Solar stocks are basking in the warmth of a sudden surge following democratic nominee Kamala Harris’ spotlight on alternative energy assets during Tuesday’s presidential debate. While heavy-hitters like First Solar, Sunrun, and Array Technologies shine bright among stocks, the Zacks Solar Industry finds itself in the shadowy depths, ranked in the bottom 43% of over 250 Zacks industries.

The solar energy arena, while in its nascent stages, grapples with the challenges of a high inflationary landscape. However, investors may find glimmers of hope amidst the shadows of volatility, hinting at potential opportunities waiting to be unearthed.

First Solar: Standing Firm as the Beacon

First Solar leads the way in the solar stock rally, with its significant spike of nearly +15% post the presidential debate marking its territory. Renowned as the largest solar module manufacturer, First Solar’s ambitious growth trajectory is evident, with its stock soaring by +35% in this year’s climb.

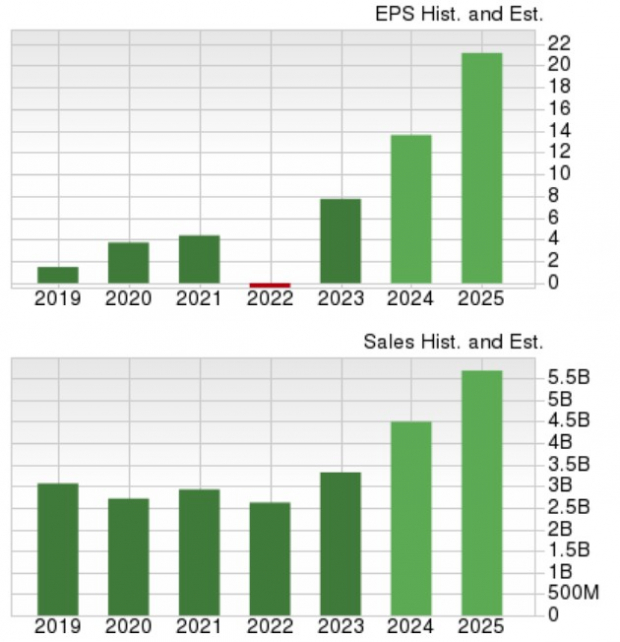

Although categorized with a Zacks Rank #3 (Hold) after its substantial surge, First Solar’s future looks promising with projected high double-digit growth rates in both top and bottom lines for fiscal 2024 and FY25, paving its path as a sturdy long-term investment.

Image Source: Zacks Investment Research

Sunrun: Embracing the Radiance with a Zacks Rank #1 (Strong Buy)

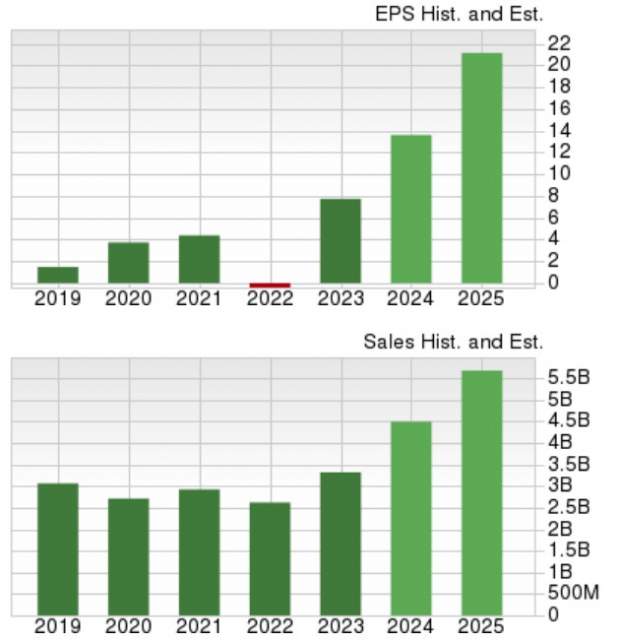

Provider of residential solar energy systems, Sunrun shines as the top-rated stock within the Zacks Solar Industry, boasting a Zacks Rank #1 (Strong Buy). Earnings estimates for FY24 and FY25 have been on an upward trend in the last 60 days, painting a road to profitability for Sunrun.

