As the electric vehicle landscape charges forward, Tesla Inc TSLA and Rivian Automotive Inc RIVN stand as two of the most-watched U.S. players in the industry.

But while Tesla has a strong profit engine driving its future, Rivian has been burning cash, relying on partners like Volkswagen AG VLKAF to keep up the pace.

Who has the edge in the EV race, and can Rivian’s adventurous brand and recent partnerships help it close the gap?

Profitability: Tesla’s Cash Vs. Rivian’s Burn Rate

Tesla has mastered profitability, showing that EVs can be lucrative even in a competitive market.

Rivian, by contrast, reported a $1.46 billion loss in the second quarter, translating to roughly $33,000 lost on each vehicle sold. Despite initial buzz and a record IPO, Rivian’s financials remain challenging, casting doubt on its path to profitability.

Products & Brand Appeal: Tesla’s Tech Dominance Vs. Rivian’s Adventure Edge

Tesla’s streamlined, tech-focused vehicles continue to dominate urban and suburban markets, and the Cybertruck has even Tesla skeptics intrigued.

Read Also: Tesla Engineer Denies Prioritizing ‘Affluent’ Cybertruck Owners For Lightbar Installation

Rivian, with its rugged R1T and R1S models, targets adventure enthusiasts but now faces reliability issues, which may impact its niche reputation.

Upcoming mid-size models like the R2 and R3 could broaden Rivian’s appeal if it can stabilize production.

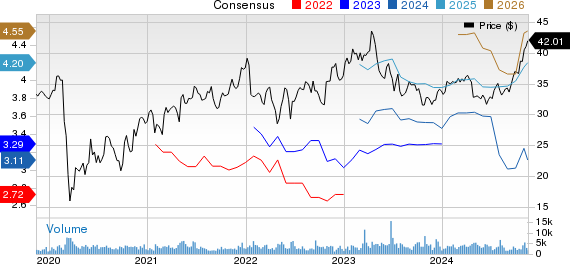

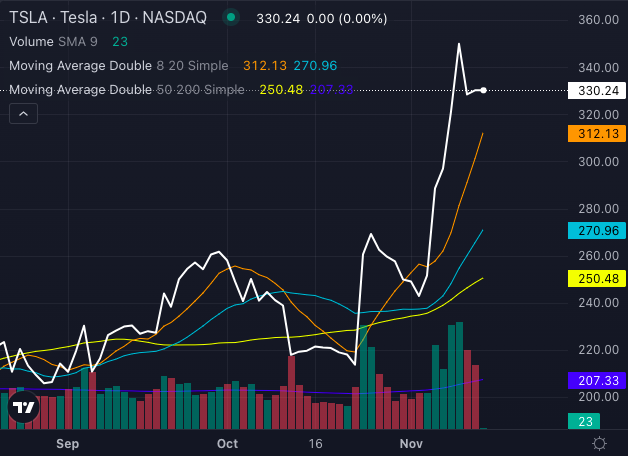

Tesla Stock Vs. Rivian Stock: Bullish Streak Vs. Unsteady Climb

Chart created using Benzinga Pro

Tesla’s stock remains bullish, with prices well above major moving averages, signaling strong market confidence.

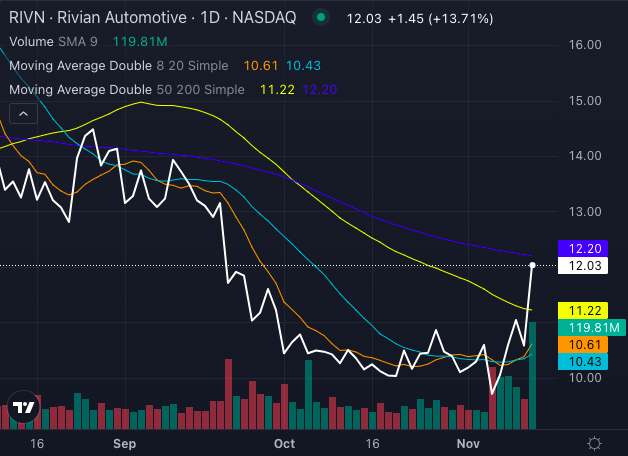

Chart created using Benzinga Pro

Rivian, despite recent boosts from its Volkswagen deal, struggles to sustain long-term momentum.

While partnerships with giants like Volkswagen hint at future potential, Rivian’s stock is volatile, with mixed technical indicators suggesting investors remain cautious.

Read Next:

Rivian vs Tesla. Photos via Shutterstock

Market News and Data brought to you by Benzinga APIs