As the S&P 500 continues its upward trajectory in the current bullish market, investors may ponder if they’ve missed the boat on potential gains. However, fear not, as long-term investments of at least five years can unearth profitable opportunities across various market landscapes. Time acts as a benevolent ally in investing, allowing companies to metamorphose and fulfill promises, be it through product launches or exponential earnings growth.

The present juncture presents a riveting prospect to explore tech investments in anticipation of the impending AI revolution. Several AI stocks have witnessed meteoric rises, while others are yet to hit their stride. In this dichotomy lies the seeds of potential growth over an extended period. For individuals with $50,000, or even a smaller sum, earmarked for long-term growth, investing in a diversified portfolio of tech stocks poised to benefit from the AI surge represents an enticing proposition.

The Unstoppable Surge of Super Micro Computer

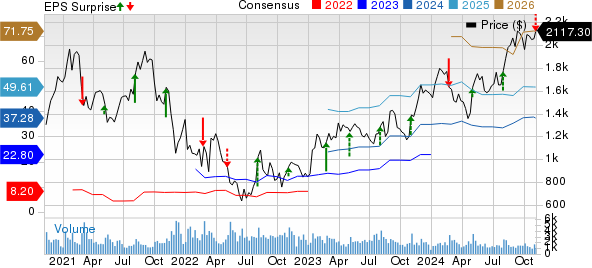

Super Micro Computer (NASDAQ: SMCI) has exhibited a staggering 2,200% surge in stock value over the past three years, a performance that might give pause to prospective investors. Paradoxically, this skyrocketing trend could merely mark the nascent phase of Supermicro’s growth saga. The realm of AI development is in its infancy, and Supermicro stands to reap rewards from the proliferation of premier AI chip manufacturers.

The company’s array of servers, comprehensive rack-scale solutions, and other requisite equipment for AI functionalities integrates chips from industry behemoths. Supermicro not only incorporates these prominent chips into its systems but also closely monitors these manufacturers’ product evolution, ensuring rapid adoption for its clientele.

Recent reports from Supermicro indicate a continuous surge in demand for its rack-scale solutions tailored for AI, featuring popular chips. Anticipation surrounding imminent milestones like Nvidia’s forthcoming Blackwell architecture could catalyze increased orders. The domino effect translates into sustained earnings growth in the foreseeable future, propelling share prices skyward.

Intel: Reshaping Its Destiny in the AI Realm

Intel (NASDAQ: INTC) reigns as the foremost CPU producer, a pivotal component of computing apparatus. Despite its industry dominance, Intel has yet to harness the fervor surrounding AI applications. Lagging strides in the AI domain have exerted downward pressure on its stock performance.

The winds of change are brewing within Intel’s corridors, propelled by two compelling factors. The company recently unveiled a groundbreaking suite of AI-centric offerings, including the Gaudi 3 AI accelerator, poised to rival Nvidia’s H100 chip. While Intel may not outpace the current market leader, Gaudi 3’s exemplary performance and cost-effectiveness could carve a niche in the market share landscape, bolstering Intel’s revenue and stock value over time.

Another silver lining emerges as Intel embraces an open-door policy for its manufacturing operations, heralding a fresh growth avenue amidst the AI boom’s continued surge.

Amazon: Pioneering Profitability Amid Technological Frontiers

Amazon (NASDAQ: AMZN), a stalwart in earnings expansion, owes its success to commanding positions in burgeoning e-commerce and cloud computing sectors. Sustained investments fortify Amazon’s leadership in these high-growth domains. Amazon’s logistical reshuffle to expedite deliveries in e-commerce augments customer satisfaction and operational efficacy.

Cloud computing, a pivotal arena for future growth, stands to benefit significantly from AI integration. Amazon Web Services (AWS) displays unwavering commitment toward addressing AI demands, spanning from fundamental chip and software requisites to tailor-made services for clients seeking customizable large language models.

Amidst this backdrop, AWS’ eminent status as the premier cloud computing services provider globally is poised for further augmentation, paving the way for increased revenue streams. AWS, historically a prime profit engine for Amazon, underscores the company’s trajectory for continued prosperity, ensuring ample headroom for stock appreciation even post-recent upswings.

Alphabet: Aiding and Advancing in AI Environments

Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), with its ubiquitous presence infusing daily life, epitomizes utility for countless individuals worldwide. Boasting ownership of Google Search, the unrivaled search engine commanding over 90% of the global search market share, Alphabet’s preeminence permeates daily vernacular, with “Googling” becoming synonymous with seeking information.

Alphabet’s foray into AI investments is slated to fortify its hegemony in the search domain. The rollout of Gemini, Alphabet’s cutting-edge AI model, permeating all facets of service and product portfolios, including search functionalities, augurs well for enhanced search experiences and streamlined advertising processes. This strategic pivot is pivotal in sustaining advertising revenue growth, a cornerstone of Alphabet’s revenue streams predominantly generated through Google advertising.

Boasting a robust track record of earnings escalation, Alphabet weathered recent economic tumult commendably, with advertising revenue exhibiting resilience. Alphabet emerges as a secure AI investment bet on the list, offering a viable avenue to allocate a fraction of your $50,000 corpus.

The Curious Case of Super Micro Computer Missing Out on Top Stock Selections

The recent exclusion of Super Micro Computer from a list of the “10 best stocks for investors to buy now” has left many scratching their heads. While the chosen 10 stocks are touted to potentially yield substantial returns in the years to come, the absence of Super Micro Computer raises eyebrows.

Intriguing Investment Insights

Investors seeking guidance can turn to services like Stock Advisor, which offers a clear roadmap to success. With expert advice on portfolio construction, regular analyst updates, and two new stock picks each month, Stock Advisor has outperformed the S&P 500 by a significant margin since 2002.*

Unveiling the Stock Selections

For those curious about the chosen stocks, a detailed look at the list is crucial. Each stock that made the coveted cut represents a potential goldmine waiting to be explored. The opportunity for considerable returns beckons.

For more information on the 10 stocks that made the grade, investors are encouraged to delve deeper into the analysis and reasoning behind each selection. Making informed decisions is paramount in the world of investing, and these choices are no exception.

Reflecting on Stock Advisor’s Performance

Amidst the buzz surrounding the stock selections, it’s essential to acknowledge the track record of services like Stock Advisor. The impressive returns achieved since 2002 underscore the value provided to investors who heed the advice offered within.

With the stock market’s ebbs and flows, having a reliable source of information and recommendations can make a substantial difference in an investor’s portfolio performance. Stock Advisor’s continued success is a testament to the benefits it brings to its subscribers.

*Stock Advisor returns as of April 8, 2024