J.P. Morgan’s Strategic Analysis

Alibaba (NYSE:BABA) stands among the giants of Chinese e-commerce stocks, alongside PDD and JD, all boasting similar forward PE ratios. J.P. Morgan’s Alex Yao, however, sees Alibaba shining the brightest for investors. Yao points to anticipated catalysts in the near future, along with the potential for a market positioning shift that could elevate its valuation.

Anticipating Challenges

Despite the optimistic outlook, challenges loom on the horizon. Yao cautions against impending headwinds in the September quarter, warning of a subdued consumption environment that may impact Alibaba’s financial performance. The macroeconomic climate, including a slowdown in China’s gross merchandise volume growth, poses a hurdle for the e-commerce giant.

Strategic Recommendations

Looking past short-term obstacles, Yao advises investors to keep a long-term perspective. He foresees positive momentum building in the following quarters, driven by potential government stimuli to boost consumption and enhanced revenue growth from recent monetization policies. Furthermore, Yao expects increased active buyer participation post Weixin Payment integration, and anticipates continued inflow of investments after Alibaba’s inclusion in the HK Stock Connect program.

Market Rating and Targets

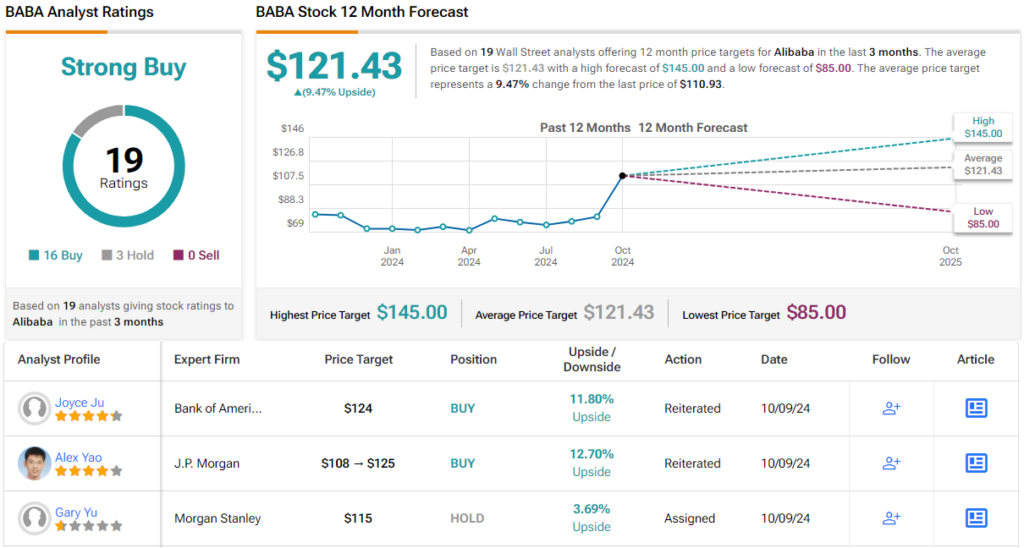

Yao’s bullish stance is reflected in his “Overweight” rating on BABA shares, accompanying a price target of $125, signaling a potential upside of approximately 13%. Wall Street analysts echo this sentiment, with a majority recommending a Buy rating on the stock. The average price target of $121.43 implies a potential return of 9.5% in the near term.

Considering the Future

Yao’s strategic guidance encourages investors to think ahead and weigh Alibaba’s long-term potential amidst current challenges. By staying attuned to market shifts and upcoming drivers of growth, investors can position themselves advantageously in the ever-evolving e-commerce landscape.

To seek more undervalued stock opportunities, investors can explore the insights provided by TipRanks’ Best Stocks to Buy tool, consolidating various equity analyses for informed decision-making.

Disclaimer: The views expressed in this article reflect the opinions of the featured analyst. This content serves informational purposes and underscores the importance of conducting thorough due diligence prior to investment decisions.