Artificial intelligence (AI) stole the spotlight this week as the Royal Swedish Academy of Sciences honored remarkable achievements in the field with two prestigious awards. Simultaneously, the financial markets witnessed Bitcoin’s continued susceptibility to macroeconomic shifts, while Tesla (NASDAQ: TSLA) attempted to impress investors with the debut of its highly anticipated full self-driving vehicle, an endeavor that left shareholders underwhelmed.

At OpenAI, a glimpse at financial projections revealed that profitability remains on the horizon.

Stay abreast of the latest technological developments with the Investing News Network’s comprehensive update.

AI Breakthroughs Garner Nobel Prizes

The Royal Swedish Academy of Sciences recognized innovation in artificial intelligence (AI) during the annual Nobel Prize announcements. Two out of the three science prizes were awarded to researchers in the AI domain.

On a pivotal Tuesday, the Nobel Prize in physics was granted to Canadian computer scientist Geoffrey Hinton and American physicist John Hopfield. Their work on neural networks set the stage for the evolution of machine learning rooted in how the human mind processes data.

Hopfield’s groundbreaking invention unveiled a computer mirroring the human brain’s capacity to store and retrieve data even with incomplete cues. Hinton’s efforts included designing a mechanism enabling machines to identify patterns independently, essentially empowering them to ‘learn’ sans explicit programming.

The subsequent day belonged to Sir Demis Hassabis, CEO of Google DeepMind and Isomorphic Labs, alongside John Jumper, Director of Google DeepMind. They were bestowed the Nobel Prize in chemistry for their pioneering creation, AlphaFold 2. Developed by the Alphabet subsidiary in 2020, this AI model accurately predicts the three-dimensional structure of proteins, a feat traditionally strenuous and costly for human researchers.

In a monumental achievement, AlphaFold 2 succeeded in predicting the structures of nearly all 200 million known proteins precisely, solely utilizing their amino acid sequences as input. This revolutionary technology paves the path for extraordinary discoveries in scientific and medical realms, potentially expediting drug discovery and development.

Despite this triumph, Alphabet, Google’s parent company, faced adversity. A judicial ruling on Monday mandated a transformation of Google’s mobile app store, opening doors for Android users to acquire apps from alternate suppliers. Following this, the US Department of Justice hinted at potential legal measures to compel Google to segregate its Chrome and Android businesses, stemming from a prior antitrust lawsuit against the tech behemoth on August 5. Consequently, Google’s stock witnessed a 2.65 percent decline over the week.

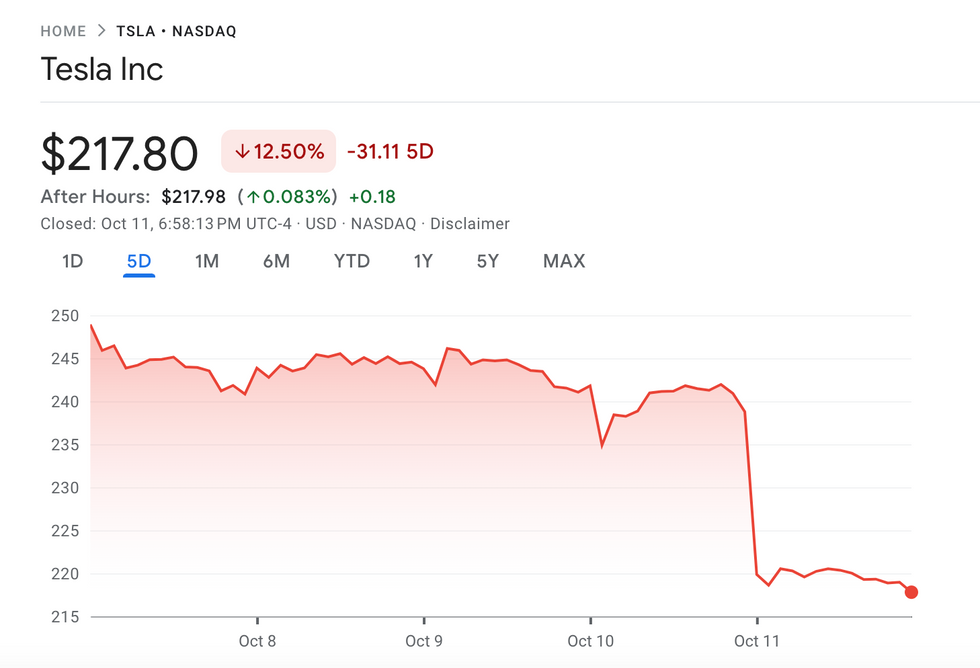

Tesla’s Cybercab Disappointment

Tesla’s shares plummeted by 8.78 percent on a tumultuous Friday afternoon subsequent to the company’s grand unveiling of the electric vehicle manufacturer’s highly-touted full autonomous vehicle.

