When Nvidia recently announced its stock split, the market reverberated with excitement. The company’s shares soared by a remarkable 36% since then, showcasing great success but also sparking curiosity among investors eyeing other AI players in the industry.

While stock splits do not fundamentally alter a company’s operations, they do make shares more affordable and appealing, particularly to employees and investors. Following in the footsteps of Nvidia, other AI corporations might consider similar actions to enhance market participation.

Microsoft: A Tech Behemoth Ready to Divide?

Microsoft, once the world’s most valuable company, stands out as a prime candidate for a stock split. Surprisingly, despite substantial appreciation over the years, Microsoft has refrained from a split for over two decades now. During the late 1980s and early 2000s, the tech giant split its stock nine times, aligning with its dominant position in PC operating systems back then.

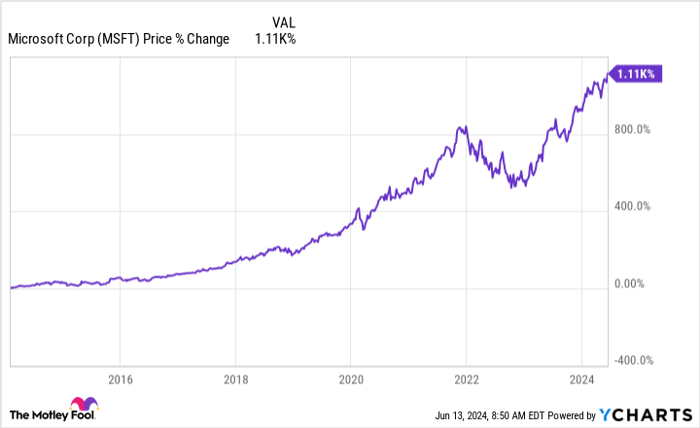

However, challenges emerged with the Dot-Com bubble burst, and Apple’s ascendancy with the iPhone under Steve Ballmer’s leadership. It took Satya Nadella’s strategic vision in 2014 to reshape Microsoft as a cloud and AI leader, propelling the stock to unprecedented heights with over a 1,110% surge under his tenure.

Given Microsoft’s remarkable growth trajectory and its position in the Dow Jones Industrial Average, a stock split seems inevitable to prevent an outsized impact on index movements. As the company continues to exhibit robust financial performance, a split appears not just imminent but necessary to sustain its momentum.

Meta Platforms: The Time for Change?

Meta Platforms, formerly Facebook, has never executed a stock split, but the winds of change may be blowing in that direction. With a current share price hovering around $504, the stock’s affordability remains a concern for many retail investors. By contemplating a 3-for-1 or 5-for-1 split, Meta could democratize access to its shares and attract a broader investor base unable to purchase fractional shares.

Furthermore, a recent Bank of America study highlighted the potential for outperformance following stock splits, providing an additional impetus for Meta Platforms to embark on this new chapter. As the company evaluates its growth trajectory and investor inclusivity, a stock split could be the strategic move needed to unlock new opportunities and drive greater market engagement.

The Potential Impact of Stock Splits on Market Performances

Stock Splits: A Historical Outlook

Research from 1980 shows that stocks tend to outperform the S&P 500 in the year following a split, a pattern consistently observed over the last four decades. This trend highlights the positive implications that stock splits have historically had on market performance.

Meta Platforms: An Abstainer from Stock Splits

Contrary to industry norms, Meta Platforms has refrained from conducting any stock splits in its 12-year history as a public company. This reluctance stands in stark contrast to tech giants like Adobe and Microsoft, who have implemented multiple stock splits during their early years. Despite Meta’s stance, its robust digital advertising business continues to drive impressive growth, positioning it as a top performer in the tech sector.

Super Micro Computer: A Candidate for Stock Split

Super Micro Computer, known for its modular server systems, has witnessed a surge in demand parallel to the rise of AI technology. With revenue growth reaching 200% year over year and promising earnings projections, the company stands to benefit from ongoing data center expansion. Amid a soaring stock price, a potential stock split could enhance liquidity, accessibility for investors, and reignite market interest following recent stagnation.

The Case for Stock Splits in Market Dynamics

While some companies refrain from splitting their stock despite substantial appreciation, the decision to do so can address liquidity constraints, facilitate gradual investment accumulation, and attract positive market attention. The aftermath of a stock split often propels share prices higher, offering a mutually beneficial outcome for stakeholders.

Investment Insights: Microsoft’s Potential and Historical Context

Considering investment opportunities, Microsoft’s omission from a recent list of high-growth stocks underscores the dynamic nature of market performance. Reflecting on historical success stories like Nvidia’s meteoric rise post-recommendation, investors are urged to weigh the potential for future returns and diversification strategies.