In the bustling arena of today’s stock market, no company has captivated investors quite like Nvidia (NASDAQ: NVDA). The ascent of artificial intelligence (AI) has magnified the allure of Nvidia’s graphics processing units (GPUs), positioning them as a coveted commodity in the realm of AI training.

This surge has propelled Nvidia to the pinnacle of stock market fervor. From September 2022 to September 2024, its stock skyrocketed by an impressive 750%, outshining the S&P 500’s gains by a staggering 18-fold over that period. Such a meteoric rise is no mean feat for a company whose market cap hovered around $300 million at the onset of this remarkable journey.

Not to be outshone, Nvidia has augmented this narrative with commendable financial performances, bolstering revenues and operating income by 122% and 174%, respectively. The accolades showered upon Nvidia are indeed well-deserved. Nevertheless, amidst this clamor, two other stalwarts in the tech realm have caught my eye for potential investments due to their perceived long-term stability.

The Steady Ship: Taiwan Semiconductor

The Taiwan Semiconductor Manufacturing Company (NYSE: TSM) – known as TSMC – may not boast the same household name recognition as some tech behemoths, but it stands tall in the tech firmament as one of the most vital entities. Operating the world’s largest semiconductor foundry, TSMC crafts bespoke chips tailored to the unique specifications of varied clients.

While the process might seem straightforward at first glance, the intricacies of manufacturing such chips with unparalleled precision and scale entail labyrinthine processes and cutting-edge technologies unmatched by any of its peers.

Nvidia heavily relies on TSMC for the production of its chips, spanning GPUs, data-center processors, and other AI-oriented chips. The symbiotic relationship is accentuated by TSMC’s unmatched manufacturing prowess, a linchpin in maintaining Nvidia’s products’ quality standards. It is this reliance that steers me towards favoring TSMC’s steadiness over Nvidia’s lofty but potentially volatile trajectory.

Moreover, TSMC’s attractive dividend offering acts as a buffer, dampening investment risks. With a dividend yield surpassing the S&P 500 average, TSMC’s allure lies in its ability to reassure investors during turbulent times, underpinning trust in its enduring prospects.

Fruit of the Orchard: Apple

Apple (NASDAQ: AAPL) didn’t ascend to the zenith of being the globe’s most valuable public entity by mere happenstance. It embodies a legacy punctuated by unwavering diligence and astute execution. Despite the AI ardor pervading Wall Street, Apple’s measured response amidst the frenzy sparked bewilderment among many observers.

Apple’s hallmark strategy entails observing industry trends, refining them, and launching superior, user-friendly products. This approach has borne fruit across various tech spheres, from smartphones (iPhone) to smartwatches (Apple Watch), attesting to Apple’s acumen in market disruption.

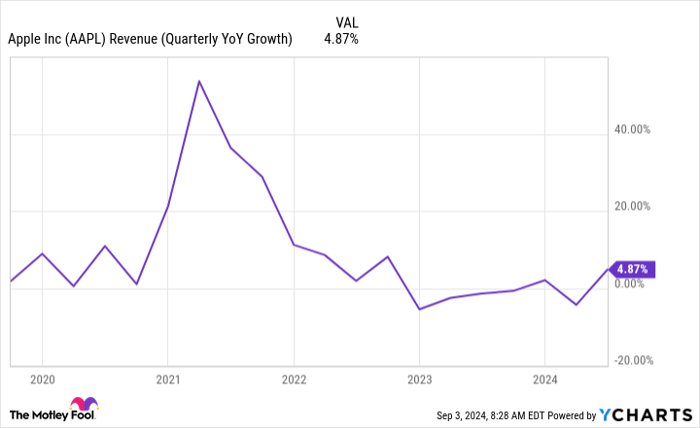

Apple’s foray into AI, branded as “Apple Intelligence,” echoes this narrative. By eschewing the frenetic AI race embraced by peers, Apple aims to forge its path, leveraging its legacy of calculated innovation to potentially unlock new avenues for growth.

While Nvidia teeters on the precipice of volatility, Apple’s modus operandi insulates it from similar risks (albeit not entirely immune). The anticipated boost from Apple Intelligence, tethered to consumer interest in newer hardware models, could invigorate Apple’s fortunes, especially following a sluggish phase in its smartphone sector.

Moreover, when contemplating long-term investments, few companies exude the reliability and promise that Apple embodies. The allure of Apple’s prospects consistently outweighs the specter of potential downsides, making it a beacon of stability in the tempestuous seas of the tech industry.

Strategic Investments in Tech Giants

Amidst the fervor surrounding Nvidia’s historic ascension, discerning investors might find solace in the stalwart stability of Taiwan Semiconductor and the seasoned resilience of Apple. While Nvidia’s trajectory blazes a trail of unparalleled growth, the measured approaches of TSMC and Apple offer a steady course through the volatile waters of the tech marketplace.

As investors navigate this dynamic landscape, the allure of these tech titans presents a compelling narrative of calculated investment decisions grounded in long-term stability and enduring growth prospects. The stage is set for strategic investments that harmonize the allure of innovation with the reassurance of seasoned resilience.