Big-time investors are showcasing a robust bullish stance towards Barrick Gold, and this is a development warranting serious attention. Recent revelations from Benzinga’s public options data analysis shed light on this significant maneuver today. The identity of these investors remains shrouded in mystery, but such a substantial shift in GOLD usually heralds a major event on the horizon.

Upon close scrutiny earlier today, Benzinga’s options scanner brought to the forefront 9 extraordinary options activities concerning Barrick Gold. This heightened level of activity sets off alarm bells.

Among these high-stakes investors, sentiments are split, with 66% tending towards bullish sentiment and 33% leaning bearish. Noteworthy options include 4 puts amounting to $364,606 and 5 calls totaling $485,755.

The Projections and Sentiments

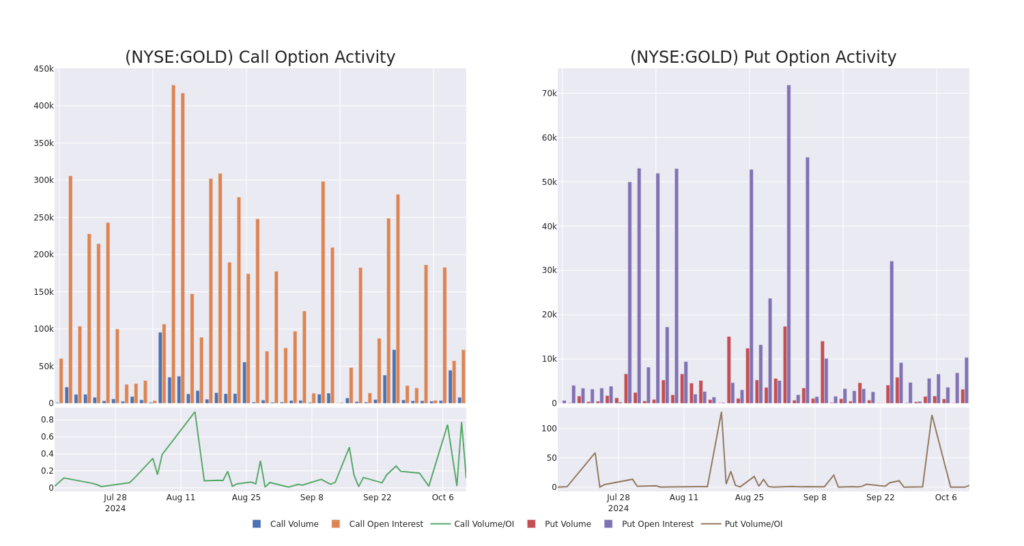

Delving into trading volumes and Open Interest, it becomes apparent that major market movers have zeroed in on a price range spanning $17.0 to $25.0 for Barrick Gold over the past three months.

Tracking Volume & Interest

In terms of liquidity and interest, the average open interest for Barrick Gold options trades today stands at 11,794.14 with a cumulative volume of 11,396.00.

Examining the chart below provides a visual narrative of the volume and open interest for call and put options within a strike price range of $17.0 to $25.0 for Barrick Gold’s significant trades over the last 30 days.

Insight into Barrick Gold’s Options Performance

Spotting the Standout Options

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GOLD | CALL | SWEEP | BEARISH | 01/17/25 | $3.45 | $3.40 | $3.40 | $17.00 | $340.0K | 40.9K | 2.0K |

| GOLD | PUT | SWEEP | BULLISH | 03/21/25 | $5.10 | $5.00 | $5.00 | $25.00 | $149.5K | 131 | 300 |

| GOLD | PUT | SWEEP | BULLISH | 01/16/26 | $5.75 | $5.65 | $5.65 | $25.00 | $111.3K | 940 | 206 |

| GOLD | PUT | SWEEP | BULLISH | 10/18/24 | $0.35 | $0.34 | $0.34 | $20.00 | $68.0K | 7.7K | 2.4K |

| GOLD | CALL | SWEEP | BULLISH | 11/15/24 | $1.16 | $1.14 | $1.15 | $20.00 | $50.4K | 22.5K | 502 |

A Glimpse into Barrick Gold’s Background

Headquartered in Toronto, Barrick Gold stands as one of the world’s largest gold miners. With a production of nearly 4.1 million gold ounces and approximately 420 million copper pounds in 2023, the firm boasts significant gold and copper reserves stretching over two decades. Through strategic acquisitions like Randgold in 2019 and a joint venture in Nevada with Newmont, Barrick operates mines across 19 countries in the Americas, Africa, the Middle East, and Asia. The company’s copper exposure is steadily increasing, with the potential Reko Diq project in Pakistan poised to double copper production by the end of the decade.

Given the recent options frenzy surrounding Barrick Gold, it’s time to delve into the company’s current trajectory.

Evaluating Barrick Gold’s Present Status

- With a trading volume of 14,983,988, Barrick Gold’s price has dipped by -0.45% to $19.98.

- RSI indicators suggest the stock currently hovers in neutral territory, oscillating between overbought and oversold conditions.

- The forthcoming earnings report is slated for release in the next 27 days.

Can $1000 transform into $1270 in a mere 20 days?

An options trading veteran with two decades of experience unveils a one-line chart technique signaling optimal buy and sell points. Emulate his trades, which have historically yielded a 27% profit every 20 days. Access the insights here.

Options present a riskier platform compared to conventional stock trading, but they harbor greater profit potential. Seasoned options traders mitigate these risks through continuous education, strategic trade entries and exits, multi-indicator analysis, and meticulous market vigilance.

To remain updated on the latest options movements concerning Barrick Gold, utilize Benzinga Pro for real-time options trade alerts.

Market News and Data brought to you by Benzinga APIs