Examining the recent changes in shares outstanding among the ETFs covered at ETF Channel, the SPDR Portfolio S&P 500 High Dividend ETF (Symbol: SPYD) stands out with an approximate $265.4 million dollar outflow. This reflects a 3.9% decrease week over week, from 180,150,000 to 173,200,000 shares.

Noteworthy Components

Among the prominent underlying components of SPYD, Ford Motor Co. (Symbol: F) saw a 0.9% decrease, Digital Realty Trust Inc (Symbol: DLR) experienced a 0.7% decline, and Public Service Enterprise Group Inc (Symbol: PEG) dropped by about 0.1%.

Price Performance Evaluation

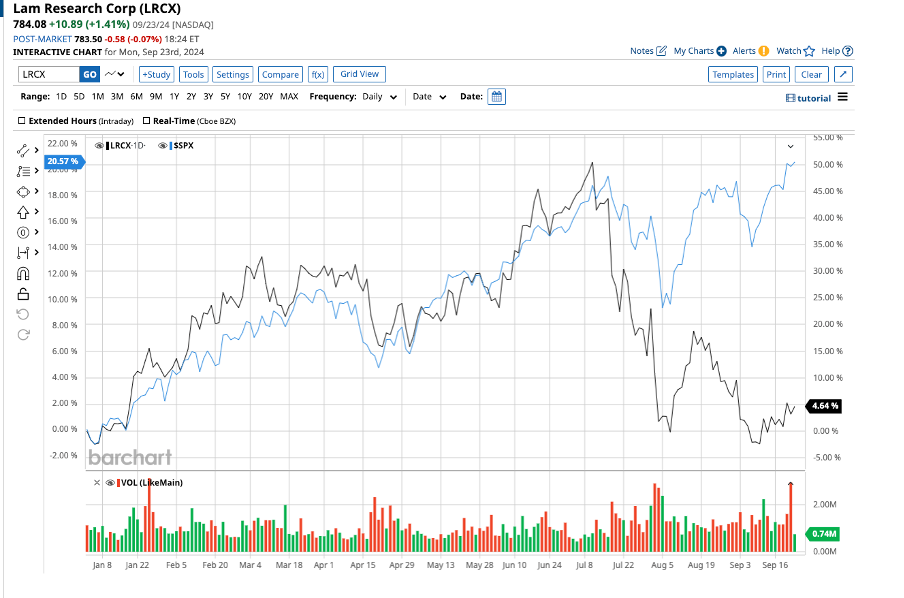

Over the span of a year, SPYD’s price performance as compared to its 200-day moving average can be observed through the chart below:

Within the 52-week range, SPYD’s lowest point was at $32.88 per share and its highest peaked at $42.18.

Comparing the most recent share price to the 200-day moving average can provide valuable insights for technical analysis.

Understanding ETFs

Exchange-traded funds (ETFs) function similarly to stocks, where investors trade ”units”. These units can be traded back and forth just like stocks, or created or destroyed to meet investor demand. Monitoring the week-over-week change in shares outstanding data reveals ETFs with notable inflows or outflows.

Creation of new units necessitates the purchase of underlying holdings, while destruction of units involves selling underlying holdings, implying that large flows have the potential to impact the individual components held within ETFs.

Discover which other 9 ETFs have experienced notable outflows »

Additional Resources: