreseeing an 88.3% augmentation, potentially cresting at $28.14 billion. Nonetheless, shadows loom over the firm’s fate, cast by the malevolent hand of Hindenburg Research – a name that echoes with rifts of accusation. Their recent aspersions of accounting chicanery, aimed at Super Micro, have fanned flames of doubt, causing the stock to stumble and imbuing whispers of skepticism regarding the managerial helm. Quivering, Super Micro Computer has forestalled the unveiling of its annual report, a tremor felt across the market’s expanse.

Is SMCI A Buy, Hold, or Sell? Navigating the Swirling Maelstrom

Veiled in uncertainty, the path ahead for Super Micro Computer appears treacherous, casting it as a risky venture – hence, I tread warily with my Hold stance. Yet, the faltering stock, now perched at $465, a far cry from its zenith at $1,229, offers a siren call to bargain hunters. Should the murky allegations swirling around the company be vanquished, this descent may herald an opportunity cloaked as calamity.

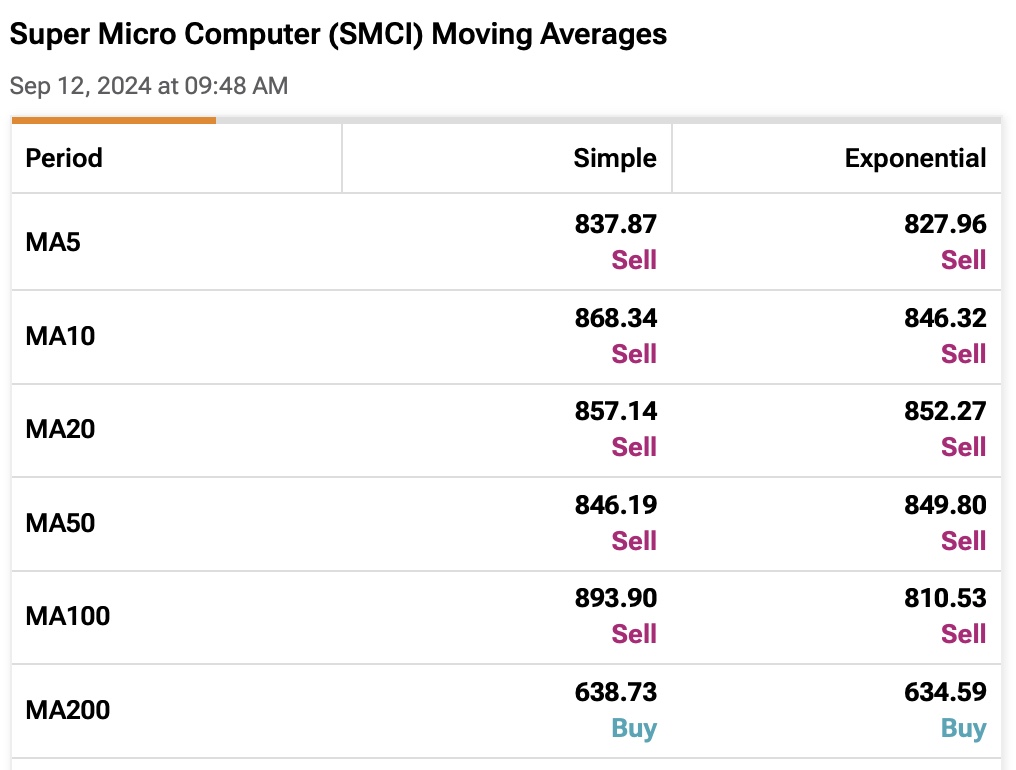

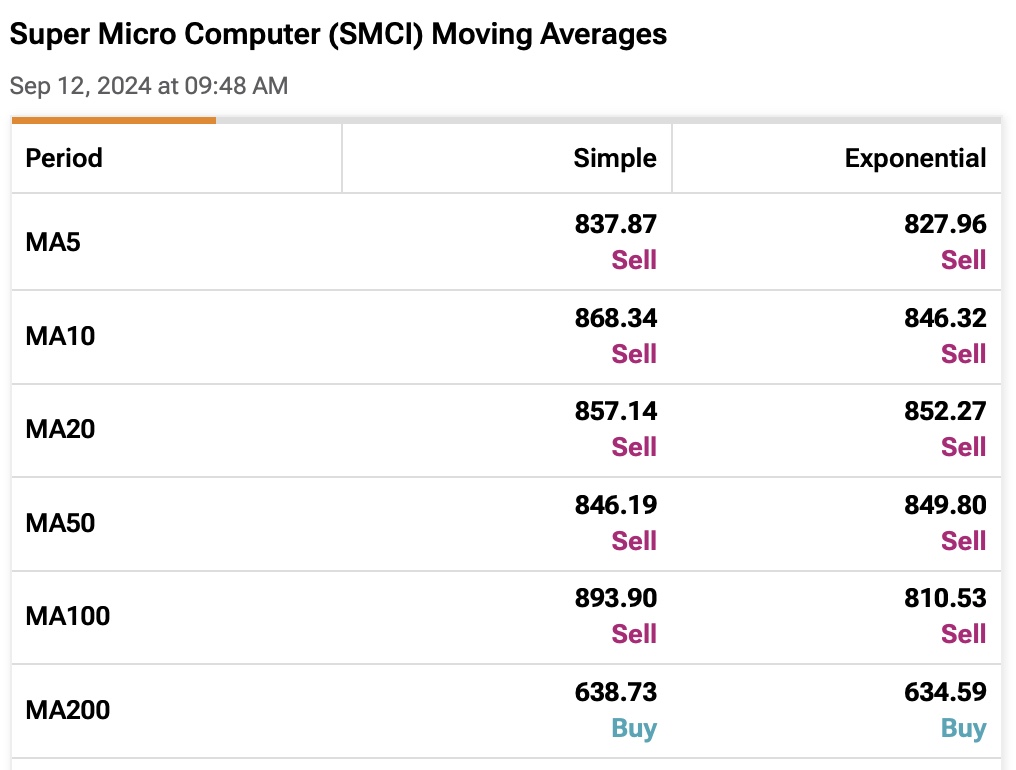

Perusing the momentum indicators, the current lies paint a bleak narrative: below the 10, 50, and 100-day moving averages, signaling a bearish tide. Yet, lurking beneath the surface, a glimpse of light as it grazes the 200-day average, beckoning contrarians to seek fortune amidst desolation.

