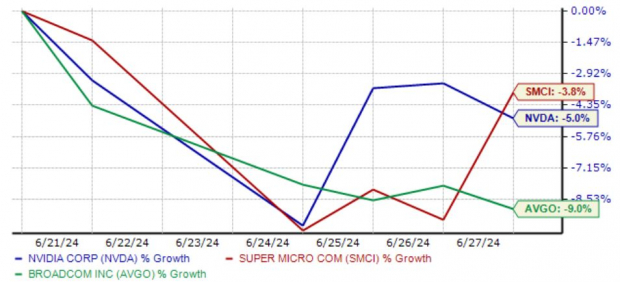

Large-cap technology stocks linked to the AI sector have experienced significant downward pressure recently, catching the attention of many investors. Notably, Nvidia NVDA, Super Micro Computer SMCI, and Broadcom AVGO have all witnessed declines in their share prices. Let’s delve deeper into whether this presents a buying opportunity for those monitoring the situation.

Nvidia’s Data Center Surpasses Expectations

Nvidia’s Data Center sales have been a standout amidst the AI frenzy, displaying remarkable growth in the past year as companies eagerly adopt their chips. In the latest period, Data Center revenue soared to $22.6 billion, surpassing expectations and setting yet another quarterly record.

Despite recent price fluctuations, Nvidia’s valuation multiples remain robust, with the current forward 12-month earnings multiple at 43.0X, signaling stability compared to historical levels. This indicates that despite the current downward trend, Nvidia remains well-positioned for growth.

Super Micro Computer Shows Resilience

Super Micro Computer has been a standout performer, with shares surging nearly 200% in 2024, making it one of the top-performing S&P 500 stocks. The company’s focus on application-optimized server and storage solutions has garnered significant demand, propelling its growth.

While trading at a premium relative to historical levels, Super Micro Computer’s forward 12-month earnings multiple of 24.3X remains steady, reflecting optimism in the company’s growth potential. The recent crossing of the 50-day moving average is a positive sign for investors.

Broadcom’s AI Revenue Hits Record High

Broadcom, a global technology leader in semiconductors, recently reported record revenue from AI products, totaling $3.1 billion. This strong performance was backed by an increase in the current-year sales outlook and a notable 18% year-over-year jump in free cash flow.

Analysts responded positively to Broadcom’s quarter, with earnings outlooks receiving upgrades. Despite trading at a forward 12-month earnings multiple of 28.9X, which is above the five-year median, the company’s solid financials and growth prospects provide a strong foundation for future success.

Looking Ahead

While AI-related technology stocks have faced challenges recently, companies like Nvidia NVDA, Super Micro Computer SMCI, and Broadcom AVGO continue to exhibit positive earnings outlooks. The current market phase may simply represent a profit-taking period after significant growth, rather than a fundamental shift in the companies’ trajectories.

As earnings estimate revisions underline the positive business trends, investors should consider the recent dip in prices as a potential opportunity to enter or expand positions in these promising companies.

Disclaimer: This article is for informational purposes only and is not intended as investment advice.