Tesla (NASDAQ:) is geared up to unveil its Q2 earnings report come July 17th. Before that, the pioneering EV giant is poised to release its Q2 deliveries this week. This quarterly update coincides with the much-anticipated “robotaxi day” announcement slated for August 8th, a development predicted to significantly influence the Tesla narrative.

The current state of affairs sees Tesla’s stock retaining its top position, weighing in at 12.91% of Cathie Wood’s esteemed ARK Innovation ETF (NYSE:). Year-to-date, TSLA stock has seen a 12.6% decline, while ARKK has witnessed an 8.5% dip. Standing at $208 per share currently, Wood remains confident that TSLA is slated to surge past 10 times its current value by 2029, aiming for a price target of $2,600 per share.

Veering towards optimism, Wood’s bullish outlook revolves significantly around Tesla’s robotaxi journey. She envisions the robotaxi segment constituting 63% of Tesla’s revenue and a whopping 86% of the company’s pre-tax earnings by 2029. However, excluding the robotaxi component, Wood’s more conservative TSLA price prediction sits at $350 per share.

Anticipated Growth in Tesla’s Deliveries for Q2

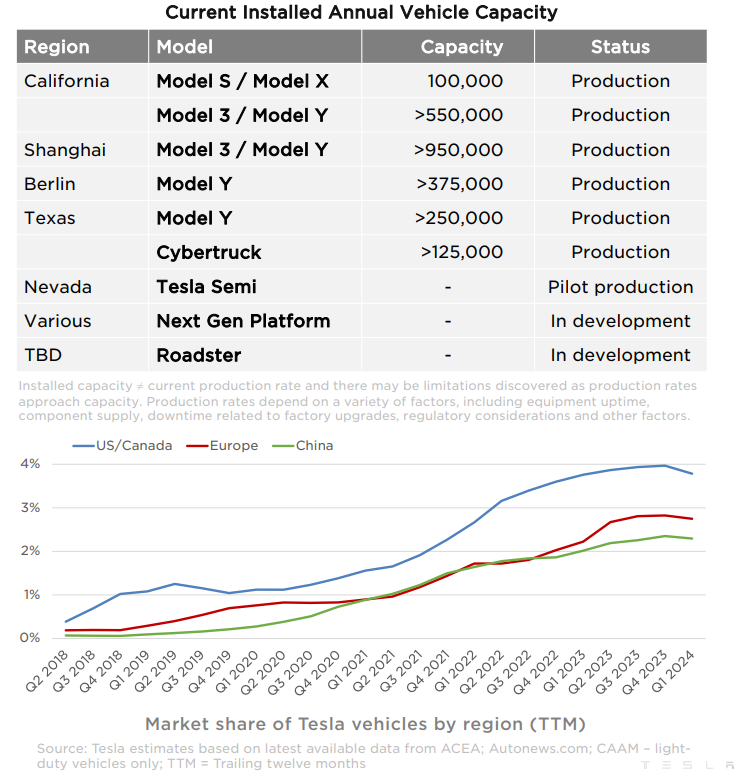

During Q1 ‘24, Tesla rolled out 386,810 EVs, with a notable emphasis on Model 3/Y models. This marked a 20% decline from the preceding quarter, Q4 ‘23, which had witnessed 484,507 units delivered. However, Tesla managed to boost its annual vehicle deliveries by 37.6% year-over-year in 2023, summing up to 1,808,581 units moved.

Analysts’ consensus expectation for Q2 ‘24 envisages Tesla delivering approximately 448,000 EVs, indicating a potential surge of close to 16% in sales as compared to the previous quarter. Notably, some industry experts, such as Wedbush’s Dan Ives, have advised bracing for a more conservative range, pointing towards figures between 415,000 – 420,000 units.