Image Source: Zacks Investment Research

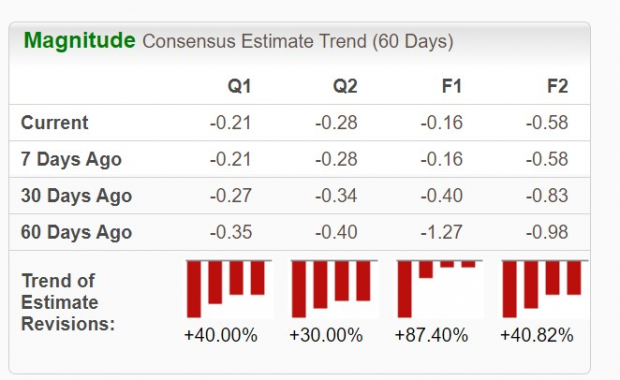

Further fueling optimism, expectations of a rebound in sales growth forecast Sunrun’s total sales to recover by a whopping 20% in FY25 from a -5% dip predicted for this year. This potential growth surge would represent a staggering 100% increase from the pre-pandemic sales figures in 2019.

Sunrun also showcases significant financial resilience, with cash & equivalents soaring from $363 million in 2019 to over $1 billion by the end of Q2 2024. This robust financial backbone has started to validate the premium placed on Sunrun’s stock despite its non-profitable status, presently trading around $20.

Image Source: Zacks Investment Research

Array Technologies: A Phoenix Rising from the Ashes?

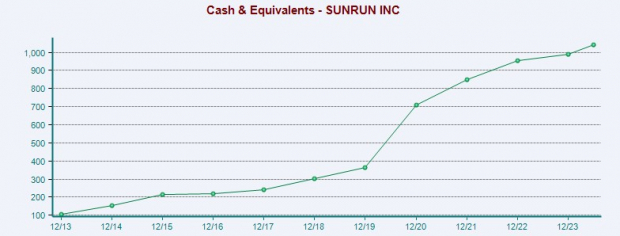

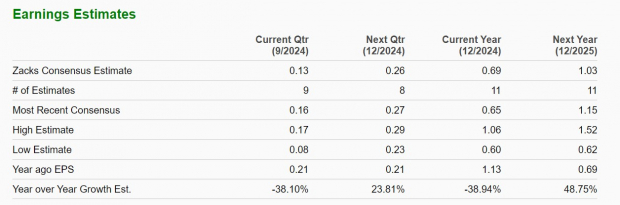

Specializing in ground mounting systems for solar energy projects, Array Technologies emerges as a potential candidate for a significant rebound. The company, currently profitable, sees its stock trading at a modest $6, shadowing a sharp decline from its peak of $26.

The forward-looking horizon for Array Technologies reveals a price-to-earnings ratio of 9.6X, with EPS estimated to plummet by -39% in FY24 but set to rebound energetically with a forecasted 49% surge in the following year, soaring to $1.03 per share.

Although resting with a Zacks Rank #3 (Hold), Array Technologies holds an “A” Zacks Style Scores grade for Value, instilling a glimmer of hope amidst its recent price upswing by +2% in the current trading session.

Image Source: Zacks Investment Research

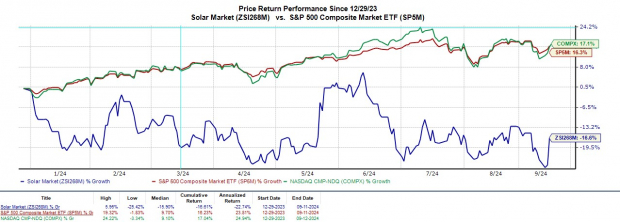

The Solar Sunset: A Performance Check

The Zacks Solar market, year to date, still struggles with a -16% downturn, casting a shadow upon the gleaming performances of the S&P 500 and Nasdaq, which have recorded gains exceeding +15%. Even with the recent revival, the solar market continues to lag, showing a -4% dip this month and trailing behind the broader market indexes.

Image Source: Zacks Investment Research

Closing Thoughts: Navigating the Solar Eclipse

As investors gaze upon the sky, hopeful for a prolonged solar upswing, caution should be the guiding star when considering investments in this sector. While First Solar, Sunrun, Array Technologies, and several others twinkle with allure, the solar sector remains eclipsed by significant downside risks. The anticipated rate adjustments may cast a positive ray, countering the adverse effects of inflation which have clouded their operational landscapes and growth trajectories.

Unveiling Zacks’ Top Semiconductor Stock

Like a hidden gem, the top semiconductor stock named by Zacks stands as a minnow against the behemoth NVIDIA, which surged by over +800% post-recommendation. This rising star, with robust earnings growth and a widening customer base, positions itself to meet the soaring demands of Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor manufacturing arena is poised for exponential growth, projected to swell from $452 billion in 2021 to an astounding $803 billion by 2028.