Friday’s Trading Patterns

Despite a lackluster volume, Friday’s trading session revealed a notable shift as buyers emerged at the trendline support. The market saw minimal technical alterations, except for a whipsaw signal in relative performance against the backdrop of a prior ‘sell’ signal for the MACD.

Nasdaq Insights

The Nasdaq managed to recoup some of the losses incurred on Friday, yet it still falls short of challenging the ‘bull trap’ and lags behind breakout support levels. Furthermore, the index continues to exhibit weaker performance compared to its counterparts. On-Balance-Volume remains stagnant against the signal line, although it has shifted back into a ‘buy’ signal.

S&P 500 Overview

Similarly, the S&P 500 struggles to surpass trendline support following Friday’s attempted recovery. While the index outperforms relative to the S&P 500, both On-Balance-Volume and MACD cling to their previous ‘sell’ signals.

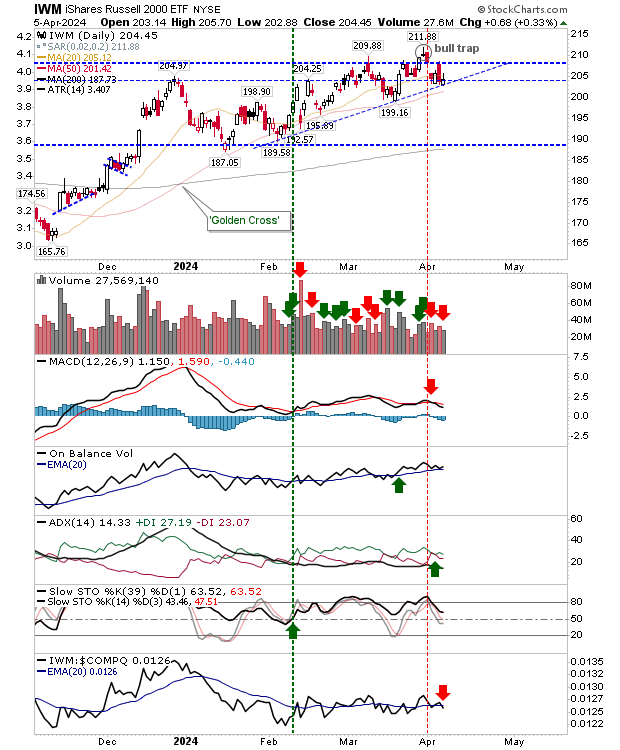

Today’s focal point shifts to the Russell 2000 ($IWM) as it sustains momentum from the recent support bounce. Should this momentum fade within the initial trading hour, attention may pivot towards the Nasdaq ($COMPQ) and S&P 500 ($SPX) for potential shorting prospects, especially if these indices approach trendline resistance formerly recognized as support.