The Contrarian Temptation of 60% Yields

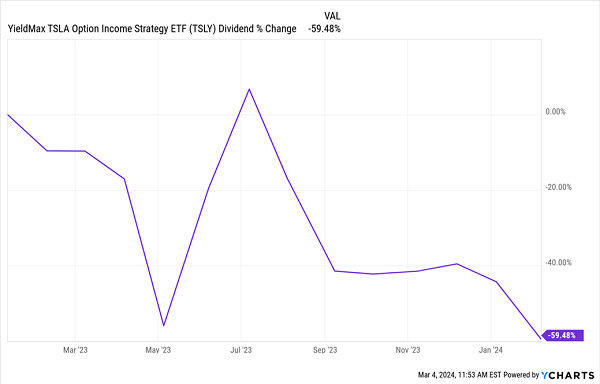

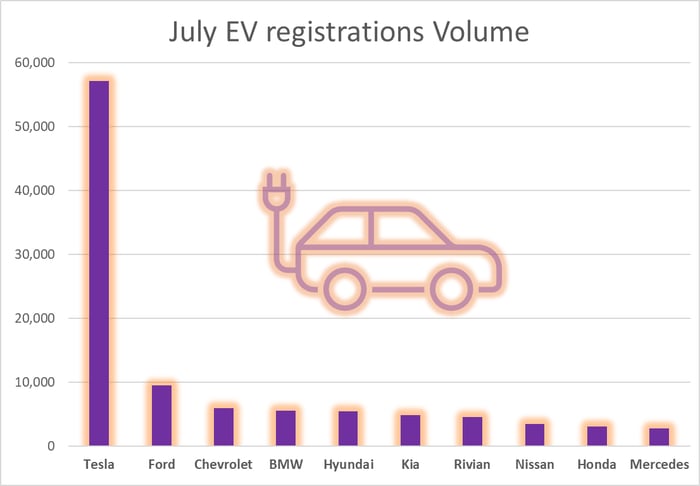

We can’t deny the allure of robust yields in the world of investments. However, every so often, a yield shines so brightly that instead of beckoning, it screams a cautionary tale. One such case in point is the staggering 60.4% yield on the tech-centric fund known as the YieldMax TSLA Option Income Strategy ETF (TSLY).

The Dilemma of Sustaining sky-high Yields

While the prospect of recuperating your initial investment in under two years solely from dividends may sound enticing, it is crucial to pump the brakes. In instances where dividend yields stretch the boundaries of plausibility, income-hungry investors might find themselves lured by a yield that’s not built to last and conceals subpar long-term performance.

Unmasking the Facade: TSLY vs. STK

Comparatively, the Columbia Seligman Premium Technology Growth Fund (STK) emerges as a more stable alternative, despite sporting a smaller headline yield of 5.5%. Unlike TSLY, STK strategically sells call options to fuel its dividends, thereby minimizing risks and ensuring a diversified portfolio that includes prominent tech names such as Lam Research (LRCX), Broadcom (AVGO), and Teradyne (TER).

Performance Check: TSLY vs. STK

When assessing the total returns of TSLY and STK since TSLY’s IPO slightly over a year ago, a stark contrast emerges. While TSLY grapples with losses despite its significant dividend, STK boasts over a 40% increase in value. Even compared to Tesla’s performance in the same period, STK has proven to be a more lucrative investment.

Beyond Yields: STK’s Superiority

STK’s supremacy extends beyond sustainable payouts and impressive returns. Over the past decade, STK has outperformed the NASDAQ, as evidenced by the benchmark Invesco QQQ Trust (QQQ). This can be attributed to management’s adeptness in identifying top performers and sidestepping underperforming assets.

The New Game in Town: AI Funds Shake Up Tech Stock Landscape

Shifting Sands of Stock Volatility

In the realm of electric car companies, volatility is akin to a wild race on an uncertain track. Recent weeks have seen TSLY experience a surge in volatility, possibly due to fears of increasing competition from rival electric car manufacturers. Should the stock continue its downward trend without catching up swiftly, investors staring at their depleting dividends will have gathered nothing but dust.

Unmasking Unsustainable Yields

A 60% yield dangling on a stock’s branches like an overripe fruit is a mirage in the desert, an oasis promising riches but delivering drought. The grandeur may blind some but history reminds us that such lofty heights are not built to last, regardless of the façade the stock may wear.

Standing in stark contrast, STK offers a more modest 5.5% yield, a steady ship in a tumultuous sea of market frenzy. Despite sailing at a 9% premium above its net asset value, this fund has garnered the attention of eager investors trooping in, drawn like moths to a flame by the tech stock enthusiasms of the hour.

AI Funds: The Vanguard of Tech Stocks

While STK holds its ground, there are whispers of more lucrative prospects in the air. To outshine the sinking ship of TSLY, smart tech funds beckon, offering the promise of wealth beyond dreams while leaving their reckless counterparts far behind in the rearview mirror.

Microsoft CEO Satya Nadella’s words ring loud and clear, illuminating the path to prosperity in the era of AI. No longer a mere novelty act, AI stands as a powerhouse, a robust engine fueling profits for industry giants like Microsoft.

STK, though a commendable vessel, sets its compass towards semiconductor seas, missing the direct route to the treasure trove of AI stocks. The need of the hour? A more unswerving path, courting funds that harbor not only the stalwarts like Microsoft but also the unsung heroes poised to lead the AI revolution to new heights.

AI Funds: Rewinding the Clock to Strategic Investment

A quartet of AI funds beckons, offering a symphony of returns to eager investors. Sporting a collective yield of 7.8%, these funds stand as time machines, ferrying investors to a bygone era where AI stocks were but a steal, ripe for the picking.

The clock, however, shall not turn backward forever. As the drums of income-hungry investors beat louder, the discounts that cloak these lucrative opportunities shall fade, vanishing like morning mist under the golden sun.