Even after surpassing quarterly revenue and profit expectations, Nike NKE and Lululemon LULU encountered a dip in their stock prices today owing to weaker guidance.

Considering Nike’s stock is down by -13% year to date and Lululemon’s shares have declined by -20%, investors are contemplating whether it’s the right time to capitalize on this downside in two prominent retail giants.

Image Source: Zacks Investment Research

Favorable Third Quarter Results

In their fiscal third quarter earnings report, Nike achieved an earnings per share of $0.98, marking a 24% annual rise and surpassing Q3 forecasts by 42%. Quarterly sales of $12.42 billion, slightly up from last year’s $12.39 billion, exceeded estimates by 1%. Of note, Nike has outperformed earnings expectations in three of the last four quarters, boasting an average earnings surprise of 22.55%.

Image Source: Zacks Investment Research

On the other hand, Lululemon reported Q4 earnings of $5.29 per share, surpassing estimates by 5% and surging 20% from the previous year’s $4.40 per share. Fourth-quarter sales soared by 15% to $3.2 billion, slightly exceeding the projected $3.18 billion. Impressively, Lululemon has exceeded earnings expectations for 15 consecutive quarters, with an average earnings surprise of 9.68% in the last four quarterly reports.

Image Source: Zacks Investment Research

Guidance Concerns

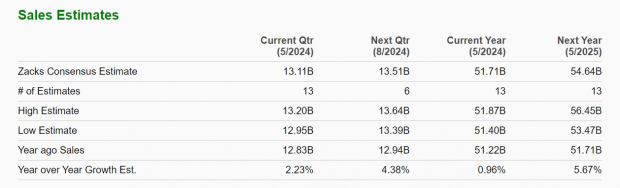

The apprehension surrounding Nike and Lululemon losing their edge emerged as both companies provided weaker revenue guidance. While Nike anticipates a 1% sales increase in fiscal 2024, aligning with Zacks estimates, the athletic juggernaut warned of a single-digit revenue decline in the first half of FY25 due to product portfolio innovations in a subdued economic atmosphere.

Image Source: Zacks Investment Research

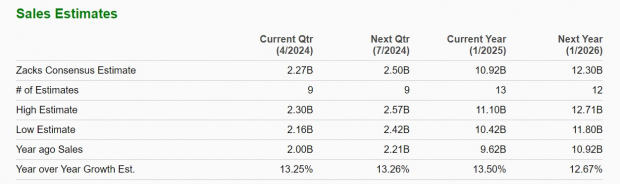

In contrast, Lululemon attributed its softer sales guidance for the upcoming fiscal quarter to sluggish consumer demand. The yoga-inspired brand foresees Q1 sales ranging from $2.17 billion to $2.2 billion, slightly below Zacks’ estimate of $2.27 billion. Additionally, Lululemon predicts its FY25 total sales to fall within $10.7-$10.8 billion, reflecting an 11-12% surge, while Zacks forecasts $10.92 billion or 13% growth.

Image Source: Zacks Investment Research

Outlook on Earnings

Earnest Future Prospects

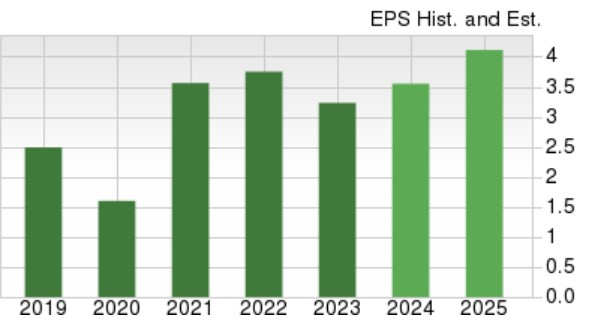

Nike has maintained its full-year net income projection for FY24, with earnings per share (EPS) anticipated to surge 9% to $3.54 according to Zacks estimates. Fiscal 2025 projects a further earnings escalation of 16% to $4.12 per share.

Image Source: Zacks Investment Research

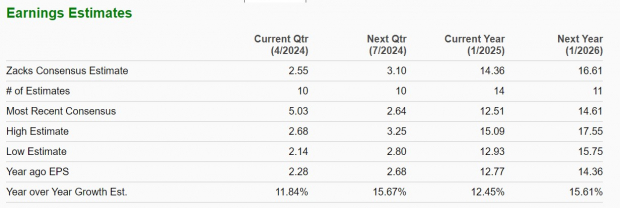

Conversely, Lululemon presents an EPS guidance for Q1 within $2.35-$2.40, whereas Zacks anticipates earnings of $2.55 per share, reflecting 12% growth. For FY25, Lululemon expects an EPS range between $14.00-$14.20, slightly below the current Zacks Consensus of $14.36 per share and over 12% growth. Furthermore, FY26 projects an additional 15% growth in EPS to $16.61 per share based on Zacks assessments.

Image Source: Zacks Investment Research

Final Analysis

Although both Nike and Lululemon encounter challenges in meeting growth expectations, both stocks currently hold a Zacks Rank #3 (Hold). Long-term investors could find merit in retaining shares in these consumer-focused giants at present valuations, yet short-term economic pressures may influence their growth trajectory.

Disclaimer: Information provided here is for educational purposes only and does not constitute investment advice or recommendations.