Investors navigated a turbulent week, culminating in a surge of optimism on Friday (August 23) following a groundbreaking announcement by US Federal Reserve Chair Jerome Powell.

In his address at Jackson Hole, Powell hinted at the onset of interest rate reductions.

The cryptocurrency markets experienced a breakaway from a protracted period of standstill pricing. In other corporate developments, Waymo debuted an enhanced iteration of its autonomous driving technology, adding to a streak of recent triumphs.

For the latest insights into the ever-evolving tech sphere, tune in to the Investing News Network’s comprehensive roundup.

1. Markets React to Impending Rate Cuts

The beginning of the week saw a shaky start for equities markets, with the S&P 500 (INDEXSP:.INX) and Nasdaq Composite (INDEXNASDAQ:.IXIC) opening lower on Monday (August 19) than their prior week’s close, only to embark on an eight-day winning streak. The S&P/TSX Composite Index (INDEXTSI:OSPTX) followed suit.

The Russell 2000 Index (INDEXRUSSELL:RUT) climbed by 1.1 percent on the same day.

Caution among traders resulted in marginal movements for major indices on Tuesday (August 20) as they awaited fresh inflation figures. The release of revised US non-farm payroll benchmarks and minutes from the Fed’s July meeting on Wednesday (August 21) revealed that job growth from March 2023 to March 2024 was below previous estimates, despite an expanding labor market. Policymakers contemplated a 0.25 percentage point interest rate cut in July due to reduced inflation and heightened unemployment, fueling expectations for a September rate reduction. This news spurred index gains, with the Russell 2000 emerging as the frontrunner, concluding at 2,170.32 after surging over 1 percentage point.

The positive momentum persisted into Thursday (August 22) morning, with all major indices except the S&P/TSX Composite Index commencing above the prior day’s close. Economic data highlighted a dip in the US manufacturing PMI to 48 in August from July’s 49.6, falling short of expectations. Conversely, initial jobless claims in the week concluding on August 17 rose by 4,000 to 232,000 compared to the preceding week.

2. Tech Sector Positioned for Growth

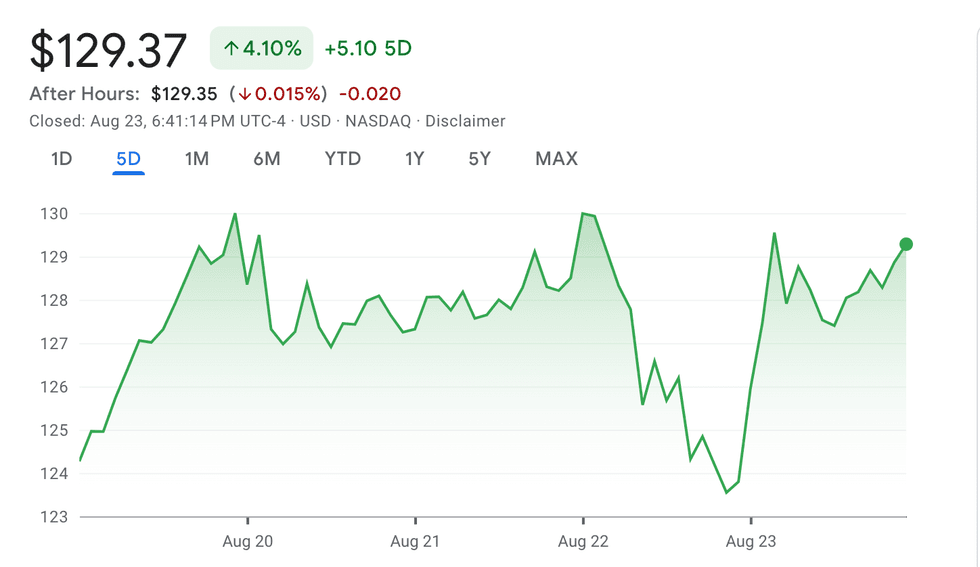

Chart via Google Finance.

NVIDIA performance, August 19 to August 23, 2024.

Stocks retreated midday Thursday, led by the

Market Insights and Crypto Trends

The tech sector encountered a turbulent week with NVIDIA facing a 4.77% decline in its share price. However, optimism made a triumphant return following Federal Reserve Chairman Powell’s address at the Kansas City Fed’s yearly economic event in Jackson Hole, Wyoming.

