Entering the arena of corporate earnings, this week witnessed remarkable feats and noticeable setbacks from industry heavyweights like Target, Costco, Marvell, and DocuSign.

Target Hits the Bullseye with Q4 Triumph

Target’s (NYSE: TGT) Q4 earnings report set the stock market abuzz as its shares surged by 12% in response to its stellar performance. The retail titan exceeded expectations with an EPS of $2.98, outshining the estimated $2.41 figure. With a quarterly revenue of $31.9 billion, surpassing the forecasted $31.83B, Target showcased its unwavering strength. Looking ahead, Target’s optimistic forecast for fiscal 2024, projecting an EPS between $8.60 and $9.60, outstripped analysts’ expectations of $8.44.

This impressive display prompted analysts to upgrade Target’s rating and raise their price targets. Deutsche Bank and HSBC both repositioned their ratings from Hold to Buy, with Deutsche Bank setting a new price target of $206 and HSBC at $195.

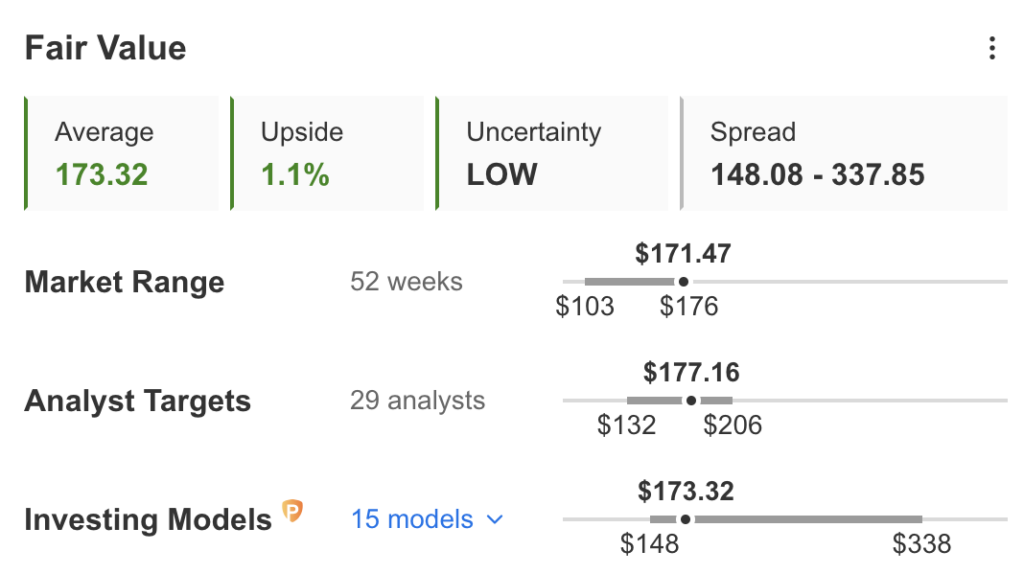

Despite the accolades, InvestingPro’s Fair Value analysis suggests a modest 1.1% potential upside for Target’s stock, reflecting the intricacies of the market.

Costco Falters with Revenue Miss

In contrast, Costco (NASDAQ: COST) faced a stumbling block as its shares dipped by 4% in pre-market trading post its Q2 results revelation. While surpassing earnings estimates with a Q2 EPS of $3.92 against the forecasted $3.62, Costco’s quarterly revenue of $57.33B fell short of the expected $59.11B. The shortfall was attributed to weakened demand for high-margin products, casting a shadow of doubt on the company’s performance.

InvestingPro’s Fair Value analysis delivers a somber forecast for Costco, estimating a likely 29.5% decrease in stock price potential from its current valuation of $553.95.

Marvell Technology Falters on Projections

Marvell Technology (NASDAQ: MRVL) witnessed a decline of over 5% pre-market, rattling investors with its Q1 earnings and revenue projections trailing behind expectations. The company’s Q1 EPS guidance of $0.18 to $0.28 failed to meet the analyst consensus of $0.40, alongside a predicted Q1 revenue of $1.15B versus the estimated $1.37B. Despite its Q4 earnings aligning with market estimates at $0.46 per share and quarterly revenue exceeding expectations at $1.43B, the dim outlook for Q1 weighed heavily on investor sentiment.

InvestingPro’s Fair Value analysis anticipates a potential 25.3% downside for Marvell’s stock, signaling caution amidst turbulent market conditions.

DocuSign Surges with Q4 Triumph

DocuSign (NASDAQ: DOCU) emerged as a beacon of success, witnessing a remarkable 9% pre-market surge following its Q4 financial revelation. The company’s Q4 EPS of $0.76 surpassed analyst predictions by $0.11, with reported revenue of $712.4 million exceeding the anticipated $698.35M. Looking forward to Q1/25, DocuSign projects revenue between $704M and $708M, painting a promising picture of growth. For the fiscal year 2025, DocuSign anticipates revenue ranging from $2.915B to $2.927B, showcasing confidence in its trajectory.

InvestingPro’s Fair Value analysis hints at a bright future for DocuSign, with an 18.7% potential increase in stock price, aligning with the company’s robust performance.