The current state of the 2024 stock market resembles a turbulent sea, with even the most celebrated stocks enduring fluctuations in their fortunes. While some former high-flyers of 2023 continue their ascent, others like Tesla (TSLA) are facing challenges. In the midst of economic uncertainties, the Federal Reserve’s stance on interest rates adds another layer of complexity.

Amidst this landscape, investors are turning to stability and value in an artificial intelligence-driven market. Established for its remarkable 65 years of uninterrupted dividend growth, 3M Company (MMM) stands out in the S&P 500 Index as a trusted Dividend King that prioritizes rewarding its shareholders.

For investors seeking a balance of income and growth, let’s delve into the latest analyst insights on this reigning Dividend King.

Unveiling the Legacy of 3M Company Stock

With a market capitalization of $59.61 billion, 3M Company (MMM) calls St. Paul, Minnesota home. Operating across four crucial segments – Safety & Industrial, Transportation & Electronics, Health Care, and Consumer – 3M boasts a diverse product portfolio ranging from Post-It Notes to advanced medical technologies, encompassing over 60,000 brands.

Despite a modest 5.2% increase in the past year, 3M stock has surged 25% from its low point in October. As a Dividend King, 3M has consistently raised its dividend for an astounding 65 consecutive years, offering investors a robust quarterly dividend of $1.51 with an attractive forward yield of 5.6%.

At its current valuation, 3M stock appears undervalued. Comparing favorably to the industrial sector median, MMM’s forward price/earnings ratio signals an appealing proposition for investors, hinting at substantial upside potential.

In the realm of earnings, 3M delivered a positive surprise in the fourth quarter with EPS of $2.42 per share, surpassing expectations. However, the stock faced downward pressure as investors focused more on the full-year forecast, which fell short of consensus estimates.

A New Era with the Arrival of a CEO

3M injected fresh momentum into its trajectory on March 12 by appointing William M. “Bill” Brown as the incoming CEO, effective May 1. This strategic leadership transition preceded 3M’s planned spinoff of its healthcare business into the new entity, Solventum. The move anticipates listing Solventum on the New York Stock Exchange under the ticker symbol SOLV on April 1.

Barclays analyst Julian Mitchell expressed optimism about the CEO succession, anticipating a potential portfolio review that could enhance 3M’s margins. Additionally, 3M has made strides in resolving legal disputes surrounding its products, which has positively impacted its outlook.

Insights into Analyst Expectations for 3M Stock

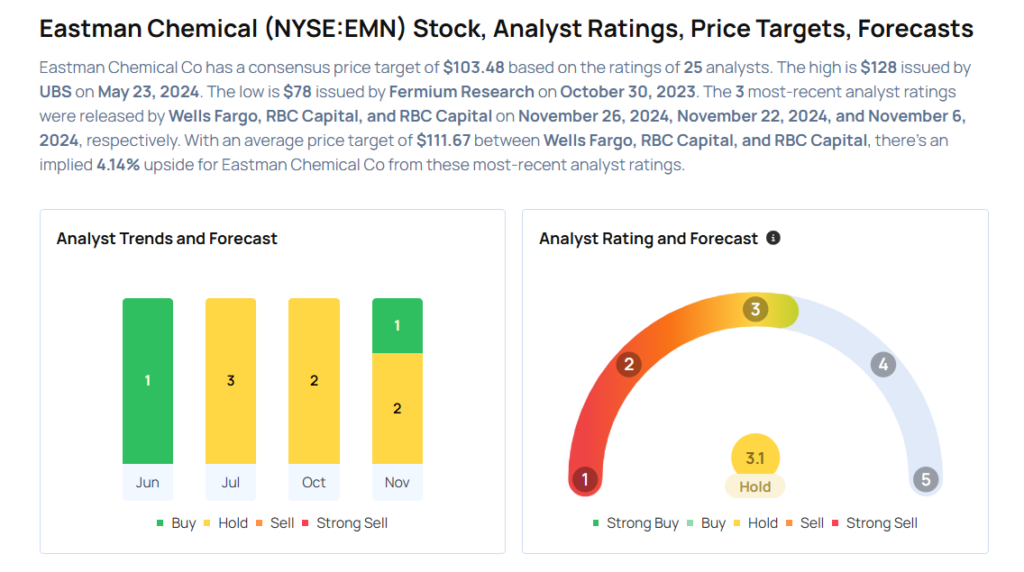

Barclays upgraded 3M to an “Overweight” rating from “Equal Weight” and raised its price target to $126 from $111, indicating an 18% upside from the closing price. However, broader analyst sentiment leans cautiously, with the consensus rating for 3M being a “Hold”. Only a few analysts advocate for a “Strong Buy,” emphasizing a division in opinions.

Embracing the Potential of 3M Stock

While opinions vary within Wall Street circles, it is undeniable that 3M stock presents an alluring opportunity at its current valuation. With a diverse product portfolio, attractive pricing, and strategic maneuvers, 3M remains an appealing choice for investors seeking stability amid potential growth. In an ever-changing market, the legacy and commitment of 3M to its shareholders stand as a beacon of fortitude and promise.