Investors are abuzz with Walmart’s WMT upcoming stock split set to debut on Monday, February 26. As Walmart strategically recalibrates its trading dynamics, anticipation mounts for the split, envisaging a $59 entry point juxtaposed against the current $177 per share price.

With a colossal workforce of over 400,000 engaging in Walmart’s stock purchase plan, the company aims to democratize share ownership. Enthusiastic retail investors eagerly await the split as they eye an affordable segue into Walmart stock. As the financial cosmos brims with expectation, wisdom impels us to scrutinize Walmart’s recent market performance, contemplating if this forthcoming transition heralds a bargain bonanza post the Q4 reveal.

Market Performance Evaluated

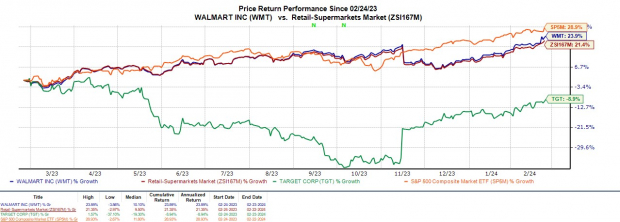

Walmart’s stocks have already surged +12% year-to-date, surpassing the S&P 500’s +6% and outpacing retail counterpart Target’s TGT +7%. Ventures into the omnichannel sphere have notably burgeoned Walmart’s stocks by +24% over the past year, overshadowing Target’s -9% dip while gating its Zacks Subindustry’s +21%. Notably, Walmart effortlessly straddles the line between competitive fervor and benchmark stoicism.

Image Source: Zacks Investment Research

E-commerce Tailwinds Propel Q4 Prosperity

In the aftermath of its Q4 disclosure, Walmart’s performance stands as a beacon for the retail realm. Earnings of $1.80 per share deftly trumped the Zacks Consensus of $1.65, marking a 9% supremacy. The quarterly earnings surged 5% YOY, mirroring a sales crescendo to $173.38 billion, a 5% uptick overshooting estimates by over 1%.

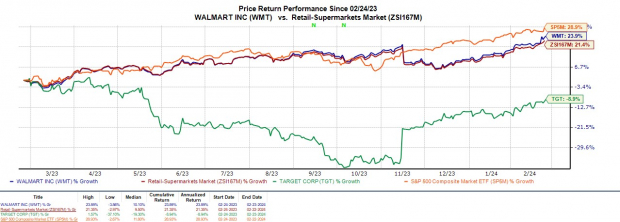

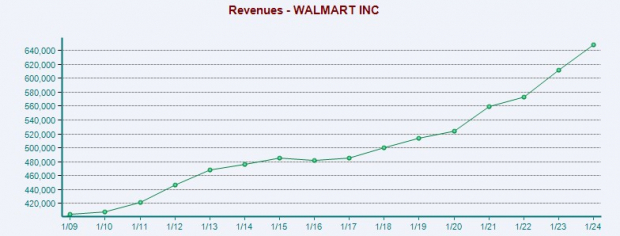

Image Source: Zacks Investment Research

Walmart’s robust quarter is attributed to the 23% growth in its e-commerce domain during Q4, propelling the enterprise’s online sales beyond the $100 billion threshold for the year. As fiscal 2024 concludes, Walmart’s total sales escalate by 6% to reach $648.1 billion. Annual earnings clinch a 6% surge, settling at $6.65 per share.

Image Source: Zacks Investment Research

EPS Momentum & Perspective

While Walmart’s EPS naturally navigate adjustments post-split due to increased outstanding shares, the essence of total earnings or net income remains untainted. Forecasts beckon a 3% top-line growth in FY25 with a projected 4% revenue surge to $698.5 billion in FY26 as per Zacks estimates. Annual earnings are poised to spike by 5% in FY25 to $7.02 per share, diluting to $2.34 post-split, with a promising 9% EPS upswing anticipated in FY26.

Image Source: Zacks Investment Research

The Final Assessment

Walmart’s current Zacks Rank hovers at #3 (Hold) post an exhilarating year commencement. Underlying the splendid YTD surge are investors flocking to Walmart’s stocks envisioning a pre-split ascent. Despite Walmart’s entrancing e-commerce allure and the promising long-term vista, astute buyers may unearth even grander opportunities post-split. Just as a split oat seed does not bear fruit instantly, navigating the stock split jungle demands perspicacious long-term optics.