The recent market performance has sent shockwaves through investors, marking the darkest days since June 2022, especially hitting hard on the tech and semiconductor sectors, reminiscent of the harsh declines seen back in March 2020.

While this may paint a gloomy picture, it’s crucial not to surrender to despair amid the prevailing negative sentiment, considering that just a month ago, a similar turbulent start was swiftly followed by a resurgence of optimism.

Amidst the market turmoil, the focus shifted to labor statistics, revealing certain metrics that failed to meet expectations.

Nevertheless, the labor market remained robust with employment growth maintaining a steady pace at 5.2%, outperforming growth rates clocked at 3.63%, and a slight dip noted in the unemployment rate from 4.3% to 4.2%.

These indicators are signaling a potential 0.25% rate cut at the upcoming FOMC meeting on September 18.

Deciphering the Market Correction Amid Anticipated Rate Cuts

Attempting to unravel the recent correction in stocks amidst pending rate cuts is a perplexing task, as various theories abound, yet certainty eludes even the most seasoned analysts.

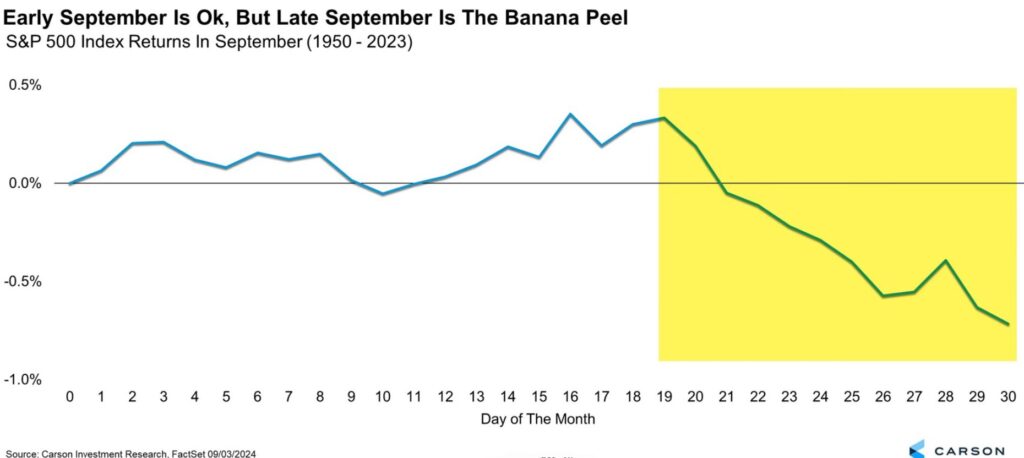

If we dive into the historical archives, we find that September has consistently dished out some of the market’s bitterest pills since 1950. The unusual early slump this year, catching many off guard, contrasts with the typical second-half market downturn in this month.

Seasonal trends hint at more market turbulence looming ahead, steering the ship possibly towards the treacherous August lows.

Furthermore, the record-breaking 545 consecutive days of an inverted yield curve—a stark departure from the 419 days seen in the late 1970s and 1980s—has ceased, ushering in a new era of economic uncertainty, often a precursor to market turmoil.

The uncertainty has disproportionately impacted high-beta stocks, which have struggled against their low-beta counterparts.

July witnessed beta ratios reaching unprecedented highs, paving the way for a bullish trend that persisted for months. However, the recent emergence of low-beta stock dominance has fractured that bullish trajectory established since December 2022, signaling short-term fragility rather than a full-blown correction.

The top-tier constituents in the Low Volatility ETF include reputable names like Berkshire Hathaway, The Coca-Cola Company, T-Mobile US, Loews Corporation, Republic Services Inc, Visa Inc, Colgate-Palmolive Company, Marsh & McLennan Companies Inc, The Procter & Gamble Company, and Linde.

These low-beta equities hold the promise of continued favoritism as the market veers towards a less volatile landscape.

Over the past five years, and notably in the recent year, the collective performance of these stocks has outstripped the S&P 500, showcasing milder retreats during bearish phases and robust recoveries in the face of adversity.

This trend towards low beta may continue to underpin these stocks, making them pivotal additions to your investment radar—certainly a move I made on my end as well.

Spotlight on Lowe’s for a Beacon of Growth Prospects

Among the roster of stocks analyzed based on their beta and growth patterns, Loews Corp emerges as a standout contender, emanating a bullish aura. The solid financial health score of 3 out of 5 further bolsters this optimistic outlook, indicative of commendable financial performance.

The stock’s low price-to-earnings (P/E) ratio hints at an undervalued asset, potentially offering a gateway to additional growth prospects.

Loews’ profitability over the past year acts as a testament to its promising trajectory. A profitable entity has the leeway to generate surplus cash for reinvestment in expansion, shareholder dividends, or stock buybacks.

A comparative analysis of Loews’ P/E ratio against peers in the industry realm can shed more light on whether it truly embodies a bargain or if there are lurking challenges embedded in its valuation.

***

Whether you’re grappling with the nuances of investment or navigating the intricacies of trading, leveraging InvestingPro may unlock a treasure trove of investment prospects while safeguarding against risks in the turbulent market environment.

Subscribing offers access to a myriad of market-beating functionalities, such as:

- InvestingPro Fair Value: Swiftly unearth if a stock is riding the waves of undervaluation or overvaluation.

- AI ProPicks: AI-powered stock selections with a proven track record of success.

- Advanced Stock Screener: Hunt for top-performing stocks based on an array of meticulous filters and criteria.

- Top Ideas: Peep into the investment moves of magnates like Warren Buffett, Michael Burry and George Soros.

Disclaimer: This article is crafted for informational purposes only, refraining from any solicitation, offering, advice, counsel, or recommendation to invest, and hence, not designed to instigate the acquisition of assets in any form. I’d like to reiterate that asset evaluation encompasses multiple perspectives and carries substantial risk, thus, any investment decisions and the attendant risks rest with the investor.