Share repurchases, known as share buybacks, are a financial maneuver where a company buys back its own shares from the open market. Regarded by some as a tactic to enhance shareholder value, share buybacks have the potential to inflate earnings per share by reducing the number of outstanding shares, possibly driving stock prices higher. However, this strategy is not without its perils and raises pertinent questions. Let’s delve into the often-overlooked implications of aggressive share repurchase practices, shedding light on how they may not necessarily reflect financial strength and could pose risks to the company and its investors in the long term.

The Allure of Buybacks

Investors often find allure in the concept of buybacks. Frequently viewed as a mechanism to boost shareholder value by reducing the total outstanding shares, thereby potentially lifting stock prices and earnings per share (EPS), share repurchases are seen as a way for companies to demonstrate confidence in their current position and future trajectory. Recent large-scale buyback initiatives by companies like (AAPL) and (GOOG) underscore their robust cash flows and commitment to delivering value to shareholders. While generally well-received in the market, it’s crucial to examine beyond the surface.

The Risks of Debt-Financed Buybacks

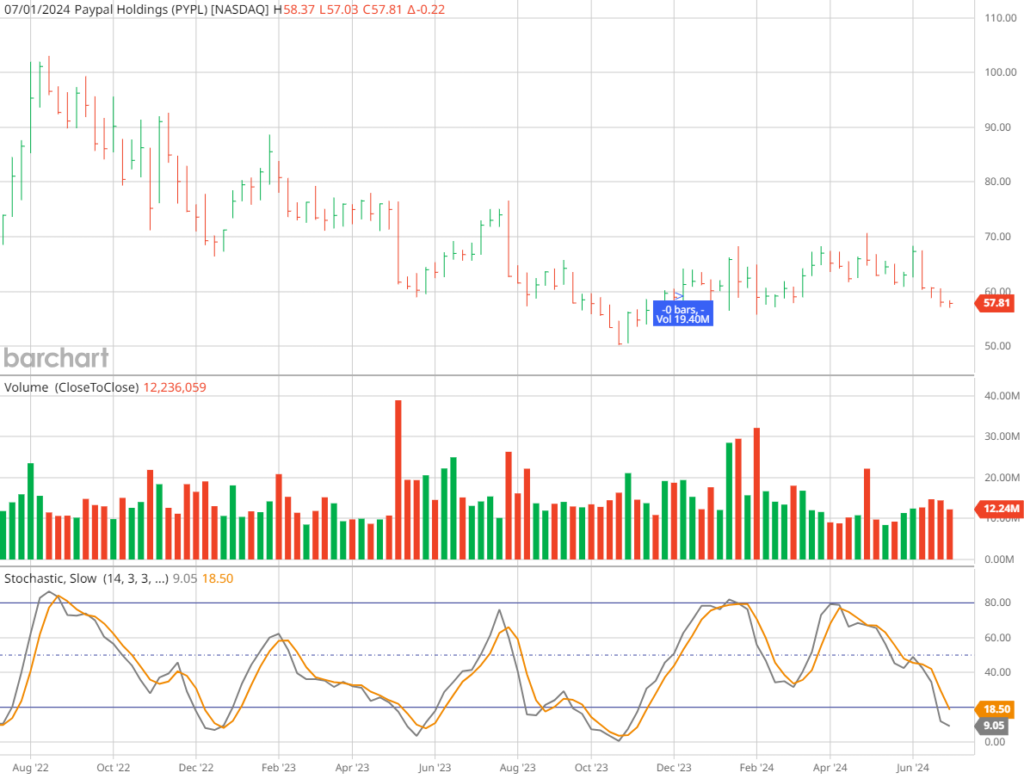

Debt-fueled share repurchases can be misleading to investors, especially when companies such as (IBM) resort to borrowing to fund these buybacks. This approach, while potentially boosting a company’s EPS, masks real business growth and elevates the firm’s financial risk profile, impacting its capacity for innovation and expansion. (PYPL)’s strategy of allocating over $5 billion for buybacks, exceeding its annual free cash flow, raises concerns about the sustainability of its financial practices. By concealing declining sales and stagnant revenue, this aggressive buyback scheme presents a distorted view of financial well-being, artificially inflating EPS. Furthermore, the substantial allocation to buybacks diminishes (PYPL)’s liquidity, jeopardizing its ability to make growth-oriented investments and making it vulnerable in economic downturns. This emphasis on buybacks could indicate a deficiency in attractive internal investment opportunities, hindering innovation and expansion in a fiercely competitive fintech sector.

Challenges with Share Repurchases at PayPal

Financial Engineering Concerns

Share buybacks, sometimes employed as financial engineering tools to enhance EPS, may not always reflect genuine business progress. For instance, (IBM)’s aggressive buyback strategy has faced criticism, especially during periods of stagnant or declining income. Despite dwindling sales figures over several quarters, (IBM)’s EPS appeared stable or improved due to the impact of buybacks in reducing outstanding shares. This discrepancy can mislead investors about a company’s actual condition, concealing underlying issues such as waning market competitiveness or limitations in innovation.

Implications on Company Liquidity

Buybacks have the potential to significantly deplete a firm’s cash reserves, limiting its ability to navigate financial uncertainties or make future growth-oriented investments. Prior to the COVID-19 pandemic, Bed Bath & Beyond actively pursued stock repurchases. However, when the crisis hit, this approach eroded the company’s liquidity, exacerbating its financial woes as consumer spending contracted and economic instability grew. The company’s ongoing struggles stemmed from this liquidity shortfall, impeding its agility to adjust and invest in necessary enhancements during the crisis, especially critical for technology companies where high R&D investment is essential.

Long-Term Strategic Implications

Share repurchases sometimes signal a dearth of appealing investment prospects within a company, suggesting potential stagnation in terms of development and innovation. A company heavily engaged in buybacks may be perceived as reaching a plateau in its growth trajectory, opting for shareholder returns over venturing into new markets or technologies. In contrast, enterprises like (AMZN) and (GOOGL) showcase the advantages of plowing profits back into research and development (R&D) or strategic acquisitions, sustaining their competitiveness through constant operational diversification.

(CSCO) provides another example where share repurchases have sparked debate. Some argue that (CSCO) could have allocated the billions spent on buybacks towards strategic acquisitions or R&D to bolster competitiveness and foster innovation. Critics suggest that extensive buybacks could stem from a lack of compelling investment opportunities within the company, hindering long-term growth in an industry reliant on ongoing innovation. Investors are scrutinizing Cisco’s future strategic direction and its ability to keep pace with rapidly evolving technology markets.

In Conclusion

Investors should approach share buybacks with caution. While they may offer a superficial boost to EPS and stock prices, these benefits might not reflect the underlying financial well-being of a company. Examples like (IBM) and (PYPL) illustrate how buybacks, especially when financed by debt, can mask genuine performance issues, deplete liquidity, and curtail future growth potential by restricting funds available for reinvestment. As investors, it’s vital to delve beyond surface-level financial metrics and advocate for transparent and balanced strategies prioritizing sustainable growth and authentic value creation over short-term gains.

Explore more Stock Market News from Barchart