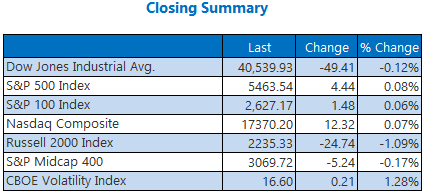

As the new week dawned on Wall Street, the stock market displayed a sluggish start. Investors witnessed a lackluster performance with the Dow Jones Industrial Average retracting triple-digit gains to end in the red. In contrast, the Nasdaq managed to salvage some of its initial triple-digit gains, closing marginally higher. The S&P 500 squeaked out a victory, setting the stage for a mammoth week of Big Tech earnings as the market carefully observed the movements of tech behemoths like Amazon.com (AMZN), Apple (AAPL), Microsoft (MSFT), and Meta Platforms (META), all of which concluded the day on a positive note ahead of their upcoming quarterly reports.

Further insights can be gained by exploring today’s market landscape:

- This hidden gem in the tech sector may emerge as a colossal entity.

- An exploration of the advantages of employing a long strangle strategy during earnings season.

- Insights on ABT’s turbulent journey, an overview of the oil industry, and a reflection on the recent earnings season events.

Key Notables for the Day

- Mounting volumes of student loan debt continue to accumulate.

- The Bank of Japan (BoJ) exhibits reluctance towards interest rate cuts this week.

- A significant drug stock encounters a standstill at a crucial trendline.

- Prominent oil stocks gear up for their earnings announcements.

- A retrospective look at the noteworthy reports from the previous week.

Commodities Outlook Leading into a Volatile Week

The echoes in the oil market reverberated today as prices took a tumble, further deepening a three-week slump amidst escalating Middle-East tensions. The price of September-dated West Texas crude plummeted by $1.35, translating to a 1.8% drop, settling at $75.81 per barrel for the day.

Similarly, gold futures experienced a cooling effect as the U.S. dollar gained strength in anticipation of the upcoming Federal Reserve meeting. Against this backdrop, August-dated gold futures recorded a 0.2% decline, closing at $2,375 per ounce.