Apple (NASDAQ: AAPL) stock concluded 2023 with a robust 47% increment, yet has experienced a 4% decline in 2024. This downward trend has instilled unease among Wall Street analysts, primarily attributable to the decelerating iPhone sales that constitute nearly half of Apple’s total business, as well as its underperformance in China, which contributes one-fifth of the company’s revenue.

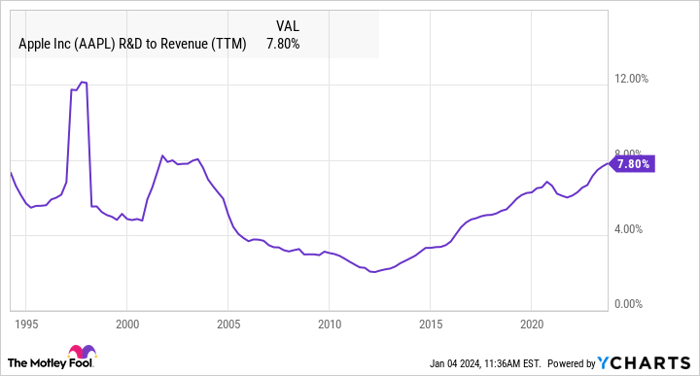

However, amid these disconcerting figures, Cupertino, California is rife with activity. Apple allocated 7.8% of its total sales in the previous year towards research and development (R&D) expenses, amounting to almost $30 billion. This level of investment is the highest percentage of its revenue over the last 20 years, a period reminiscent of Apple’s expansion into the iPod and music sector, as well as the development of its groundbreaking iPhone.

AAPL R&D to Revenue (TTM) data by YCharts

Although Apple’s R&D expenditure has displayed a steady upward trajectory over the past decade, the company has not introduced a significant new product since the Apple Watch in 2015. While the imminent launch of the Vision Pro headset is promising, Apple’s existing products have remained largely unchanged for years.

Apple’s CEO, Tim Cook, divulged that the surge in R&D spending encompasses innovations in Vision Pro, artificial intelligence, machine learning, and the transition from Intel processors to Apple’s proprietary chips, specifically designed for Mac and other products.

For years, Apple has been investing in artificial intelligence (AI) and machine learning, primarily evident in the Siri voice assistant. However, Cook hinted at undisclosed developments, potentially signaling a substantial advancement in Apple’s product development endeavors.

Though, with Apple’s colossal $383 billion annual revenue, the era of a single transformative device propelling the company to stratospheric heights, akin to the iPhone’s impact in 2007, has passed.

Nevertheless, the redirection of funds toward widening the company’s competitive moat and fortifying its profitability elucidates why renowned investor Warren Buffett maintains a substantial stake in Apple and why prospective investors should contemplate a similar position.

Apple’s investments are creating enormous shareholder value

Despite Apple’s absence of groundbreaking product launches, the company is benefiting from a formidable profit margin, which is gravitating towards record highs, underscoring the 47% surge in stock value in 2023 despite declining sales.

AAPL Profit Margin data by YCharts

The heightened margins are partially attributable to the augmentation in R&D spending, with Cook highlighting the allocation of funds to AI technology. This technology underpins numerous iPhone features, including Siri, photo searches, Face ID, and the neural engine enhancing the iPhone’s camera capabilities—features that accentuate customer satisfaction and spur spending on services, which yield double the margin of hardware products.

Services, inclusive of app sales and subscriptions, represent Apple’s fastest-growing sector, expanding by 9% in fiscal 2023. The management perceives prolonged growth in this arena.

“Our installed base of over 2 billion active devices continues to grow at a nice pace and establishes a solid foundation for the future expansion of the ecosystem,” noted CFO Luca Maestri during the lastearnings call

Given that services currently constitute only 22% of Apple’s total sales and are outpacing other sales categories in growth, their margins and profits are expected to traverse an upward trajectory in the future. Apple’s strategic investment in the foundation of its competitive advantage—its brand and user experience—foreshadows burgeoning profits, escalating dividend payouts, and a stock that is poised to reach new zeniths in the years to come.

Should you invest $1,000 in Apple right now?

Before you buy stock in Apple, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Apple wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 18, 2023

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool recommends Intel and recommends the following options: long January 2023 $57.50 calls on Intel, long January 2025 $45 calls on Intel, and short February 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.