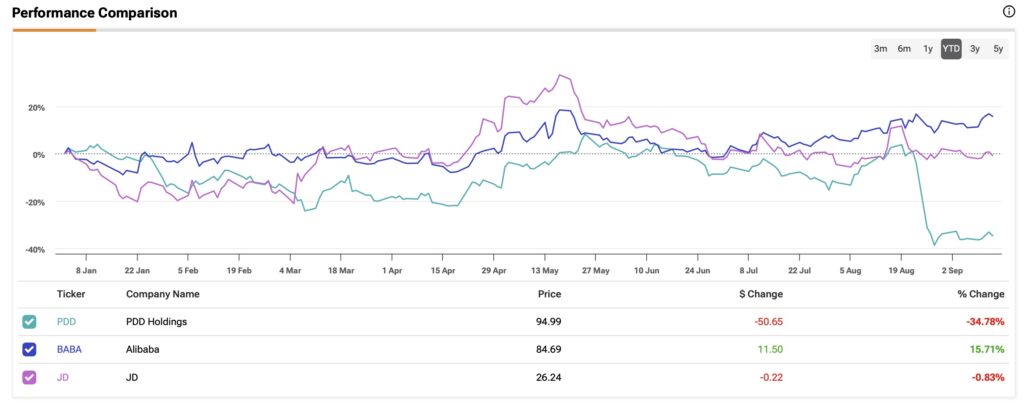

The positive projections for Q2 deliveries also factor in a rise in Tesla EV sales in China, where the company sold 72,573 units in May, reflecting a 17% increase from the same period the prior year. Despite contending with intense price competition from various peers such as BYD (SZ:), Li Auto (NASDAQ:), XPeng (NYSE:), Nio Inc (NYSE:), Tesla continues to hang onto the second-largest chunk of the market share in China. Noteworthy, BYD, a firm endorsed by Warren Buffett, managed to sell 330,488 EVs in May, marking the third consecutive month of surpassing 300k unit sales.

The Dynamic Evolution of Tesla’s Narrative

Venturing into the field of robotics, Tesla’s foray with the Optimus humanoid robot signifies a pioneering move. Despite these strides, even Cathie Wood acknowledges that widespread commercial implementation may not be a reality by the end of the decade. Rather, Tesla’s robotics evolution is anticipated to predominantly stem from the development of EVs into autonomous robotaxis.

Mirroring advancements in eVTOLs, commonly dubbed flying cars, China has stolen the lead. Thanks to entities like Baidu (NASDAQ:) (often dubbed China’s Alphabet (NASDAQ:)) and the mobility startup Pony.ai, the self-driving industry in China is forecasted to claim 60% of the country’s ride-hailing sector by 2030. Projections by IHS Markit point towards a burgeoning $180 billion market in due course.

According to ResearchAndMarkets, this momentum places the China Autonomous Vehicle Market’s compound annual growth rate (CAGR) at 21.66% for the duration spanning 2024 – 2030. With a stronghold in the US and EU as the primary EV provider, Tesla stands poised to harness this growth potential to the maximum.

Dominating its peers is bolstered by Tesla’s network effect derived from the processed driver data at hand. Currently perched at SAE Level 2, this data forms the bedrock for delivering Full Self-Driving (FSD) ability (FSD corresponds to SAE Level 4). However, even assuming the technical hurdles are surmounted, Tesla would still need to tackle the local and federal regulatory barriers that lay ahead.

Given that Elon Musk had underestimated the timeline for FSD by approximately eight years, further protracted delays seem probable. Professor Philip Koopman from Carnegie Mellon University had previously hinted that a span of 10 – 20 years aligns more closely with realism.

If Tesla manages to surpass the conventional expectations during the “robotaxi day” unveiling on August 8th, a pivotal upswing in Tesla’s stock trajectory is nearly certain. Recent news affirming the green light for FSD testing in China hints at a brighter outlook.

Exploring Affordable Tesla EVs and Tesla Energy Inclusions

Even if the narrative around robotaxis faces delays, Tesla enthusiasts can keenly anticipate the “Model 2” initiative. Initially dubbed “Redwood”, this rumored project aiming for a $25k price range endeavors to address the primary hurdle to EV adoption—affordability—by mid-2025.

The upcoming Tesla hatchback will rival models from industry stalwarts such as Volvo (OTC:) EX30, Renault (EPA:) 4, Fiat 500e, VW ID.2, among others.

Beyond the realms of EVs and robotics, Tesla Energy holds substantial growth potential. The clean energy segment boasts offerings such as solar panels, inverters, powerwalls, and large-scale energy storage systems aptly named Megapack.

Q1 bore witness to Tesla Energy achieving a record deployment of cumulative 4,053 MWh in energy storage, marking a 7% increase in revenue on a year-over-year basis. Likewise, Tesla beefed up its AI training compute operations by a significant 130% during the quarter.

Evaluating Tesla’s Stock Price Targets

Despite a staggering 674% year-over-year plunge in free cash flow, dropping from $2 billion in Q4 2023 to a negative $2.5 billion in Q1 2024, Tesla succeeded in rattling investors. Nevertheless, these capital-heavy infrastructure expenditures signal Tesla’s unwavering preparation for the long haul.

Diving into Nasdaq’s forward-looking predictions, the average TSLA price target stands at $182.1 for the upcoming year, with the ceiling hovering around $310 per share. The floor is set at $22.86, indicating the plethora of uncertainties stemming from technological challenges, macroeconomic dynamics, logistical hindrances, lithium supply concerns, and the evolving competitive landscape in Tesla’s domain.

At the current price tag of $208, Tesla is perched midway from its pinnacle at $409 in November 2021. Reflecting on the 52-week timeline, the average price for TSLA stock stands at $216, with the present valuation comfortably above the 52-week low of $138 per share.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.