As investors gear up for the Q4 earnings season, attention will invariably be drawn to big banks like JP Morgan (JPM) and Bank of America (BAC). However, the consumer lending stocks have also shown promise in the financial sector, with Ally Financial (ALLY) and Synchrony Financial (SYF) standing out in particular.

Both companies are on the cusp of their 52-week highs and are slated to report their Q4 results later this month, with Ally’s report due on January 19 and Synchrony’s on January 23. Consequently, it is apt to analyze whether it’s the right time to consider investing in Ally or Synchrony for a further increase.

Recent Performance Overview

Ally Financial offers a wide range of financial products and services primarily to the auto industry, while Synchrony provides various credit products through a diverse group of retailers, merchants, and manufacturers. Over the past year, Ally’s stock has surged by 36%, outpacing the S&P 500’s 24% increase. Meanwhile, Synchrony has also put up a very respectable performance with a 17% rise. Notably, Synchrony reached 52-week highs of over $38 a share, while Ally is knocking on the door of its $35.78 high last February.

Image Source: Zacks Investment Research

Q4 Previews & Outlook

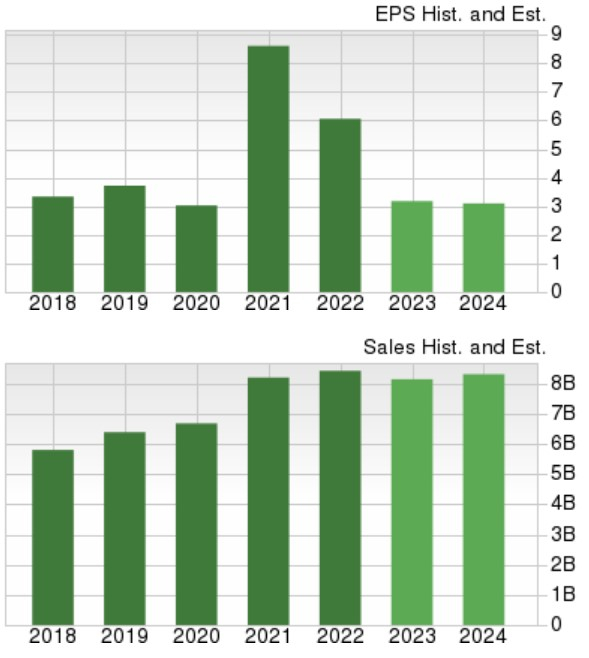

Ally and Synchrony are facing a daunting task in the upcoming Q4 earnings, with estimates indicating a downward trend. Ally’s Q4 earnings are expected at $0.51 per share, down from $1.08 per share in Q4 2022. Similarly, Synchrony’s Q4 earnings are predicted to decrease by 22% to $0.98 per share compared to the same quarter last year. Nevertheless, both companies are projected to recover in the upcoming year. Ally’s FY24 earnings are forecasted to rise 14%, and Synchrony’s FY24 earnings are anticipated to rebound and rise 7% to $5.51 a share.

Image Source: Zacks Investment Research

Strong Value

While the bottom line figures may show a dip, both Ally and Synchrony’s stocks have surged due to their reasonable valuations. Currently, Ally’s stock trades at a very reasonable 10.8X forward earnings multiple, and Synchrony’s shares trade at just 7.3X. Moreover, Ally offers a generous 3.5% annual dividend yield, and Synchrony’s 2.67% yield surpasses the S&P 500’s 1.4% average.

Image Source: Zacks Investment Research

Takeaway

Currently, both Ally Financial and Synchrony Financial’s stock hold a Zacks Rank #3 (Hold). The possible attainment of new highs may gravely hinge on their Q4 results, but maintaining positions in these consumer finance leaders has potential benefit at existing price levels.