Jan. 23 turned out to be quite a stellar day for the stock market. The S&P 500 and Dow Jones Industrial Average reached unprecedented heights. On that same day, three of the “Magnificent Seven” stocks soared to all-time highs – Microsoft (NASDAQ: MSFT) at $398.90 a share, Nvidia (NASDAQ: NVDA) at $598.73 a share, and Meta Platforms (NASDAQ: META) at $385.20 per share. The other four Magnificent stocks include Apple, Alphabet, Amazon, and Tesla.

The climb to surpass its previous record close of $382.18 a share, set on Sept. 7, 2021, took Meta Platforms until Jan. 23. The significance of this achievement is magnified by the fact that the stock quadrupled since it plummeted below $90 a share in early November 2022.

Image source: Getty Images.

The Value of Meta Platforms in the Magnificent Seven

Even after Meta Platforms’ remarkable 15-month rally, the stock maintains an appealing valuation. This underscores how undervalued the seemingly discounted Meta truly was. Its apps, such as Facebook, Instagram, and WhatsApp, are nothing short of cash cows. Meta boasts the second-lowest price-to-free cash flow ratio in the Magnificent Seven.

Meta’s apps can be likened to digital real estate, offering affordable, effective, and measurable ad space. The company has made considerable strides in enhancing and monetizing Instagram, dispelling doubts about its relevance in the wake of TikTok’s rise. While Meta is currently incurring significant losses in its reality labs segment, its capacity to take risks and endure cash hemorrhages without disrupting its core business sets it apart in a league of a few.

The Blistering Growth of Nvidia

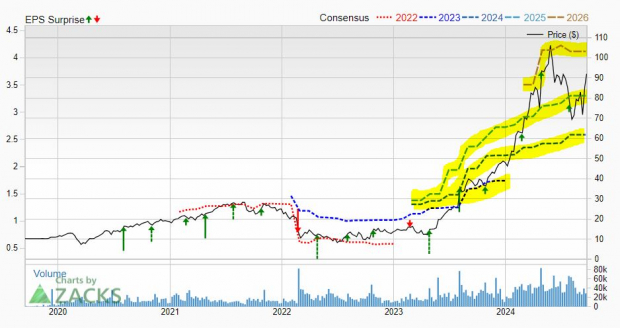

Nvidia crossed the $1 trillion market cap threshold in June and is now on the cusp of breaching $1.5 trillion. At this pace, it could easily overtake Amazon and Alphabet to become the world’s third-most valuable company. However, the stock’s current valuation price-to-earnings (P/E) ratio of 78.3 poses a significant risk, given that much of its future growth is factored in. Nevertheless, Nvidia’s incredible growth is undeniable. Its sales have surged by 66.4% in just one year, and its net income has quadrupled. The company’s profit margins are equally commanding, generating $18.9 billion in net income from $44.9 billion in sales.

Nvidia has weathered significant downturns in the past, given the cyclical nature of the semiconductor industry. However, its investment in artificial intelligence (AI) has garnered significant attention, marking the advent of across-the-board industrial transition to generative AI and accelerated computing. If this trajectory sustains, Nvidia’s stock could appear undervalued. Conversely, any slowdown would render the stock overpriced for its own good. While Nvidia’s performance as a business is exemplary, its stock valuation teeters on the brink of excessive pricing.

Microsoft: A Clear-Cut Path to AI Capitalization

Microsoft encapsulates the best facets of both Meta Platforms and Nvidia. It functions as a proven business model, akin to Meta, while concurrently making substantial investments in AI and reaping the rewards in a similar vein to Nvidia.

Microsoft is essentially the AI sandbox, having garnered a profound reputation for its prowess in this domain.

Why Microsoft’s AI Investment is a Game Changer for Investors

Microsoft’s Strategic Move in AI

Microsoft’s foray into Artificial Intelligence (AI) heralds a strategic move that carries the potential to revolutionize multiple industries, ranging from professional services to everyday applications. In gaining insight and understanding of consumer behavior across such diverse touchpoints, Microsoft enjoys an unparalleled advantage, akin to keeping a finger on the pulse of the market.

Legacy of Perfecting User-Friendly Products

Historically, Microsoft is known for perfecting user-friendly products with widespread appeal. Microsoft Word and Excel may not have been the absolute best in their respective categories, but their exceptional packaging and user-friendliness set them apart. This approach now extends to AI integration, with Microsoft leveraging its expertise to ensure that AI tools remain accessible to a broad spectrum of users.

Copilot: A User-Friendly AI Assistant

Copilot, Microsoft’s generative AI integrated into its existing applications, represents the company’s commitment to making AI more approachable. Acting as a helpful assistant, Copilot enhances the functionality of Microsoft applications without adding complexity. This user-centric approach further underscores Microsoft’s dedication to providing value through AI technology without alienating less tech-savvy users.

Financial Strength and Versatility

Microsoft’s financial prowess, marked by substantial cash flows, affords the company a considerable level of versatility. This financial stability empowers Microsoft to reinvest in organic growth, engage in stock buybacks, or seize opportunities for strategic acquisitions. Such agility sets Microsoft apart, as it can actively explore and refine different AI solutions, offering the company a learning-by-doing advantage in the AI landscape.

Potential for Investors

Considering these factors, Microsoft’s risk-to-reward ratio arguably presents an attractive investment opportunity. For discerning investors seeking exposure to the technology sector, Microsoft emerges as a compelling choice, outshining competitors such as Meta and Nvidia in terms of its strategic AI initiatives and financial robustness.