Owning shares of Tesla can feel like riding a rollercoaster on a turbulent day. The stock’s behavior tends to be as unpredictable as a capricious hurricane, leaving many shareholders with a queasy sensation as they navigate its peaks and valleys.

Despite a soaring surge of over 10% following a recent earnings report, Tesla’s stock remains submerged in a sea of red, languishing at a disheartening 25% loss since the dawn of 2024.

Can this sudden spike be the herald of a bullish market rebirth for Tesla? Or is it simply an exaggerated knee-jerk reaction?

The Disappointing Q1 Results Echo Loudly

When delving into Tesla’s tumultuous trajectory, one must grasp that its stock isn’t tethered solely to its present operational standing. The company’s upcoming ventures and product launches hold substantial influence.

The grim reality is stark when scrutinizing Tesla’s first-quarter performance, which left many investors disheartened.

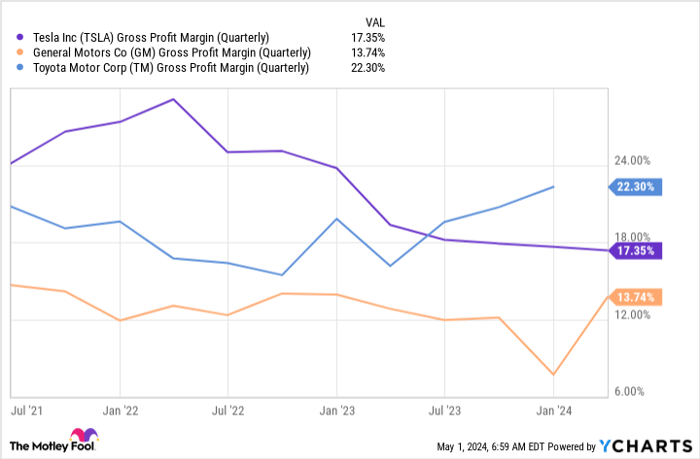

A dismal 9% year-over-year decline in revenue shadowed by a dip in gross margin from 19.3% to 17.4% unveiled a troubling narrative. Once revered for its alluring margins, Tesla now stands shoulder to shoulder with its auto-manufacturing counterparts on a concerning margin trajectory.

Revenue erosion and contracting margins cast a heavy shadow over Tesla’s earnings per share (EPS), plunging a worrying 53% year over year to a mere $0.34. But the most alarming signal flickers as Tesla’s free cash flow careens into negative territory, indicating a cash burn to sustain its operations.

New Horizons of Innovation Spur Investor Enthusiasm

In the minds of Tesla investors, a vista unfolds where an all-electric vehicle domain thrives under Tesla’s regal reign. Envisioning newer innovations like autonomous cabs and semi-trucks adds to this rich tapestry, even though these are presently sketches on a drawing board.

However, a pivotal moment looms on the horizon.

Come August, the world will witness Tesla’s maiden foray into robotaxis with the unveiling of the Cybercab. This debut carries monumental significance, as a significant slice of Tesla’s valuation hinges on commanding the market for passenger and cargo transport.

Tesla’s teasers about an imminent update to its product roadmap signal a pronounced shift. Previously slated for a second-half 2025 release, these novel vehicles are now earmarked for a first-half 2025 debut, potentially even as early as late 2024. This fresh lineup is set to include a more budget-friendly model, a much-anticipated offering for many investors. If Tesla can streamline mass production of an affordable electric vehicle, it might entice a broader spectrum of commuters keen on shorter travel hauls over long distance journeys.

The portrait of Tesla that investors paint is crystalizing, promising a treasure trove of enlightenment in the coming months. Yet, the current state of Tesla’s affairs casts a shadow of doubt.

Is buying the dip a strategic move? I’d lean towards a “yes” only if you pledge allegiance to the Tesla vision. And let’s face it, that vision borders on the extraordinary. However, if the populace hesitates to embrace an all-electric era, Tesla’s valuation may find itself stranded on shaky ground, even in the face of triumphant product launches.