Tech equities surged this week as speculated interest rate modifications in the US captivated investors.

As markets buzzed, OpenAI introduced a revolutionary artificial intelligence model renowned for its sophisticated reasoning capabilities. However, Apple’s latest product revelations failed to stir much excitement among stakeholders.

Moving on, Bitcoin soared past the landmark $60,000 mark, while Google found itself entangled in a legal tussle, battling allegations of leveraging its authority to claim dominance within the ad tech sector.

Amidst this tech frenzy, keep tabs on the latest industry strides with the Investing News Network’s comprehensive digest.

Wall Street Concludes the Week with Panache

Monday on Wall Street (September 9) unraveled demurely following Friday’s (September 13) job report, leaving investors pondering over the likelihood of robust rate cuts by the US Federal Reserve during its forthcoming September 17-18 meeting.

In a stoic fashion, the Nasdaq Composite (INDEXNASDAQ:.IXIC) commenced the day 0.88 percent above its Friday closing. Simultaneously, the S&P 500 (INDEXSP:.INX) embarked on a similar positive trajectory, marking a 0.62 percent incline from Friday’s wrap-up.

By the day’s dusk, both indices notched up gains of 0.29 and 0.53 percent, respectively.

Trading on Tuesday (September 10) unraveled with subdued energy as traders awaited midweek disclosures of US August inflation data, coupled with the anticipatory debate between presidential contenders Donald Trump and Kamala Harris. In midday sparring, all indices dipped, with the Nasdaq Composite taking the steepest fall at 1.32 percent below its opening value, yet miraculously closing at par.

Wednesday’s US consumer price index (CPI) updates spotlighted a 0.3 percent rise in the index for all-non-food and energy items in August versus July’s 0.2 percent uptick, indicating a burgeoning inflation tendency.

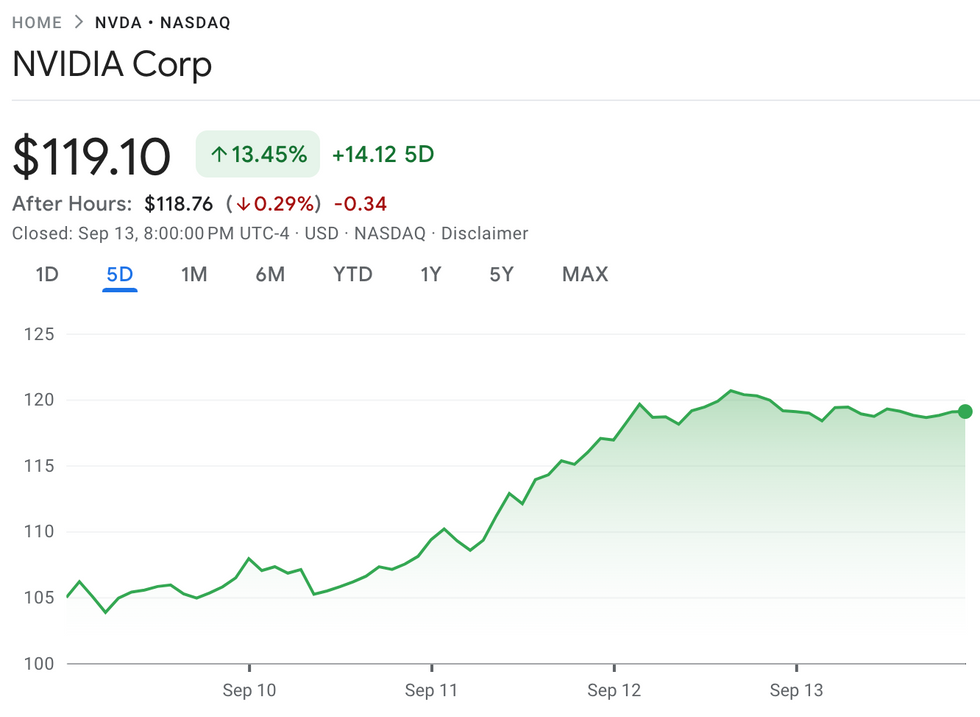

Yet, for the annual span ending in August, the all-items index inched up by 2.5 percent, the most moderate escalation since February 2021, hinting at a sluggish price surge. This contradictory rhetoric triggered a momentary downturn across indices, only to be swiftly counterbalanced by a tech stock rally, spearheaded by a remarkable 7 percent ascend in NVIDIA’s (NASDAQ:NVDA) stock value.

Charting NVIDIA’s Performance: September 9 to 13, 2024

View graphical data via Google Finance.

Behold NVIDIA’s performance from September 9 to 13, 2024.

Thursday (September

Market Insights: From Inflation to AI Developments

August Producer Price Index Indicates Stable Growth

The release of the August Producer Price Index (PPI) brought a sense of calm to the markets, with wholesale prices only rising by 0.2 percent, in line with expectations. The core rate, excluding food and energy, ticked up 0.3 percent, modestly surpassing the forecasted 0.2 percent.