1. Federal Reserve Sparks Investor Enthusiasm

During Powell’s highly anticipated speech, he hinted at an upcoming rate cut without divulging specifics. He emphasized the need for policy adjustments, creating a surge across major stock indexes. The Russell 2000 stood out, showing robust growth of over 3% midday, reflecting the heightened investor interest in mid-cap stocks due to recent positive Fed data trends.

By the week’s close, all major indexes demonstrated robust gains of more than 1%, with the Russell 2000 leading at over 3% rise, concluding a prosperous period bolstered by investor optimism.

2. Cryptocurrency Rollercoaster: Bitcoin’s Journey Beyond US$60,000

Bitcoin had an eventful week, dipping below US$58,000 in early trading before recovering and surpassing US$61,000. However, fluctuations continued with a sharp pullback on Tuesday, aligning with a dip in US stock indexes. As Tuesday unfolded, a record low seven-day average annualized funding rate since March 2023 suggested increased short bets on Bitcoin, leading to potential squeezes.

On Wednesday, Bitcoin traded around US$59,000 before breaking above the coveted US$60,000 and US$61,000 thresholds, maintaining momentum throughout the week. Recent data indicated a slight drop in demand for Bitcoin, yet institutional investors displayed a 14% growth in holding Bitcoin ETFs from Q1 to Q2, signaling sustained interest from major players.

Analysts’ forecasts hinted at a possible downturn for Bitcoin based on technical indicators, but favorable economic news on Friday steered the crypto market upwards. Bitcoin surged past US$64,000 on the speculation of an imminent September rate cut, coinciding with Ether trading above US$2,770 at the same period.

3. Omission in Democratic Platform Stirs Crypto Conversation

Prior to the Democratic National Convention, the party unveiled its 2024 Platform, exploring various issues but notably excluding Vice President Kamala Harris’s stance on cryptocurrency and web3 infrastructure. While optimism swirled in the crypto community regarding Harris’s potential support for the industry, her stance remains undisclosed on regulatory and tax matters in decentralized finance.

Although the Sunday-released platform alludes to “Biden’s second term,” leaving minimal room for adjustments, the absence of clarity regarding the administration’s directives on crypto has nurtured conversations speculating on future policy shifts in the sector.

Insights into Recent Developments in the Tech Sector

Just a moment before President Joe Biden bowed out of the race, the tech industry witnessed a whirlwind of events that sent shockwaves throughout. The tides turned, the wind shifted—cryptocurrency politics began to make waves in the realm of political campaigns.

Amidst the Cryptocurrency Conundrum

As the Democratic National Convention set sail in Chicago, the spotlight beamed on Vice President Kamala Harris and her anticipated stance on cryptocurrency and web3 infrastructure. The crypticity of her views is currently a subject of broad speculation.

The absence of a definitive stance on cryptocurrency in the Democratic Party’s platform left room for interpretation. Critics infer that this ambiguity might have nudged the scales in favor of the Republican camp in the crypto arena, shifting the odds and influencing voter sentiment.

Waymo Unveils Cutting-Edge Technology

Meanwhile, over at Waymo, a subsidiary of Alphabet, the emergence of the 6th Generation Waymo Driver shook the tech world. This groundbreaking system is a testament to progress—bolstered capabilities, heightened efficiency, and enhanced adaptability in the face of adversities, such as harsh weather conditions.

Waymo’s remarkable journey, which commenced as a self-driving project in 2009, has seen exponential growth and strategic partnerships, including a significant alliance with Uber. The latest milestone—surpassing 100,000 rides per week through its robotaxi service, Waymo One—underscores the company’s trajectory towards innovation and customer-centric solutions.

AMD’s Strategic Acquisition Spurs Market Fervor

Elsewhere, the semiconductor titan Advanced Micro Devices (AMD) made a bold move by announcing the acquisition of ZT Systems, a firm specializing in server and network equipment development. This strategic juncture marks a pivotal moment in AMD’s trajectory, bolstering its AI capabilities in the data center domain.

CEO Dr. Lisa Su’s resounding declaration of AMD’s overarching AI strategy echoes a commitment to industry leadership and scalable solutions that resonate across cloud and enterprise landscapes. The shrewd deal, valued at a staggering US$4.9 billion, fuelled a surge in AMD’s shares, propelling it to new heights and garnering attention from investors.

The tech sphere is abuzz with a cacophony of developments, each narrative intertwining with the next, painting a vivid picture of a dynamic sector on the brink of unprecedented transformation. As the dust settles and the echoes of these announcements reverberate, the tech landscape brims with anticipation, ripe with possibilities and poised for the next evolution.