Stocks such as Nvidia have garnered significant attention in the past 18 months, but nothing on Wall Street ascends indefinitely. Eventually, every stock’s meteoric rise reaches its pinnacle, leaving investors seeking the next big opportunity.

Enter three tech stocks poised for growth according to Motley Fool contributors.

Palantir Technologies (NYSE: PLTR), Affirm (NASDAQ: AFRM), and MercadoLibre (NASDAQ: MELI) have emerged as compelling investment ideas. These companies exhibit substantial growth potential and are still at an early enough stage to generate substantial returns for investors in the years ahead.

Consider embracing and retaining these three promising tech stocks for the next half-decade.

The Rising Star: Palantir’s Exceptional Trajectory

Jake Lerch (Palantir Technologies): When contemplating emerging tech stocks with long-term potential, Palantir Technologies stands out distinctly as a top contender.

First and foremost, Palantir is firing on all cylinders. Recently, the news of Palantir’s entry into the S&P 500 surfaced. This development not only excited me personally, as I had predicted Palantir’s inclusion in the benchmark index, but it also propelled the company’s shares by 14%. Palantir’s stock has more than doubled year-to-date, positioning it as the second-best performing stock in the index, trailing only Nvidia.

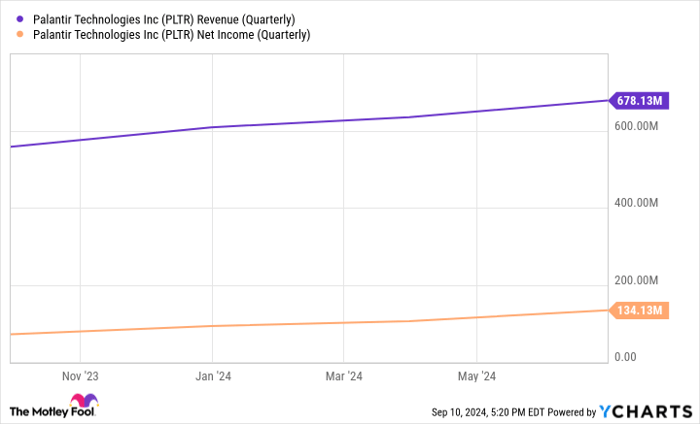

This outstanding stock performance stems from Palantir’s robust growth. In the most recent quarter (ending June 30), the company reported $678 million in revenue, marking a 27% increase year-over-year. Net income also surged by 87% to $134 million.

Moreover, Palantir’s customer base and free cash flow are experiencing significant growth. With the company sealing over 27 deals exceeding $10 million each, the demand for its AI-powered platform is on the rise.

In summary, Palantir’s stellar 2024 performance has secured its position in the S&P 500. This milestone may soon transform this once-obscure stock into a household name. Nevertheless, there remains ample opportunity for investors to acquire Palantir’s stock while it works towards reclaiming its previous all-time high of $45 in 2021.

Given the company’s exceptional execution, investors might regard 2024 as an opportune moment to invest in Palantir stock.

Affirming a Bright Future: Affirm’s Apple Partnership

Justin Pope (Affirm): Affirm, a buy now, pay later company, emerges as a clear long-term winner due to its innovative lending model. The company employs algorithms to provide loans on a transaction-by-transaction basis, enabling borrowers to evade accumulating debt. Affirm’s user-friendly business approach, devoid of late fees, has cultivated a user base of 18.7 million.

Affirm’s revenue growth has surged to nearly 50% since early last year, fueled by partnerships with over 300,000 merchants, including giants like Amazon and Shopify.

Moreover, the recent integration of Affirm into Apple Pay, with Apple discontinuing its own buy now, pay later product, is poised to propel Affirm’s growth further. This move will expose Affirm to an estimated 153 million iOS users in the United States.

With the Apple collaboration complementing its already robust growth, Affirm is expected to experience substantial progress over the next five years. Despite the stock being down 77% from its 2021 peaks, Affirm’s recent attainment of its first operating profit signifies its journey towards bottom-line profitability in the coming years.

The company’s impressive growth and improving financials are likely to prompt a reevaluation by Wall Street, rendering Affirm a rising star with significant investment potential.

Unveiling the E-Commerce Gem: MercadoLibre’s Market Potential

Will Healy (MercadoLibre): While many investors overlooked the burgeoning e-commerce realm, Amazon evolved from an online bookseller to a tech giant dominated by e-commerce and cloud services.

The Rise of MercadoLibre in Latin America

As the sunset of the 2020s approaches, investors look back and realize how many missed the relentless and explosive growth of the e-commerce titan south of the border, MercadoLibre. Much akin to its American counterpart, Amazon, MercadoLibre was birthed as an online vendor within the vast region spanning from Tijuana to Tierra del Fuego. However, the intricate tapestry of Latin America’s unique business environment nudged MercadoLibre towards diversification.

Digital Financial Innovation: Mercado Pago

In Latin America, where cash reigns supreme and a significant portion of the populace lacks traditional bank accounts or credit cards, MercadoLibre crafted a solution. Enter Mercado Pago, a brainchild aimed at fostering digital financial tools to facilitate online transactions. The success of this venture was so monumental that MercadoLibre expanded its services to encompass a broader audience, including individuals and enterprises not engaged in its e-commerce platform.

Overcoming Fulfillment Hurdles: Mercado Envios

Facing constraints in fulfillment and shipping infrastructure across the Latin American landscape, MercadoLibre rolled out Mercado Envios. This strategic move not only ensured the smooth processing of orders but also set the stage for the introduction of same-day and next-day delivery options in regions where such expedited services were previously non-existent.

Despite being a behemoth in its own right with a market capitalization hovering around $100 billion – a mere fraction of Amazon’s colossal $1.9 trillion valuation, MercadoLibre is maneuvering through the competitive terrain with remarkable swiftness. In the opening half of 2024, the company witnessed a stellar 39% annual surge in revenue, swelling to reach a formidable $9.4 billion.

By exercising prudence in managing expenses, MercadoLibre achieved a remarkable feat of elevating its net income to $875 million in the initial two quarters of 2024, marking a staggering 89% upsurge when juxtaposed against the corresponding period of the preceding year.

Market forces have begun to cast a more discerning eye on MercadoLibre’s trajectory, catapulting its stock price to ascend above 40% over the past year, propelling it towards uncharted heights.

Strategic Pricing Analysis

Notwithstanding its stellar performance, MercadoLibre currently trades with a price-to-earnings (P/E) ratio of 73. Yet, the accelerated pace of profit expansion has enabled it to maintain a price/earnings-to-growth (PEG) ratio of nearly 0.9. This compelling metric considerably positions MercadoLibre as an enticing option for investors, given its relatively modest market capitalization.

In a financial universe where the unpredictable reigns supreme, MercadoLibre emerges as a steady and burgeoning star, beckoning investors to ponder the prospects that lie within its dynamic orbit.