Positive Market Sentiment Post Inflation Report

Following the final inflation report ahead of the upcoming Fed meeting, all major stock indexes experienced a notable upswing. The Nasdaq Composite led the charge with a 1 percent gain, the S&P 500 showed growth of 0.75 percent, and the Russell 2000 emerged as the day’s frontrunner, closing 1.22 percent higher, painting a picture of optimism for market participants.

Rumors and Realities in the Bitcoin Market

Bitcoin’s price journey over the week was akin to a roller coaster ride, with the digital currency starting off steady around the US$54,000 to US$55,000 range. Factors like the Consumer Price Index (CPI) reading and the presidential debate nudged Bitcoin higher, propelling it to a Monday peak of US$57,635. Amidst speculations of a Trump victory potentially elevating prices to an ambitious US$90,000, Bitcoin oscillated in response to the unfolding political landscape.

However, Tuesday’s debate failed to provide a bullish boost, leading to a minor dip in Bitcoin’s value. Amidst uncertainties surrounding future regulations and market conditions, the cryptocurrency saw a slight retreat on Wednesday morning, showcasing its sensitive nature to external factors.

Despite the fluctuations, Bitcoin managed to regain momentum post the PPI data release, surpassing the US$60,000 mark by the end of the week. Trading at US$60,557.20, Bitcoin’s upward trajectory demonstrated resilience and a 4.3 percent increase in value within just 24 hours, underscoring the dynamic nature of the crypto market.

OpenAI Unveils “Strawberry” Model

OpenAI, a prominent player in the AI landscape, stirred anticipation with rumors of its latest AI model dubbed “Strawberry.” Shrouded in mystery, the model promises to offer advanced reasoning capabilities, reflecting the continuous innovation in the artificial intelligence realm. The announcement of OpenAI o1, a model designed for enhanced problem-solving in various domains, signifies a significant step towards more sophisticated AI solutions.

Technology Giants Make Waves in AI, Antitrust Trials, and Product Launches

OpenAI’s Impressive Leap in AI Reasoning Capabilities

A recent comparison by the company between OpenAI o1 and GPT-4o showcased a remarkable evolution in AI reasoning. While the latter struggled with a mere 13 percent success rate in an International Mathematics Olympiad test, OpenAI o1 excelled with an impressive 83 percent score, marking a significant advancement.

The company also highlighted OpenAI o1’s performance in the Codeforces competition, where it soared to the 89th percentile, proving its coding prowess. Despite limitations in web browsing, the software’s exceptional reasoning abilities set a new standard for AI capabilities.

Google Enters the Legal Arena in Antitrust Battle

Amidst allegations of “anticompetitive and exclusionary conduct,” Google faced its second antitrust trial of the year in Virginia, initiated by the US Department of Justice. Accused of leveraging its dominance to control advertising tech tools, Google’s legal battle raised concerns over its influence within the online advertising landscape.

The adversarial courtroom clash saw Google defending itself against claims of stifling competition. The DOJ argued that Google’s actions aimed to crush rivals, leading to a contentious legal showdown likely to extend over several months, with potential implications for Google’s advertising business.

Apple Faces Consumer Disappointment with iPhone 16 Launch

Apple’s grand unveiling of the iPhone 16 series at the “It’s Glowtime” event garnered mixed reviews as fans expressed disappointment with the product’s offerings. Featuring the latest Apple A18 chip developed in collaboration with Arm’s V9 chip design, the new iPhones failed to dazzle consumers with innovative updates.

Critics lamented the lack of substantial hardware upgrades in the iPhone 16 lineup, citing minor enhancements like the Camera Control button as insufficient to justify an upgrade. Additionally, limited access to new features such as Apple Intelligence, slated for beta release in October, left consumers underwhelmed post-event.

Apple Sees Challenges Amidst Competition and Legal Rulings

Tri-foldable Huawei Mate XT Challenges Apple

Just as Apple basked in the spotlight of its “Glowtime” event, a formidable challenger emerged in the form of Huawei Technologies’ latest creation – the Mate XT tri-foldable phone. This innovative device, equipped with an AI assistant, was unveiled mere hours after Apple’s event. The timing couldn’t be more perfect, as strict data privacy regulations in China have prevented Apple from launching Apple Intelligence within Mainland China.

Legal Setback from European Court

Adding to Apple’s woes, the European Court of Justice delivered a significant blow on Tuesday by ruling that the tech giant must fork over 13 billion euros in back taxes to Ireland. This ruling marked the culmination of a decade-long legal battle that commenced when the European Commission accused Ireland of bestowing illegal tax perks upon Apple and instructed the country to collect the owed amount.

Market Response to Apple’s Turbulent Week

Despite the array of challenges faced by Apple, investors retained a sense of confidence in the company. By the end of the week, Apple’s shares managed to close with a 0.71 percent increase, settling at US$222.50.