As market jitters linger and investors seek buy-the-dip opportunities, ride-sharing giants Lyft and Uber Technologies are in the spotlight. Both companies have seen their stocks surge by over 20% in 2024, providing a tempting prospect for potential investors.

Image Source: Zacks Investment Research

Growth Trajectories

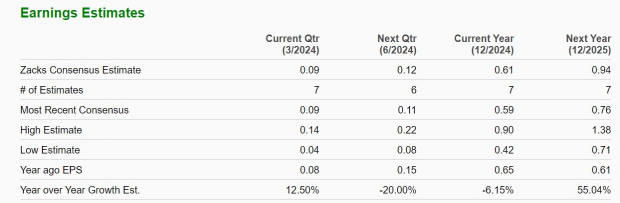

Lyft, focusing on its ride-hailing business primarily in the U.S. and Canada, is projected to have sales growth of 16% in fiscal 2024, with a further 13% jump anticipated in FY25 to $5.81 billion. Despite a slight decline to $0.61 per share in FY24, earnings are expected to rebound significantly in FY25, reaching $0.94 per share.

Image Source: Zacks Investment Research

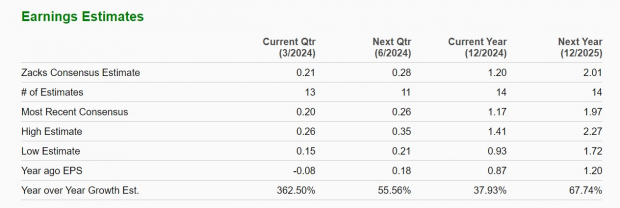

On the other hand, Uber’s international expansion plans, along with its foray into food delivery, are driving its sales growth. Sales are forecasted to rise by 16% in FY24 and another 16% in FY25 to $50.49 billion. Uber’s earnings per share (EPS) are projected to soar by 38% in FY24 to $1.20 per share compared to $0.87 per share in 2023. The outlook for FY25 is even more impressive, with an expected 68% surge to $2.01 per share.

Image Source: Zacks Investment Research

Earnings Estimate Revisions

While both Lyft and Uber have shown strong stock performances due to their growth and move towards profitability, positive earnings estimate revisions serve as a key indicator for potential stock upside. Uber stands out in this aspect, with EPS estimates for FY24 and FY25 trending higher over the past quarter and slightly increasing over the last 30 days.

Image Source: Zacks Investment Research

Conversely, Lyft’s EPS estimates for FY24 and FY25 have seen declines of -3% and -11% respectively over the past 60 days.

Image Source: Zacks Investment Research

Bottom Line

With their promising growth trajectories, Lyft and Uber emerge as strong buy-the-dip candidates. However, Uber’s stock, backed by a Zacks Rank #1 (Strong Buy), appears to have a potentially higher upside, fueled by positive earnings estimates. In comparison, Lyft secures a Zacks Rank #3 (Hold).

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure is imminent. A bipartisan endeavor of monumental proportions, this initiative is set to unleash a wave of spending, leading to unprecedented opportunities for wealth creation.

The pressing query remains, “Will you identify the right stocks early when their growth potential is at its zenith?”

Zacks has unveiled a Special Report to aid in this quest, available for free today. Uncover 5 standout companies poised to reap substantial benefits from the vast construction and renovation endeavors, spanning roads, bridges, buildings, as well as cargo transportation and energy evolution on a colossal scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.