Financial News: Captivating Updates from the Tech Industry

Tesla Unveils Cybercab, Rolls Out Autonomous Technology

After months of buzz and anticipation, Tesla finally introduced its fully autonomous model, the Cybercab, at the “We Robot” event in Burbank. The unveiling, although delayed, brought to light a futuristic two-seater devoid of traditional driving controls like a steering wheel or foot pedals.

During the event, Elon Musk, the CEO of Tesla, shared that the Cybercab would carry a price tag below US$30,000. While hinting at a production kick-off before 2027, Musk’s remarks lacked specifics on the exact production commencement details. Moreover, he tantalized the audience by mentioning plans for a Robovan capable of accommodating 20 passengers – a vehicle that would operate wirelessly.

Musk also provided insights into Tesla’s developments in full self-driving (FSD) technology. While scheduled for a 2025 launch in China, the FSD technology has encountered regulatory obstacles in the US. Additionally, Musk expressed intentions to integrate FSD into Model 3 and Model Y Teslas in Texas and California by the following year, albeit without a definitive release date.

Samsung Acknowledges Lower-than-Expected Profits

South Korea’s tech giant, Samsung, disclosed its Q3 profit forecasts, projecting a substantial 274% surge in operating profits to approximately 9.1 trillion Korean won (US$6.74 billion). However, this figure missed market expectations, causing a 1.47% drop in share value. Apologetically, Samsung’s vice chairman, Jun Young-hyun, attributed the shortfall to “one-time costs” and adverse effects in the memory division. Young-hyun reassured shareholders of Samsung’s commitment to a robust future strategy, citing a history of resilience and innovation.

Despite the setback, Samsung’s shares observed a 3.26% decline for the week, reflecting investor reactions to the unmet profit projections.

OpenAI Projects Prolonged Losses Before Eventual Profits

As per a report by The Information, OpenAI foresees sizeable financial losses in the coming years. By 2026, the company anticipates losses nearing US$14 billion, with cumulative losses of up to US$44 billion from 2023 to 2028. Primarily driven by extensive AI model training costing up to US$200 billion by the decade’s end, OpenAI’s ambitious plans are tempered by financial caution.

Following its recent funding round, which raised US$6.6 billion and involved prominent backers like Andreesseen-Horowitz, Microsoft (NASDAQ:MSFT), and Nvidia (NASDAQ:NVDA), OpenAI opted for a for-profit business model restructuring. Despite its current valuation of US$157 billion, OpenAI does not forecast profitability until 2029. The company looks to ChatGPT to fuel its revenue ambitions, eyeing a substantial revenue target of US$100 billion by that time.

The Bitcoin Battalion: Tales of Triumph and Turmoil

Bitcoin’s Price Swings and China’s Influence

Bitcoin’s journey at the onset of the week unfolded as a rollercoaster, hovering around the $63,000 mark. This fluctuation was notably influenced by China’s reticence to provide a detailed stimulus plan, paralleled by the surge in meme coins. The crypto realm witnessed Ether ETFs encountering zero flows in both directions for the second instance post-launch, whereas Bitcoin ETFs witnessed a bountiful influx, the heftiest since September 27, signifying contrasting trends within the digital asset space.

Price Erosion and the CPI Release

Bitcoin’s value witnessed a diminishing trajectory until midweek, just before the eagerly anticipated release of the Consumer Price Index (CPI) data on Thursday. A post-CPI plunge ensued, steering the price south of $60,000, breaching this level for the first time in October, historically regarded as a month where Bitcoin tends to thrive. The CPI statistics unveiled a mere 0.2 percent increase compared to the previous month and a modest 2.4 percent surge year-over-year, marking the slowest annual rise since the inception of the inflation upswing in February 2021.

The Phoenix-Like Rebound

Post the price descent triggered by the CPI report, Bitcoin began a revival, ascending once more and momentarily reclaiming ground above the $63,000 frontier as the week drew to an end on a more positive note.

Don’t forget to follow us on our pulsating journey through the digital economy!