The debate on whether Nvidia (NASDAQ: NVDA) stock is overvalued persists, shrouded in the complexity of financial metrics and market behavior.

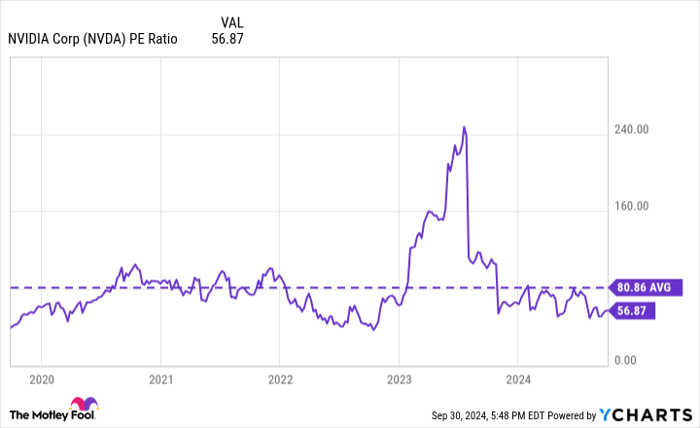

Among these metrics, the price-to-earnings (P/E) ratio stands as a yardstick often wielded by investors to gauge value. Nvidia’s P/E ratio of 57, starkly higher than the S&P 500, raises eyebrows at first glance.

The Vantage Point of Historical Context

Context, however, unveils a divergent narrative. Contrary to current appearances, Nvidia’s valuation historically roams below its average P/E ratio over five years, as illustrated below.

Many tout the wisdom of avoiding lofty P/E ratios. Yet, Nvidia’s exponential price surge of over 2,700% during its peak P/E years calls this conventional wisdom into question.

Powered by artificial intelligence, Nvidia strides ahead, with a P/E ratio now tracing a more frugal path compared to historical standards. Surprisingly, this chip giant doesn’t sit atop the valuation throne of the S&P 500. That honor goes to Axon Enterprise (NASDAQ: AXON), and CrowdStrike (NASDAQ: CRWD), who helm higher P/E ratios currently. Even the retail behemoth Costco Wholesale (NASDAQ: COST) occasionally surpasses Nvidia’s valuation zenith in recent intervals.

The juxtaposition reveals the market’s penchant for diversity. Axon’s law enforcement hardware and software, CrowdStrike’s cybersecurity expertise, and Costco’s budget-friendly retail emporium track on a similar trajectory of pricey valuations, as portrayed in the chart below.

The Enigma of High Valuations

Are high valuations a sign to bolt or a salvo to enter the fray? If investing were a binary equation governed by high and low P/E ratios, fortunes would materialize effortlessly. Yet, the enigma of assessing whether a stock is genuinely overvalued complicates this seemingly straightforward path.

Famed investor Bill Miller deliberates on this quagmire, asserting that gauging a stock’s value revolves around its future, not the past. Amidst the hypothetical musings of a behemoth company posting meager profits currently, Miller’s insight reminds us that the future profitability narrative can flip the script dramatically.

Painting the future with present hues, Nvidia’s profitability hinges on the sustainability of its profit margins. The surge in margins, propelled by the AI boom, unveils a promising sylvan path. Yet, the trajectory would see a tumultuous shift if margins retraced to customary levels, a watershed moment that looms large for Nvidia aficionados to ponder.

The Labyrinth of Expensive Valuations

Turning the gaze to the triad basking in valuations rivaling or eclipsing Nvidia’s lofty P/E, each entity’s narrative unfolds distinctly.

Two Contrasting Vistas

The saga of Costco unfurls as a saga of stability, anchored by 137 million loyal members with an enviable 90% renewal rate. Alas, the specter of growth eludes this titan, with a tepid 5% revenue uptick in fiscal 2024, castigating expectations for a meteoric rise in fiscal 2025.

Contrastingly, Axon’s trajectory sings a different tune, waltzing around the precincts of robust growth. Armed with a strategic advantage bundling hardware with cloud software, Axon skirts the winds of change that coerce agencies to tether their troves of data to its offerings. While the runway appears lengthy, hints of prudence in the current valuation spectrum linger, warranting vigilance in the investor’s stance.

The Future Outlook for CrowdStrike Stock Evaluation

CrowdStrike, while pricy by traditional valuation measures, remains a compelling investment prospect for those with an eye towards the future. The company’s meteoric rise in stock pricing may give some investors pause, but delving deeper reveals a landscape ripe with potential growth.

The Value Proposition

The market’s perception of CrowdStrike is a tale of two realities. While its price-to-sales ratio stands at double its 10-year average, its management projects substantial market growth forecasts. Indeed, the cybersecurity giant anticipates the market for its security platform to soar from $100 billion in 2024 to $225 billion by 2028.

These numbers, while staggering, provide context to CrowdStrike’s current valuation. With only $3.5 billion in trailing-12-month revenue, the company has immense room for expansion. An underwhelming 29% of customers utilize more than seven of CrowdStrike’s software products, indicating a vast untapped potential within its existing client base.

The company’s strategy lies in capitalizing on its current client relationships through cross-selling opportunities. The agility displayed in recovering from previous setbacks, such as a significant IT outage, underscores the robust love its clients harbor for its products.

In essence, where conventional valuation metrics may paint a picture of overvaluation, CrowdStrike’s growth trajectory and customer loyalty hint at untapped potential and sustainable returns in the long run.

Investing Consideration

Deliberating on a potential investment in CrowdStrike should entail a comprehensive analysis of both financial metrics and future prospects. While it may not be the conventional choice for a value investor, the company’s roadmap for growth and expansion warrants consideration.

Furthermore, historical success stories, such as Nvidia’s journey from a stock market recommendation to an investment worth $752,838, provide anecdotes to stoke investor enthusiasm.

The endorsement of the Motley Fool Stock Advisor team, though not explicitly in favor of CrowdStrike, hints at the underlying potential they see in select stocks. The service’s track record of outperforming the S&P 500 since 2002 further bolsters investor confidence in its recommendations.

Therefore, evaluating CrowdStrike’s investment potential requires a blend of historical context, market foresight, and a dash of speculative courage to navigate and potentially benefit from its ascending trajectory.