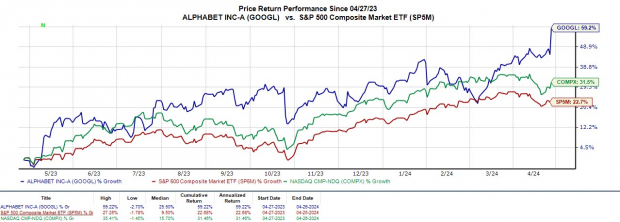

Alphabet GOOGL made headlines in Friday’s trading session after delivering a stellar first quarter earnings report, propelling the broader indexes to a strong finish.

Surging over 10% today, Alphabet shares soared on news of the tech giant’s inaugural dividend declaration and board approval of $70 billion for stock repurchases.

Let’s delve into Alphabet’s impressive Q1 performance to discern whether seizing the opportunity amidst its over 20% year-to-date ascent post-earnings is a prudent move.

Image Source: Zacks Investment Research

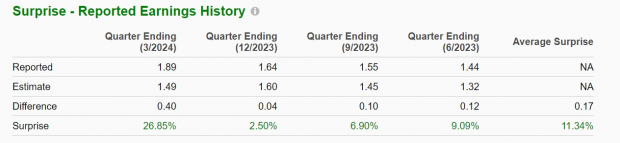

Analyzing Q1 Performance

Alphabet’s Q1 earnings surged by 61% to $1.89 per share from $1.17 in the same quarter the previous year, surpassing the Zacks Consensus by an impressive 27%. On the revenue front, Q1 sales of $67.59 billion rose by 16% compared to $58.06 billion a year ago, exceeding estimates by 2%.

Image Source: Zacks Investment Research

The robust results were mainly driven by success in Google Search, Cloud services, and a notable uptick in advertising revenue on YouTube. Alphabet also emphasized its preparedness for the future wave of artificial intelligence through its cutting-edge platform, Gemini, which boasts multimodal generative AI capabilities across audio, video, and text formats.

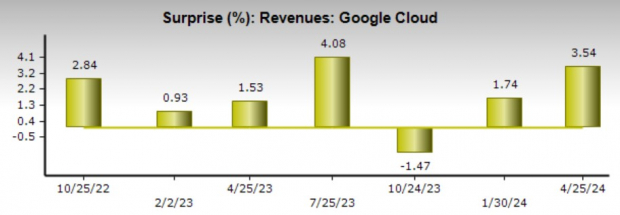

Of particular interest, Google Cloud revenue surpassed expectations by 3%, climbing by 28% year over year to $9.57 billion. Despite this growth, Alphabet is still considered to hold the third position in the U.S. cloud computing market, trailing behind Amazon’s AWS and Microsoft’s Azure.

Image Source: Zacks Investment Research

Implications of Market Cap & Dividend

Alphabet’s new quarterly dividend will amount to $0.20 per share, with the initial disbursement slated for June 17 to shareholders listed as of June 10. Fueled by the excitement over the dividend and stock buyback disclosures, Alphabet’s market value momentarily crossed the $2 trillion threshold for the first time since 2021, ranking third behind Apple and Microsoft in terms of market capitalization.

Image Source: Zacks Investment Research

Final Thoughts on Alphabet

Alphabet’s exceptional Q1 performance has reaffirmed forecasts of double-digit growth in both revenue and earnings for fiscal 2024. Presently, GOOGL maintains a Zacks Rank #3 (Hold). Nonetheless, with the potential for upward revisions in earnings estimates over the next few weeks, a favorable buying recommendation could very well be on the horizon.