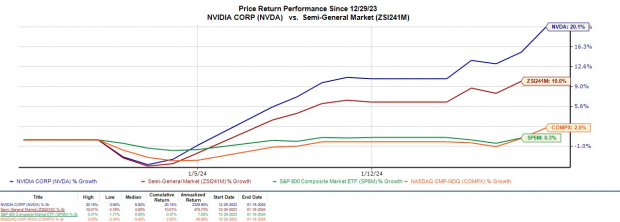

The start of 2024 has witnessed Nvidia (NVDA) as one of the top performers, with the chipmaker outperforming the broader market and soaring over +200% in the last year.

Investors are flocking to take positions in the artificial intelligence leader as Nvidia’s stock is already up +20% year to date. However, the burning question remains – is it still a good time to invest in Nvidia’s stock?

Image Source: Zacks Investment Research

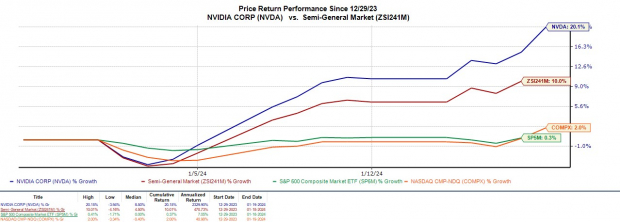

Recent Momentum

Nvidia’s stock has remarkably surpassed the $500 a share mark, continuing a bullish trend and significantly outperforming its 50-day and 200-day moving averages.

As of the latest trading session, Nvidia’s stock is on the verge of hitting $600 a share, closing up +4% and reaching new 52-week highs of $595. This surge coincides with the impending release of Nvidia’s advanced AI chip, the HGX H200, expected in the second quarter of this year, which is forecasted to maintain the company’s competitive edge over rivals like AMD (AMD) and Intel (INTC).

Image Source: Zacks Investment Research

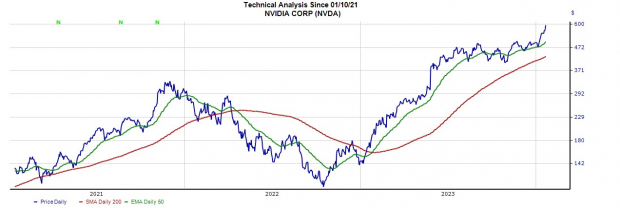

When Does Nvidia Report Earnings?

Nvidia is set to report its Q4 results on February 28, with expectations of another quarter of exponential growth.

Forecasts project a 410% surge in Q4 earnings to $4.49 a share from $0.88 per share a year ago, with quarterly sales anticipated to soar by 232% to $20.1 billion. The company’s consistent performance over the past five quarters, with significant sequential growth in both earnings per share and sales, has surpassed analysts’ expectations.

Image Source: Zacks Investment Research

Bottom Line

Nvidia’s stock currently holds a Zacks Rank #1 (Strong Buy), with an Average Zacks Price Target of $649.11 a share suggesting a 13% upside. With the company’s leading position in AI and its stellar growth, the stock could potentially trend even higher ahead of its Q4 report in February.