However, darkness does not yet envelop Super Micro’s skies entirely, for the sages of Wall Street cling to their optimism, brandishing a Moderate Buy consensus as a beacon. Their gaze fixed upon the horizon, the average SMCI price target – $978.50 – whispered by 11 seers, hints at a potential soar of 119.69%.

Nvidia (NVDA): The Luminous Beacon

Amidst the tempest of competitors, Nvidia emerges as the unassailable paragon, reigning supreme in the dominion of AI. It is this radiant aura, coupled with its eminent position in powering advanced AI systems and data fortresses, that shines resplendent – rendering my verdict: a resounding Buy. As the waltz of innovation whirls Nvidia’s products to the forefront, a titan’s share, claimed in the data-center GPU market at 98%, adds weight to my bullish credence.

A siren’s call, the past year witnesses Nvidia soaring to celestial heights with revenues crescendoing by 194.7% and earnings surging by a staggering 394.2%. Foretellers beckon to a future brimming with promise, predicting a 106.1% revenue surge, perched at $125.58 billion, alongside an anticipated 119.2% rise in earnings per share (EPS). A tale of triumph and tribulation unfolds as Nvidia’s recent financial sagas unveil a 122% annual sales surge, yet falling short of erstwhile glories when growth scaled peaks of a 200% annual ascent.

Is NVDA A Buy, Hold, or Sell? Navigating the Celestial Gales

Nvidia commands the stage as a resolute Buy, a titan with no chink in its armor. A dazzling ascent of 140% in share price across the year begs to repel naysayers, punctuating a saga of unyielding growth. Though recent murmurs of deceleration linger, the grand narrative of Nvidia’s saga remains unwavering.

Still, sailors navigating Nvidia’s seaborne pathways must brace for squalls of volatility in the short term. Technical auguries foretell a tale dipped in melancholy for the near future, yet a golden promise on the long horizon lingers. A whisper in the wind conveys a message of enduring profitability to all Voyagers steadfast in their NVIDIA sojourn.

The Chip Stock Conundrum: Unveiling the Superior Investment Choice

Wall Street’s bold endorsement of Nvidia remains unshaken. Among 42 analysts tracking the company, an overwhelming 39 advocates for a Buy rating on the stock. The tantalizing prospect of an average NVDA price target of $153.24, potentially signaling a 31.08% upside from current levels, further solidifies investor confidence.

Trials and Tribulations of Advanced Micro Devices (AMD)

The specter of a Hold rating hovers over AMD, cast by its lackluster financial ascent. Despite posting a modest 6.4% revenue uptick and a commendable 30.5% surge in earnings over the past year, AMD’s growth narrative pales in comparison to its arch-nemesis, Nvidia. The company’s predilection for hardware efficiency subtly underscores its path to relative underperformance.

Prognosticators foresee a nearly 13% revenue surge for AMD this fiscal year, propelling figures to $25.62 billion alongside a noteworthy 27.6% escalation in EPS. Nevertheless, recent financial results have painted a dreary picture. While witnessing a staggering 115% year-over-year revenue boom in the Data Center segment during Q2, AMD grappled with a disheartening 59% decline in revenue garnered from chips and processors dedicated to video game consoles. In stark contradistinction, Nvidia witnessed a commendable 16% uptick in gaming revenues. The glaring chasm in performance casts doubts on AMD’s allure as a lucrative microchip investment.

Deciphering AMD’s Investment Sentiment

Another factor anchoring the AMD stock with a tepid Hold rating is the recent $4.9 billion acquisition of ZT Systems. This transaction, financed predominantly through cash (75%) and stock (25%), has ignited apprehensions regarding potential share dilution repercussions weighing on yearly earnings. Alas, AMD’s stock registers a meager uptick of less than 10% year-to-date, lagging behind competitive counterparts and the tech-heavy Nasdaq index, which boasts a 20% appreciation within the same period.

Delving into momentum indicators, contemporaneous signals exhort a Buy stance, while the medium- and long-term pointers clang ominous bells of Sell. This bifurcation implies a fertile ground for short-term gain seekers but cautions long-term investors against plunging headlong into a vortex of bearish undertones.

AMD’s Salvation Lies in the Eyes of Wall Street

Amidst this turmoil, Wall Street’s collective consciousness fashions a resplendent Strong Buy badge for AMD. Of the 32 scrutinizing analysts, 26 extol the virtues of Buying AMD shares. The enchanting average price target of $190.25 unfurls a landscape of anticipation, hinting at a potential 26.95% upside.

Epilogue – NVDA Emerges Victorious

While the troika of Super Micro Computer, Nvidia, and AMD parade individual idiosyncrasies, the mantle of the supreme investment choice rests snugly on Nvidia’s shoulders. Buoyed by its hegemony in AI and a robust growth trajectory, Nvidia towers over its industry comrades. Amidst cautionary whispers surrounding both Super Micro Computer and AMD, Nvidia emerges as the unequivocal harbinger of market ascendancy, eclipsing its rivals in performance and market sentiment alike.