As Elon Musk remarked earlier this year, the Achilles heel of the AI revolution shifted from lingering chip shortages to a newfound battle for electricity supply. This sentiment was echoed by Amazon’s CEO Andy Jassy, emphasizing the burgeoning industry’s insatiable hunger for power, a sentiment reinforced by Sam Altman of OpenAI at the World Economic Forum.

The crux of the matter lies in the conundrum facing the AI sector: the pressing need for robust data centers and the formidable challenges of power supply. The nascent industry’s evolution hinges on confronting the limitations of the current electric grid.

The Data Center Boom

Data centers, the sprawling industrial hubs that serve as AI’s physical backbone, are poised to become paramount in the unfolding AI economy.

Projections suggest that global data center capital expenditure will soar beyond $225 billion by 2024. NVIDIA’s CEO, Jensen Huang, underlined the necessity of erecting nearly $1 trillion worth of data centers in the coming years to bolster generative AI.

Such exponential growth demands copious amounts of electricity, despite potential efficiencies in AI systems. According to the International Energy Agency, global data center energy consumption is set to more than double by 2026, surging past 1,000 terawatt hours. To put this into perspective, the US consumed roughly 4,000 terawatt hours in the entirety of 2023.

The augmented electricity appetite in US data centers could triple by the end of the decade, potentially reaching 390 terawatt hours, accounting for 7.5% of the nation’s anticipated electricity demand. With AI’s meteoric rise, fueling a tenfold surge in demand by 2026, the US risks facing widespread power shortages unless infrastructure enhancements materialize.

Powering Up Electric Utilities

For investors seeking a hidden avenue into the AI-fueled market boom, cast your gaze towards an unlikely contender: utilities.

The S&P 500 utilities sector weathered a tumultuous 2023, plummeting by 10%, recording its most dismal performance since 2008, a stark contrast to the broader 24% rise in the S&P 500 Index.

In a redemptive twist, the sector has rebounded in 2024, with a modest 6% uptick, attributed to stringent cost management balancing excessive capital outlay. The utilities sector’s resurgence, catalyzed by the burgeoning data center demand propelling AI, has reignited investor fervor.

Notably, the uptick in forward power prices has eclipsed the escalation in regional natural gas hub pricing, signaling tightening power market conditions and bolstering investor confidence in utilities.

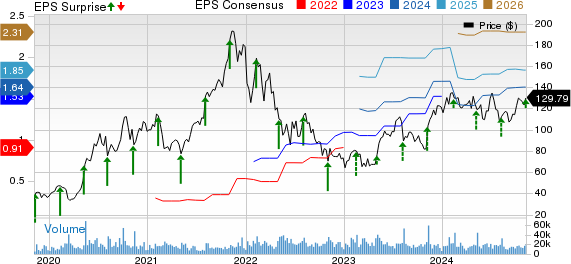

Noteworthy utility players such as Constellation Energy, Vistra Energy, and NextEra Energy are anticipated to witness a 33% surge in earnings per share relative to the prior year. NextEra Energy, with nearly 60 gigawatts of renewable energy capacity, stands to gain from the escalating electricity prerequisites of data centers, aligning with tech enterprises’ preference for renewable energy over fossil fuels.

In a groundbreaking move on May 1, technology behemoth Microsoft pledged backing to approximately $10 billion in renewable energy schemes to be spearheaded by Brookfield Asset Management and Brookfield Renewable.

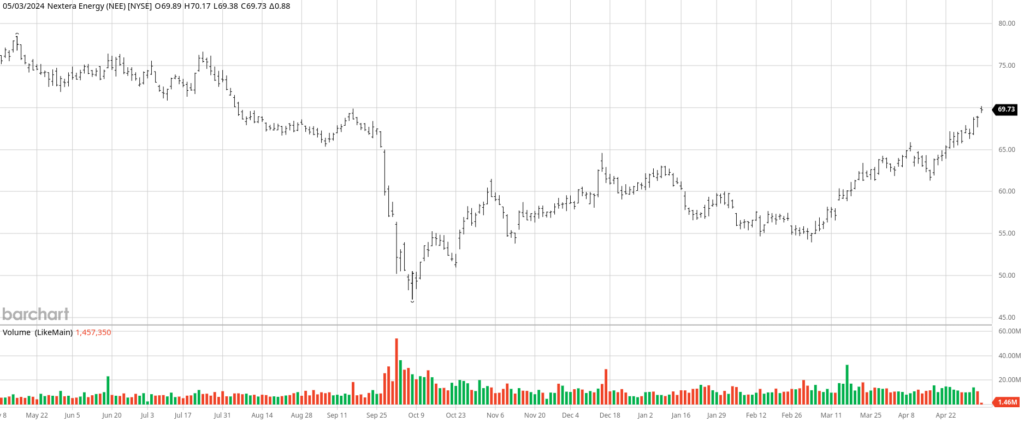

Ingenious Investment: NextEra Energy

This backdrop heralds NextEra Energy as a prime investment opportunity.

Owning the largest electric utility in the US, Florida Power & Light Company, NextEra Energy boasts unparalleled market dominance in power distribution. The company’s subsidiary, NextEra Energy Resources, LLC, ranks as the globe’s premier renewable energy producer, exemplifying excellence in wind and solar power generation and spearheading innovations in battery storage.

NextEra Energy Resources’ prowess in renewable energy operations and development places it at the forefront of the industry. Early forays into wind power secured prime locations and long-term contracts, accentuating competitive advantages. Present strategies pivot towards solar power, earmarking over half of renewable energy growth for 2026 for solar and battery storage, with the remainder dedicated to onshore wind projects.

During the earnings call on April 23, NextEra Energy’s CEO, John Ketchum, stressed the pivotal role of renewables and storage in meeting escalating data center demands. He underscored the vast market opportunities in US renewables and storage, projecting a tripling in potential growth over the next seven years relative to the preceding period.

Endorsing an annual earnings growth forecast of 6% to 8% till 2026, NextEra Energy presents investors with a dual benefit: a secure dividend yield and unparalleled renewable energy expansion prospects.

For savvy investors, NextEra Energy stock is a compelling buy below $75.