The Road Ahead for EV Stocks

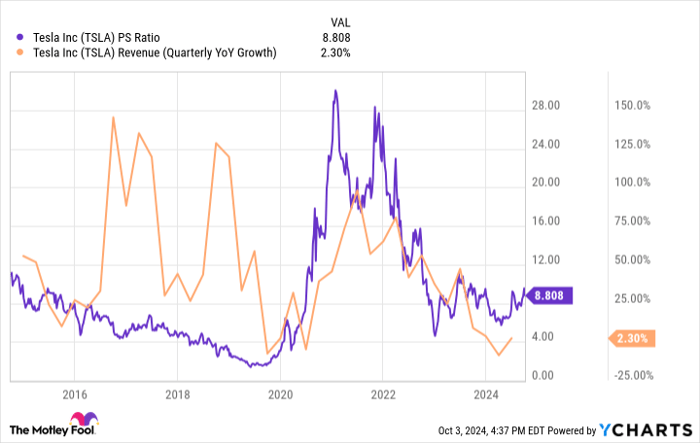

The electric vehicle (EV) sector has been a roller-coaster ride for investors, with Tesla setting the bar high. Despite its colossal $850 billion market value, the recent dip in revenue growth has caused Tesla’s shares to become more accessible. While the price-to-sales ratio has dropped significantly, this dip is not unfamiliar territory for Tesla. The company has historically rebounded with a surge in electric vehicle sales and the introduction of new models.

Looking ahead, Tesla’s focus on self-driving technology and robotics, as seen with the upcoming robotaxi event, indicates a potential growth trajectory. While skepticism may linger, backing a company with a track record like Tesla’s could pay off in the long run.

On the other end of the spectrum is Rivian Automotive, positioned for substantial growth. With new, more affordable models in the pipeline and a market capitalization of just $11 billion, Rivian offers investors an opportunity to tap into the promising EV market at a reasonable valuation.

Rivian’s Growth Potential

Unlike Tesla, Rivian’s growth story is still unfolding, with revenue growth rates exceeding 80% year over year. The introduction of three new models priced under $50,000 opens doors to a broader consumer base, aligning with the expected surge in EV sales forecasted in the coming years. Rivian’s strategic timing of new model launches and market conditions could position it as a strong player in the EV space.

Investing Strategic Insights

Considering investing in Tesla or Rivian, it’s crucial to weigh the potential returns against available opportunities. While Tesla’s historical success is evident, Rivian’s growth trajectory and valuation present an appealing proposition for investors seeking the next big player in the EV industry.

Ultimately, navigating the dynamic EV market landscape requires a keen understanding of each company’s positioning, growth strategies, and market conditions to make informed investment decisions.